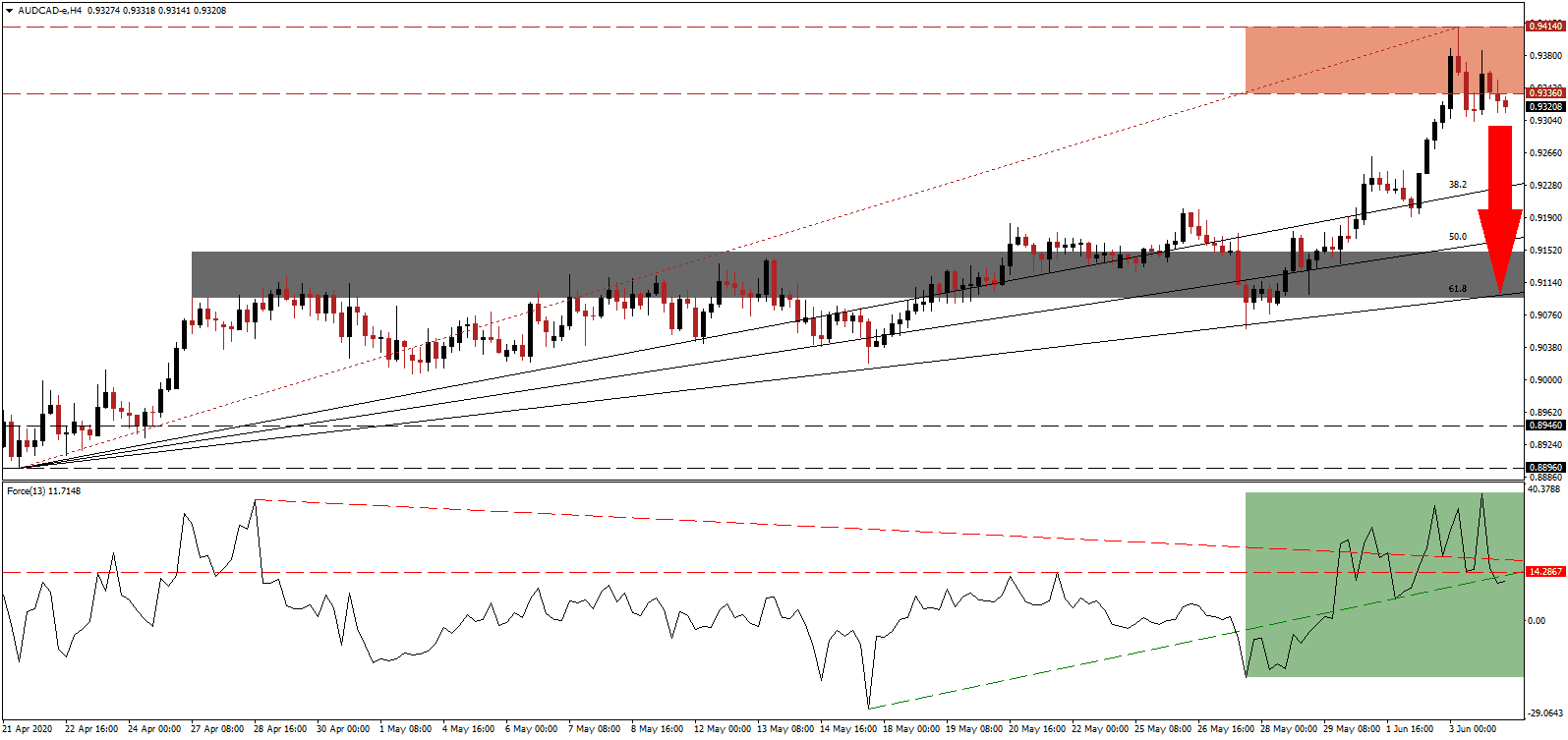

Australian exports plunged 11.0% in April with imports down 10.0%, resulting in a smaller than forecast decrease in the trade surplus as compared to March. Retail sales collapsed, but market participants are looking forward to May and June data to assess if the easing of lockdown measures had the desired positive impact. A surge in risk appetite, unsupported by fundamental conditions, assisted the AUD/CAD in its advance until it reached its resistance zone. The following breakdown was accompanied by a decrease in bullish momentum, and a more massive corrective phase is pending.

The Force Index, a next-generation technical indicator, confirmed the preceding advance with a rise to a new multi-month peak. It has since retreated below its descending resistance level and converted its horizontal support level into resistance. Adding to bearish developments was the breakdown below its ascending support level, as marked by the green rectangle. This technical indicator is favored to cross below the 0 center-line, ceding control of the AUD/CAD to bears.

Yesterday’s first-quarter GDP data out of Australia showed a 0.3% contraction, the first one since March 2011. Household consumption, down 1.1%, posted the worst slump since 1986. With Australia in a recession, the economy was underperforming before the outbreak of the Covid-19 pandemic. Spending growth has been below the long-term average for eight years, while panic buying related to the virus prevented the data from being worse, driven by a 5.7% surge in food items. Government spending and imports added 0.3% and 1.3% to the Australia GDP, highlighting the dire state of the economy. More downside in the AUD/CAD is expected following the breakdown below its resistance zone located between 0.9336 and 0.9414, as identified by the red rectangle.

Resilience in the Canadian housing sector may benefit consumer confidence. The Bank of Canada announced a reduction in the frequency of market interventions, a rare positive central bank move, adding a minor bullish catalyst to the Canadian Dollar. The AUD/CAD is likely to close the gap to its ascending 38.2 Fibonacci Retracement Fan Support Level from where an extended collapse into its short-term support zone is probable. This zone is located between 0.9096 and 0.9150, as marked by the grey rectangle, enforced by its 61.8 Fibonacci Retracement Fan Support Level.

AUD/CAD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 0.9320

Take Profit @ 0.9100

Stop Loss @ 0.9390

Downside Potential: 220 pips

Upside Risk: 70 pips

Risk/Reward Ratio: 3.14

A breakout in the Force Index above its descending resistance level could lead to a temporary price spike in the AUD/CAD. The economic outlook for Australia is increasingly bearish, magnified by the worsening of relations with its primary trading partner China. The upside potential remains confined to its next resistance zone, located between 0.9549 and 0.9613. Forex traders are advised to consider this an outstanding selling opportunity.

AUD/CAD Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 0.9460

Take Profit @ 0.9600

Stop Loss @ 0.9390

Upside Potential: 140 pips

Downside Risk: 70 pips

Risk/Reward Ratio: 2.00