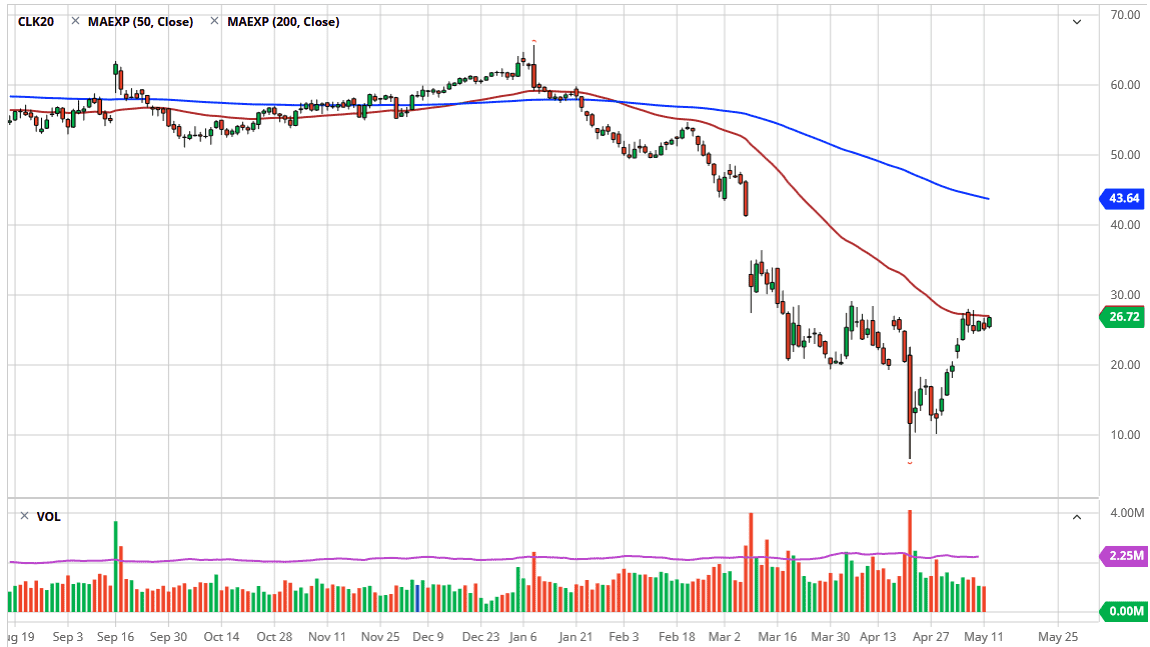

The West Texas Intermediate Crude Oil market has rallied a bit during the trading session on Tuesday, as we continue to test the 50 day EMA. That is a major technical indicator that attracts a lot of attention and it is flattening. That suggests that perhaps we are going to sit here and kill time, which makes quite a bit of sense as the market had rallied a bit too much, and now needs to digest these gains in order to continue going higher if it does in fact 12.

That being said, the $30 level should offer quite a bit of resistance as well, and as a result it is likely that the market will continue to respect this general vicinity as major resistance. As long as we stay underneath the $30 level, it is likely that we will struggle to continue to gain from here. The fact that Saudi Arabia has already announced that they were going to do further production cuts along with a couple other smaller kingdoms, and the fact that oil did not rally much based upon that suggests that there is still a lot of negativity in this market. In fact, the lack of demand is something that seems to be very much on the forefront of the minds of traders, as the global economy has been shut down completely.

If we do break above the $30 level, then it is likely that the market could go looking towards the $42 level after that. All things being equal, the market is going to continue to be extremely negative overall, but one thing is for sure it has done much better than one would have anticipated. If we break down below the $25 level it could open up a move down to the $20 level, followed by the $17.50 level. Expect volatility regardless of what happens and with the OVX, the oil volatility index, at higher levels that was after the Great Financial Crisis, this shows you just how dangerous the oil market is going to be. With that in mind it is likely that the position size should be small as the latest headlines will throw this market back and forth. Quite frankly, the only reason this market has been quiet is that the market has become somewhat exhausted after the massive move that we had seen. The inventory figures coming out later this week could be crucial.