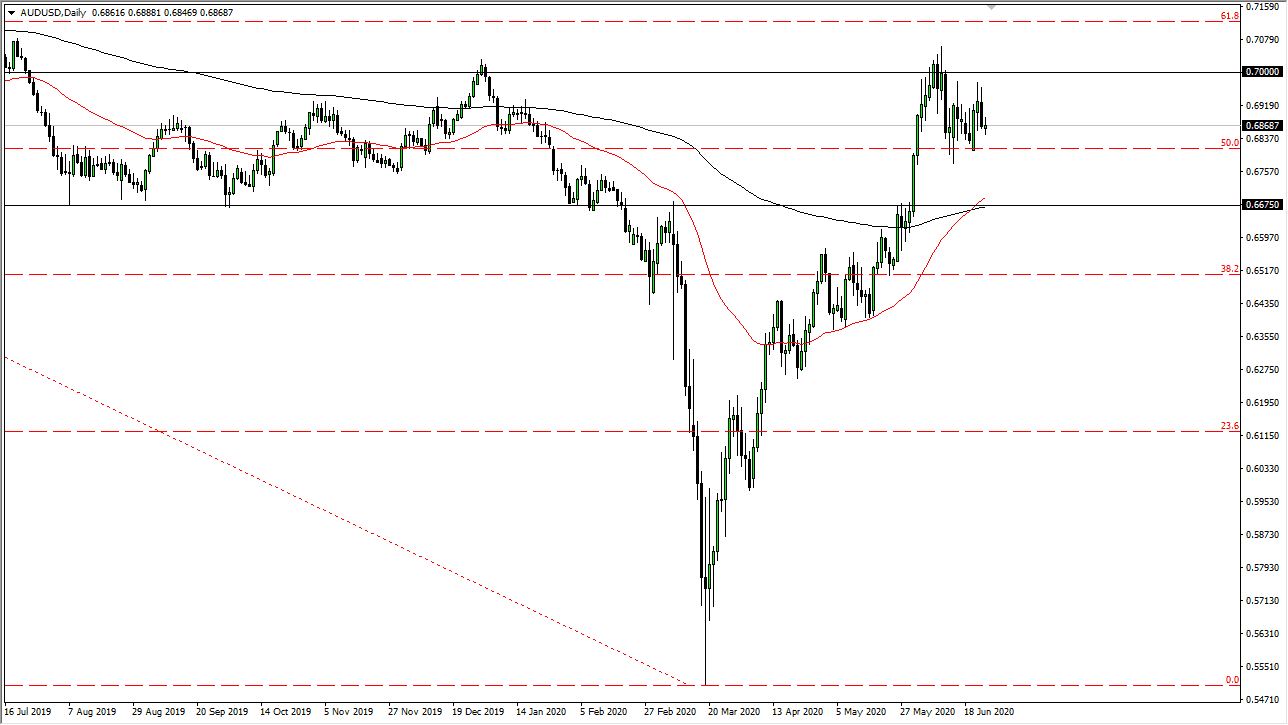

The Australian dollar went back and forth during the trading session on Thursday as we continue to see a lot of noise in this general vicinity. All things being equal, I look at the 0.70 level above is the beginning of massive resistance extend all the way to the 0.71 handle after that. If we were to break above there, the market is likely to continue to break out to an uptrend going forward. In that scenario, the market would become more “buy-and-hold”, as the trend would have shifted so drastically after a major “V bottom.”

To the downside, I believe that if we break below the 0.68 level, then we should go down to the 0.6675 handle. That is an area that also includes the 50 day EMA and the 200 day EMA. Looking at that area, it was an area that was previous resistance, so it would make quite a bit of sense that it should be an area that sellers could continue to come back into that area. At this point, I do believe that the market is finally starting to run out of bit of momentum, but as we chop back and forth the question now becomes whether or not we are going to build up enough momentum to finally break out and continue going higher or are we becoming exhausted and starting to see a bit of distribution up in this area. If that is the case, then we will begin to see this market rollover.

If you choose to follow macroeconomics, the Australian dollar should fall. However, as we have seen with other market such as the S&P 500, macroeconomics do not seem to matter much anymore. The Federal Reserve is likely to continue pumping cash into the economy, so in theory that should drive down the value of the US dollar or at least prop up other currencies. In fact, with coronavirus numbers climbing again, the question becomes whether or not the global economy functions better than it once did? I do not think that the market is ready to do anything on Friday, but eventually we will get an impulsive candlestick the becomes extremely easy to follow. We do not have that yet, so the meantime it is a back-and-forth kind of the side to side type of market. It is going to be short-term trading at best.