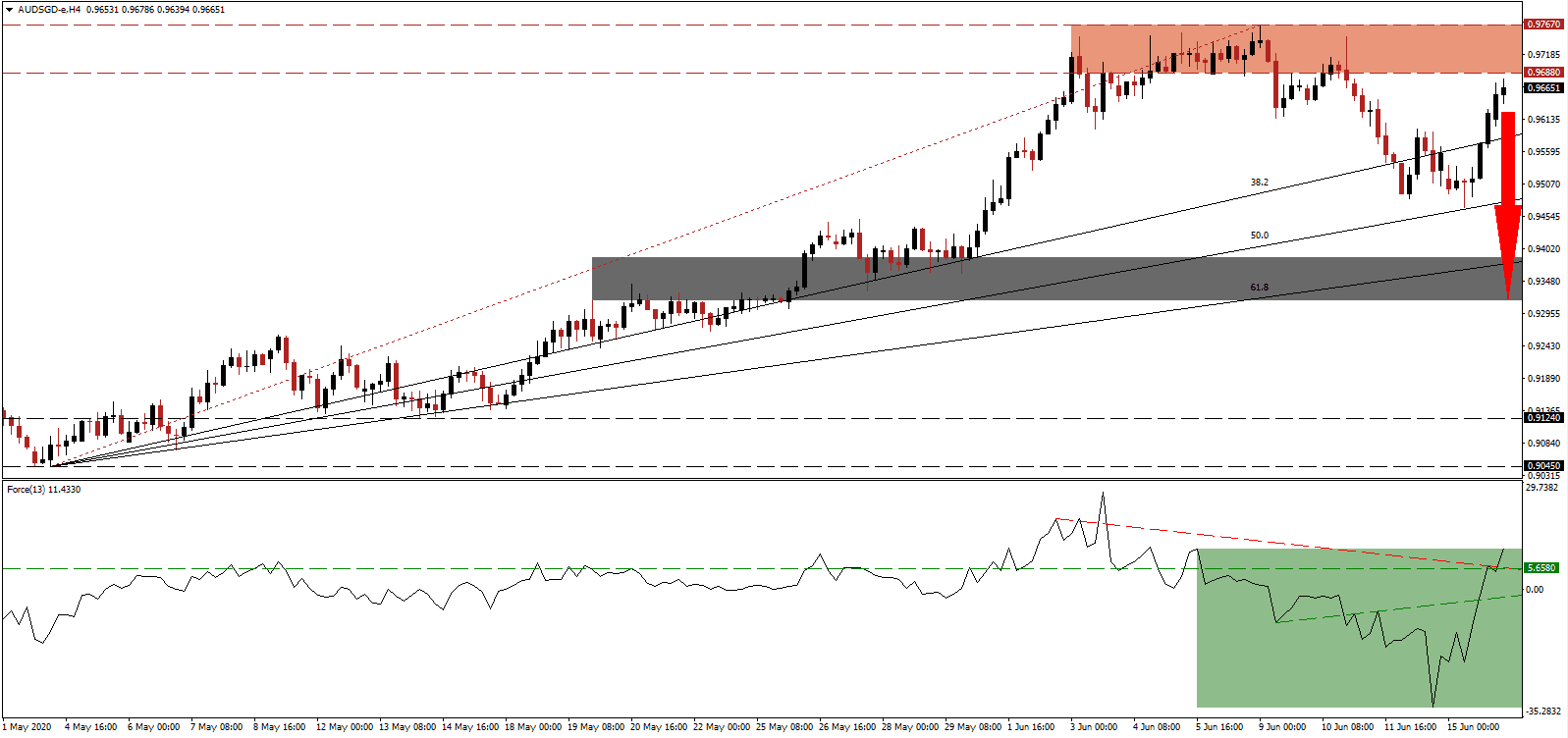

Despite the surge in global Covid-19 infections, the Reserve Bank of Australia remains more upbeat than other central banks. The release of minutes from the June 2nd meeting saw Governor Lowe acknowledge the crisis is the most significant since the 19030s depression, but that optimism remains for a quick recovery. It appears the central bank ignores the worsening relationship with its primary trading partner, China. He further confirmed the intervention in the government bond market, and willingness to do so more in an expanded capacity. Price action in the AUD/SGD stalled after moving near the bottom range of its resistance zone, from where breakdown pressures started to accumulate.

The Force Index, a next-generation technical indicator, was able to recover from a multi-week low, and reclaimed its ascending support level, as marked by the green rectangle. Bullish momentum sufficed to convert its horizontal resistance level into support and push through its descending resistance level into positive territory. While bulls have temporarily assumed control of the AUD/SGD, a swift collapse is anticipated to reverse the sequence.

China already imposed an 80% tariff on barley imports, citing anti-dumping measures. It is also evaluating iron imports. Chinese tourists and students were asked by the government to avoid Australia, expected to significantly impact the A$18 billion exposure to those sectors, together with countless jobs. Until Australia can salvage their relationship, bearish pressures on the AUD/SGD will remain dominant. Price action may attempt to push into its resistance zone located between 0.9688 and 0.9767, as marked by the red rectangle, before facing a profit-taking sell-off.

Singapore continues to make progress in its three-phased reopening process of the economy. By the end of June, most sectors are likely to resume activities restricted merely by the number of people allowed. Social distancing and protective measures will remain in place, but the government has implemented a test, trace, and isolate (TTI) infrastructure vital to resume activities. It adds to downside pressure in the AUD/SGD, favored to collapse into its short-term support zone located between 0.9316 and 0.9387, as identified by the grey rectangle, and enforced by its ascending 61.8 Fibonacci Retracement Fan Support Level.

AUD/SGD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 0.9665

Take Profit @ 0.9315

Stop Loss @ 0.9775

Downside Potential: 350 pips

Upside Risk: 110 pips

Risk/Reward Ratio: 3.18

In the event the Force extends its advance, aided by its ascending support level, the AUD/SGD could attempt a breakout. Given the headwinds for the Australian economy, in combination with positive progress out of Singapore, Forex traders are recommended to take advantage of any price spike with new net short positions. The upside potential is confined to its next resistance zone between 0.9876 and 0.9927.

AUD/SGD Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 0.9825

Take Profit @ 0.9925

Stop Loss @ 0.9775

Upside Potential: 100 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 2.00