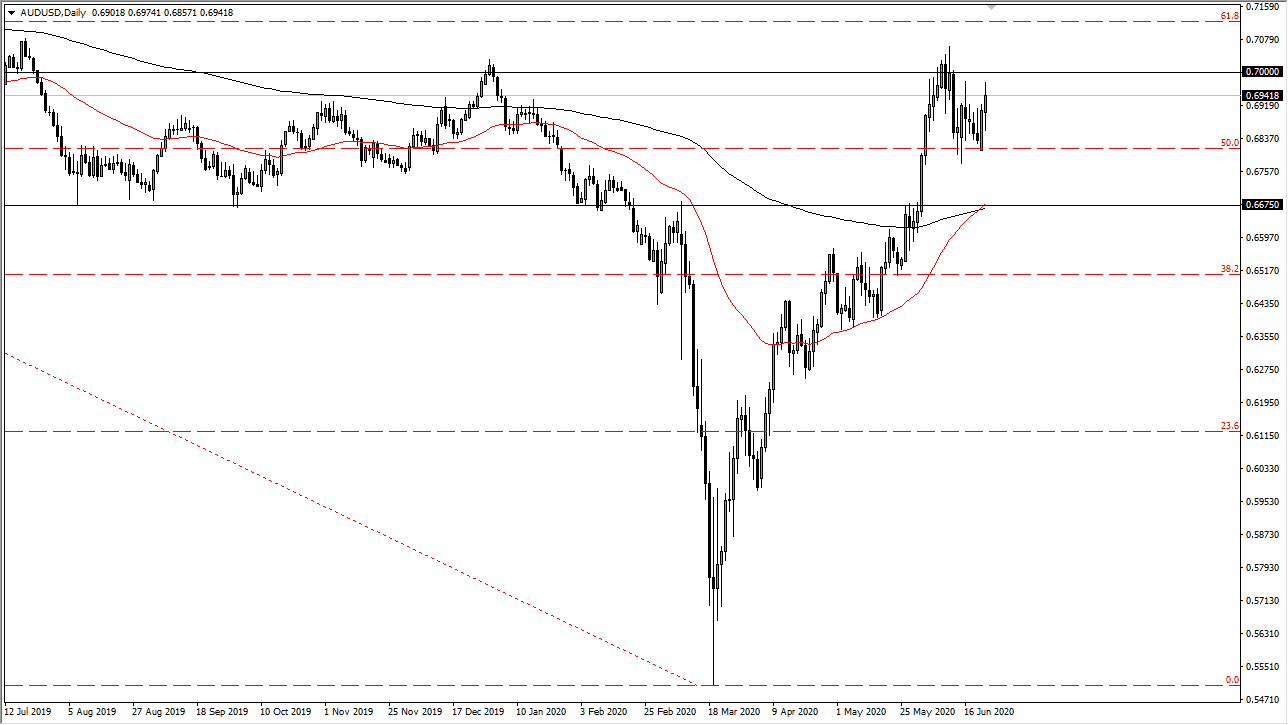

The Australian dollar initially pulled back a bit during the trading session and then shot towards the 0.70 level during the trading day. At this point, the market has found selling pressure yet again, and the 0.70 level is the beginning of massive resistance as it extends all the way to the 0.71 level. In fact, the barrier is massive, and it is trend defining. I think that it is only a matter of time before this market breaks down a bit, so I am looking for an opportunity to take advantage of the rallies that fade. In fact, I shorted a little bit towards the end of the session as I think we will probably go looking towards the 0.68 handle underneath.

Looking at this chart, you can see that we are very choppy in this general vicinity, and the 0.70 continues to attract a lot of attention. On the downside, the 0.6675 handle could be a target, which is where the 200 day EMA is sitting, and we have the 50 day EMA breaking above the 200 day EMA in order to show a bit of an attempt to go higher. This is the so-called “golden cross”, but at this point you should keep in mind that the indication typically happens after the fact, meaning that it is quite often far too late.

If we were to break down below that level, then it is likely that we could reach down towards the 0.65 handle. I am looking for an opportunity to pay those short-term rallies still. I think that this is going to be a situation where you can place multiple trades in order to take advantage of the same area that has caused shooting stars on the weekly chart and the like. I have no interest in buying the Australian dollar, at least not until we break above the 0.71 handle. If we get above there, then it becomes more or less a “buy-and-hold” type of scenario, which I think the Australian dollar could be going all the way to the 0.80 level longer term. Obviously, this is not something that is going to happen overnight but that would be a longer-term setup. The Australian dollar is overly sensitive to China and all things risk-related when it comes to global trade, so keep that in mind as well as we are starting to see an increase in coronavirus cases.