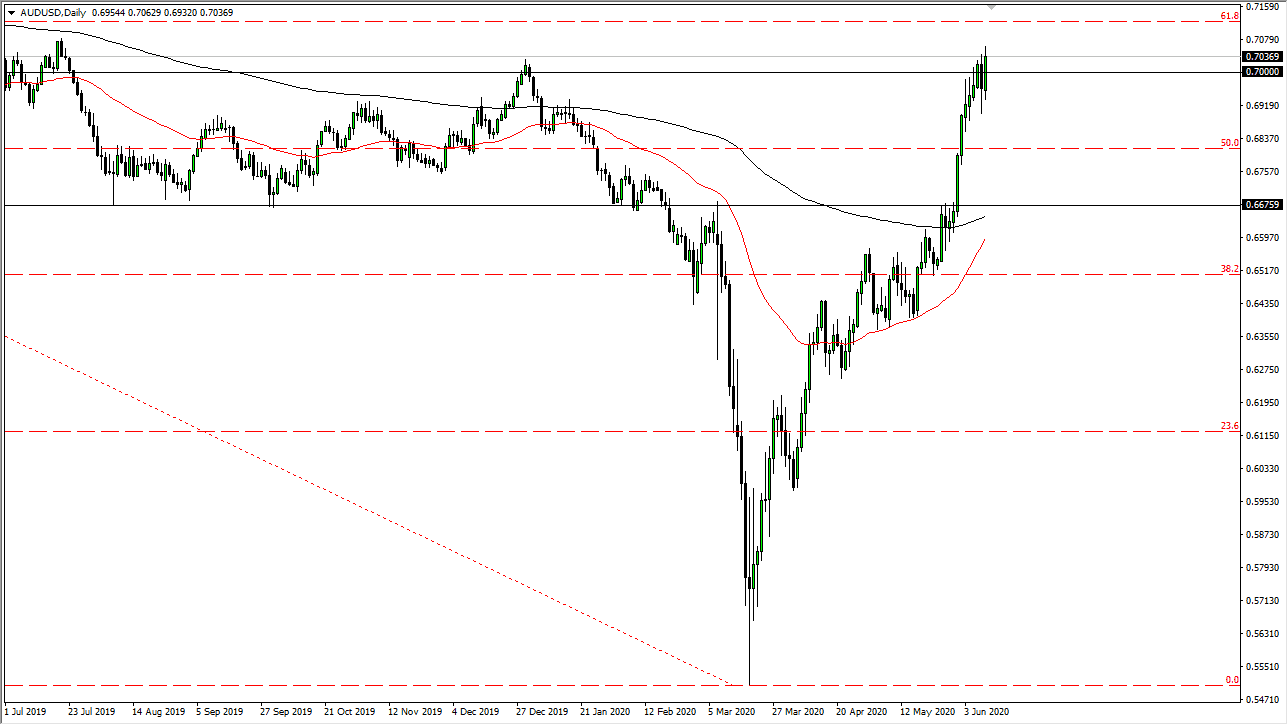

The Australian dollar has rallied over the last several months in an almost straight line, but it continues to hang around the 0.70 level, looking for some type of long-term direction. This is an area that has been trouble more than once so it would make sense that we are going to struggle. Previously, there had been rather significant support, and when we broke through it the market absolutely collapsed.

The question now is whether or not we can actually break out? It seems like it is taking a lot of effort, but I would point out that the Australian dollar has been somewhat resilient in the sense that although we are stretched, the market has refused to rollover drastically.

Looking at this market, it is obvious to me that the buyers are still hopeful, but at this point there is a lot of work to finally break out. I think the 0.71 level above is a trigger for buying, just as a breakdown below the 0.69 level could offer more selling. Ultimately, this is a market that I believe will continue to be very choppy, because the Australian dollar is representative of Asia and then by extension China. The Chinese economy seems to be doing better, and of course the global economy opening up certainly will help that. However, there are increasing tensions between the Americans and the Chinese, so that could cause major issues.

If that does in fact cause major issues, then it is likely that the pair will drift lower. The market sold off too quickly, and now it has recovered far too quickly as well, and it would not be a huge surprise to see this market pullback, but clearly it does not seem to be able to for any length of time. Eventually, we will get some type of longer-term decision, and when we do it should be rather obvious. I am looking for a big, explosive, and impulsive candle to lead the way, but right now it simply has not appeared. I think the market is treading water and killing time, trying to figure out whether or not we will continue to show a “risk on” attitude, or will fear grip the market yet again? It is worth noting that after the Federal Reserve reaffirmed its quantitative easing policy, the market has not necessarily taken off in one direction or the other. In other words, we may have more of the same.