The Aussie dollar has drifted a little bit lower against the Japanese yen during trading on Friday, with what would have been seen as a slight “risk-off trade.” What I find interesting about this pair is that it has been grinding sideways for a couple of weeks now, and although there are a lot of concerns out there that are grasping the headlines, this pair has been relatively quiet. That goes against the grain, considering that the Australian dollar is so highly levered to the global supply chain and of course the Chinese economy. After all, between the United States/China to bickering, and the coronavirus figures, one would think that riskier currencies like the Australian dollar would be shorted heavily. However, we have not seen that recently and that is rather interesting.

The Japanese yen is without a doubt one of the “safer currencies” out there, so the only thing that makes sense about the Japanese yen losing strength against a riskier currency like this is the fact that the Bank of Japan has introduced even more quantitative easing. One has to wonder how realistic that is as a driver considering that Bank of Japan has been extraordinarily loose with its monetary policy for most of the last several decades. That being said, the market is likely to look more upon the Australian dollar than the Japanese yen when it comes to this pair.

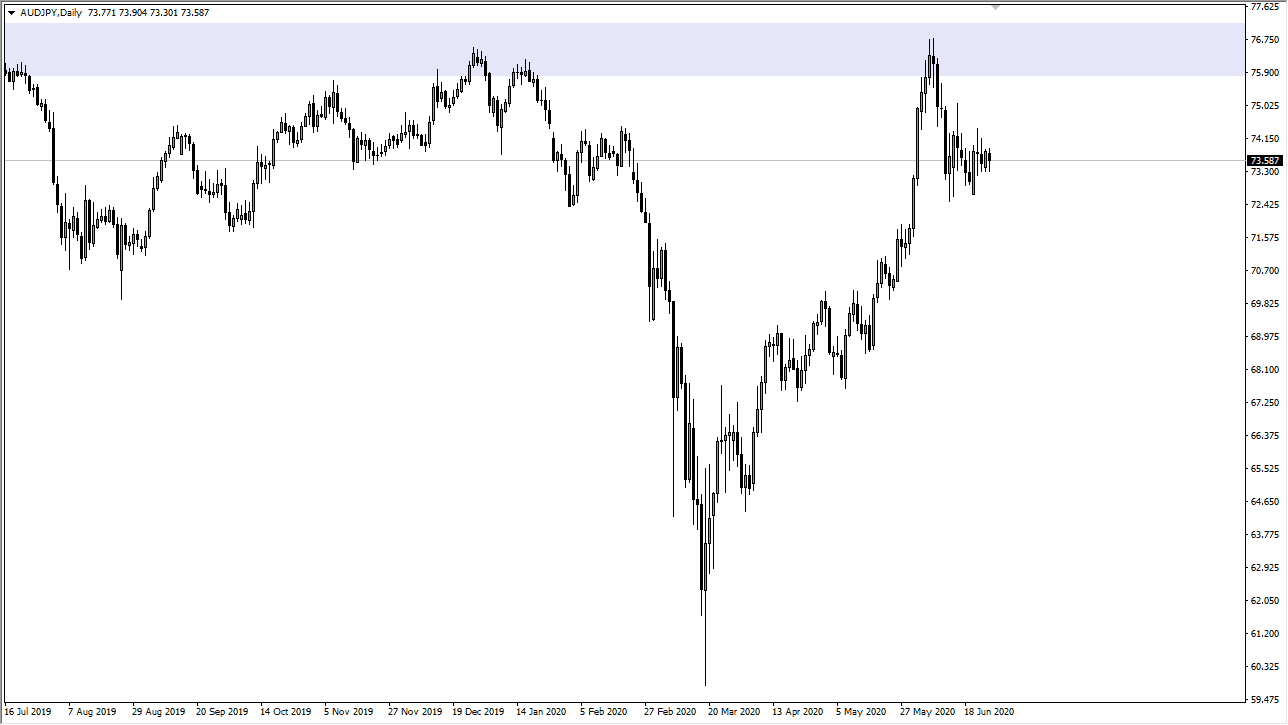

It is worth noting that the ¥75 level continues to be crucial, and at this point, we cannot break above it. The last couple of weeks have been relatively tight which tells me that the market is doing one of a couple of things: It either digested gains from the previous drive higher, or we are trying to figure out where we are going next. I suspect it is probably the latter of the two because there are so many things out there moving when it comes to headlines.

From a technical analysis point of view, I believe that if we break down below the ¥72.50 level, this market will go looking towards the ¥70 level. On the other hand, if we were to break above the ¥76.75 level, then that opens up the door for a bigger move. Having said that, the Australian dollar against the US dollar is finding a lot of trouble just above, while the US dollar is struggling to gain against the Japanese yen. I believe eventually this pair will roll over but until we get that breakdown the only opportunity to sell this pair will be fading short-term rallies.