Australian company pre-tax profits for the first-quarter plunged 16.2% in the first quarter, after a 0.6% contraction in the fourth quarter. It confirms the business sector was struggling before the Covid-19 pandemic, as the global economy was slowing down, led by manufacturing. Second-quarter data is expected to be more dismal due to the nationwide lockdown, which is being gradually eased, while global infections are accelerating. It sufficed to pause the overextended rally in the AUD/JPY, and bullish momentum is depleting, making price action vulnerable to a profit-taking sell-off.

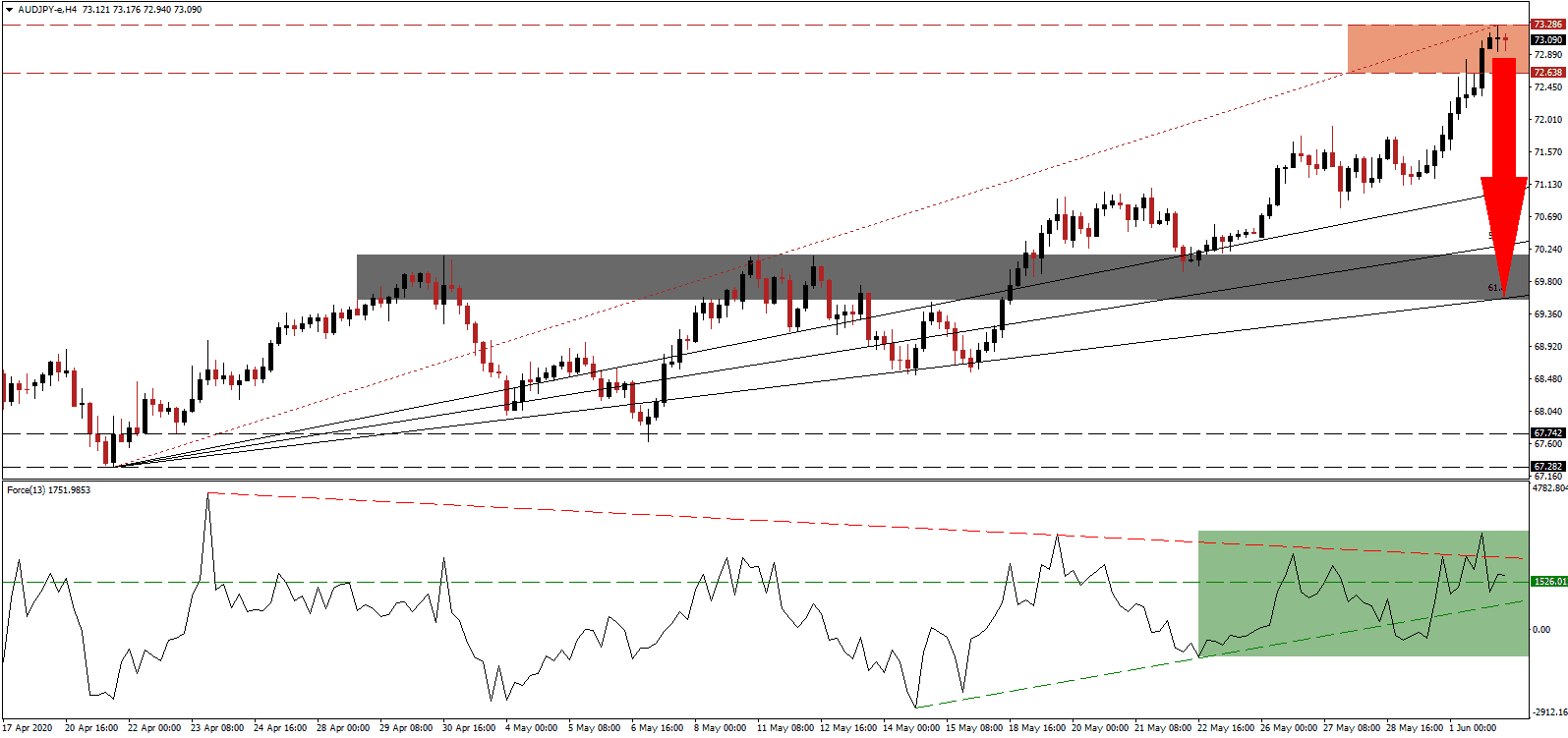

The Force Index, a next-generation technical indicator, temporarily eclipsed its descending resistance level before dipping below its horizontal support level. It has now reversed above it, but the descending resistance level is applying downside pressure, as marked by the green rectangle. A breakdown is anticipated to push the Force Index below its ascending support level from where this technical indicator can extend below the 0 center-line, granting bears control over the AUD/JPY.

Adding another significant obstacle to Australia’s economic recovery plan is a crash in immigration. The country has been labeled the world’s first immigration economy, but the Covid-19 pandemic resulted in the closure of borders. Call to severely adjust the inflow of foreigners moving forward is led by American-born Kristina Keneally, Australia’s Federal Opposition's Spokeswoman on Immigration and Home Affairs, and former Premier of New South Wales and current Senator of it. Given the magnitude of the risk-on rally, a breakdown in the AUD/JPY below its resistance zone located between 72.638 and 73.286, as marked by the red rectangle, is anticipated.

Clouding the outlook for Australia further is the diplomatic row the government started with its primary trading partner China, which could lead to an intensifying trade war. China has already increased tariffs on certain items citing anti-dumping measures and ended purchases of other goods. The safe-haven appeal of the Japanese Yen is likely to resurface. The AUD/JPY is well-positioned to correct into its short-term support zone located between 69.558 and 70.169, as identified by the grey rectangle. The ascending 61.8 Fibonacci Retracement Fan Support Level is enforcing this zone.

AUD/JPY Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 73.050

Take Profit @ 69.650

Stop Loss @ 73.800

Downside Potential: 340 pips

Upside Risk: 75 pips

Risk/Reward Ratio: 4.53

In the event the Force Index pushes through its descending resistance level, the AUD/JPY could be inspired into a breakout. The next resistance zone is located between 74.467 and 74.967. Due to the expanding issues for the Australian economy, creating a distinct bearish bias, any advance from current levels will present Forex traders with a more attractive short-selling opportunity to consider.

AUD/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 74.050

Take Profit @ 74.800

Stop Loss @ 73.800

Upside Potential: 75 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 3.00