Australia is heading towards an economic collapse unless the government maintains its present support. While many hailed the JobKeeper and JobSeeker subsidies, together with temporary changes in bankruptcy laws, they are set to disappear and revert to pre-COVID-19 law, respectively. The implemented short-term response bought businesses and the economy time, modeled based on the false assumption the global economy will be in recovery mode in the second half of 2020. Either decision taken in Canberra now, to extend the crisis response or let it expire, will apply downside pressure on the Australian Dollar. The AUD/JPY is presently challenging its short-term resistance zone, with a breakdown likely.

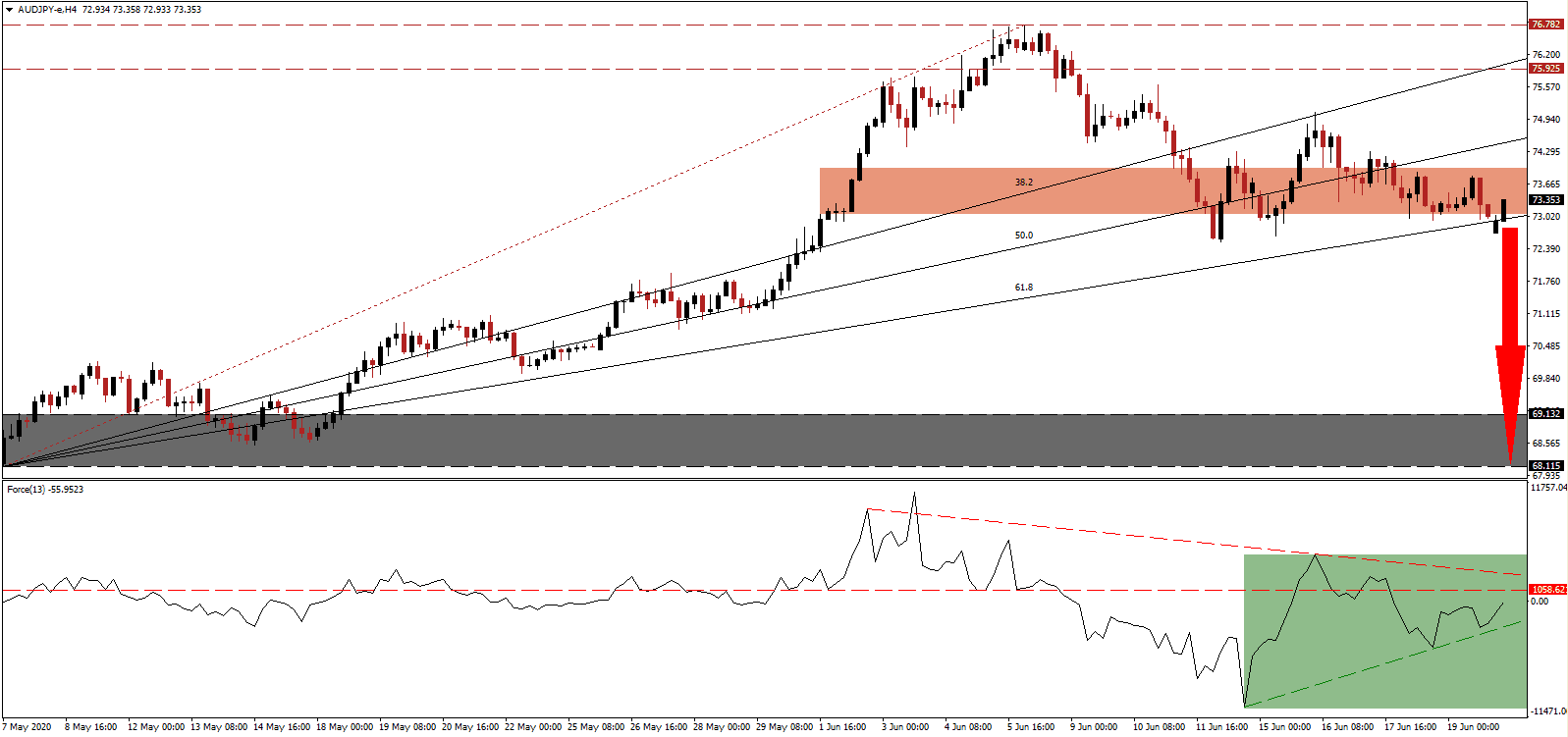

The Force Index, a next-generation technical indicator, recovered from a new multi-week low but recorded a lower high before reversing. It is now approaching its horizontal resistance level, driven higher by its ascending support level, as marked by the green rectangle. A pending rejection is favored to initiate another push to the downside. Adding to bearish pressures is the descending resistance level. Bears remain in complete control of the AUD/JPY with this technical indicator below the 0 center-line.

Optimism within the Reserve Bank of Australia remains elevated, despite the surge in new Covid-19 infections to all-time daily highs, and the worsening relationships with its primary trading partner, China. The central bank pledged to keep interest rates at record low levels, which will not prevent the pending economic challenges. While the ascending 61.8 Fibonacci Retracement Fan Support Level pushed the AUD/JPY back inside its short-term resistance zone located between 73.070 and 73.973, as marked by the red rectangle, a renewed breakdown attempt is anticipated to materialize.

Increasing domestic pressures is the looming Australian bankruptcy threat, especially in the small business sector, which accounts for 35% of GDP and 44% of the labor market. A gradual return of safe-haven demand for the Japanese Yen, the principal currency for risk-averse Forex traders, is expected to add to downside pressure in the AUD/JPY. Following a collapse below its 61.8 Fibonacci Retracement Fan Support Level, price action will have a clear path into its next support zone located between 68.115 and 69.132, as identified by the grey rectangle. Japanese data confirmed a steeper than forecast negative economic impact on global trade, with depressed recovery potential.

AUD/JPY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 73.350

Take Profit @ 68.150

Stop Loss @ 74.750

Downside Potential: 520 pips

Upside Risk: 140 pips

Risk/Reward Ratio: 3.71

In case the Force Index accelerates above its descending resistance level, the AUD/JPY could attempt a breakout. Due to the rising economic threat in Australia, in conjunction with the bearish global outlook, the upside potential remains limited to its resistance zone. Forex traders are advised to consider any advance from current levels as an excellent secondary short-selling opportunity.

AUD/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 75.350

Take Profit @ 76.700

Stop Loss @ 74.750

Upside Potential: 135 pips

Downside Risk: 60 pips

Risk/Reward Ratio: 2.25