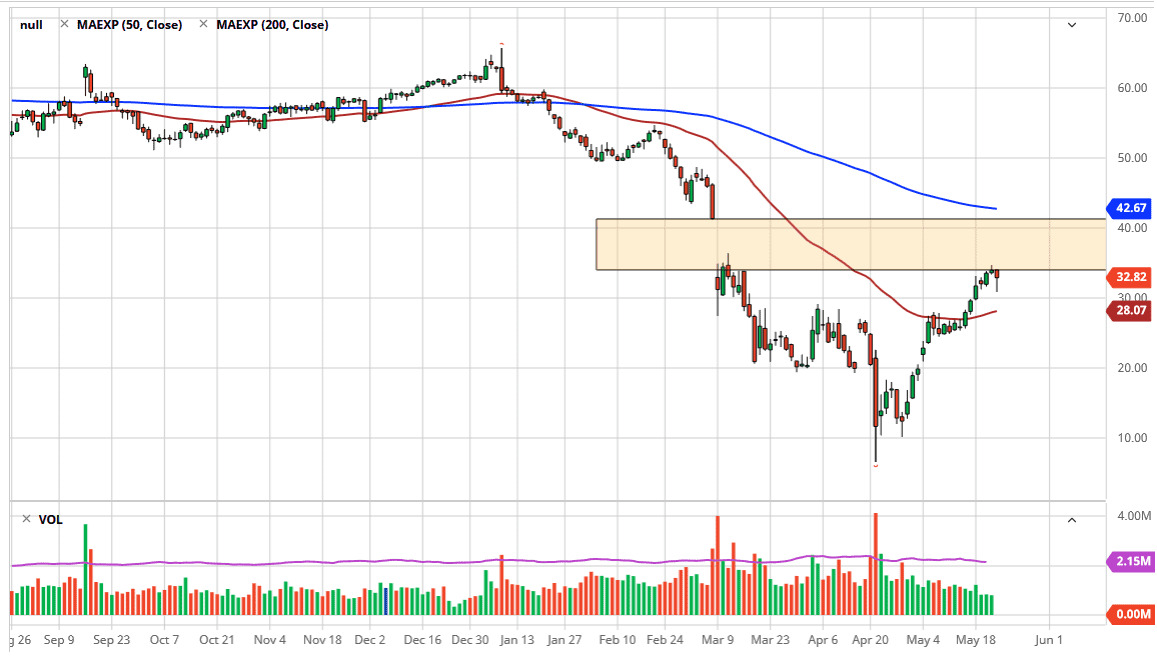

The West Texas Intermediate Crude Oil market pulled back significantly during the Friday session, but did bounced enough to show signs of resiliency. We are approaching the massive gap above being pressured, so it is possible that we break out and go looking as high as the top of the gap which is closer to the $41 level. That does not mean that the market will be simply skipping to that level, but it is also worth paying attention to the idea of the candlestick during the trading session making a potential “hanging man.”

All of that being said, crude oil markets are most certainly going to continue to react to all of the closing of rates in the United States which of course helps the idea of supply being worked on. It is going to take a while to do so, so do not be surprised at all to see the market try to break out to the upside. Furthermore, from a technical analysis standpoint it is highly likely that we will see this Get filled eventually. If that happens, then a short-term buying opportunity should present itself. That being said, crude oil breaking above the $41 level seems to be a bit much, considering the demand simply will not be there.

Furthermore, the 200 day EMA sits just above the $41 level so it is possible that we will see a move to that area before rolling back over as far as longer-term traders are concerned, as they like using that as a trend of finding technical tool. On the other hand, though, we could break down below the bottom of the candlestick and confirm a “hanging man”, which would send this market looking towards the $28 level. Having said all of this, price is price and it certainly looks as if the market is going to try to go much higher in the short term before rolling right back over.