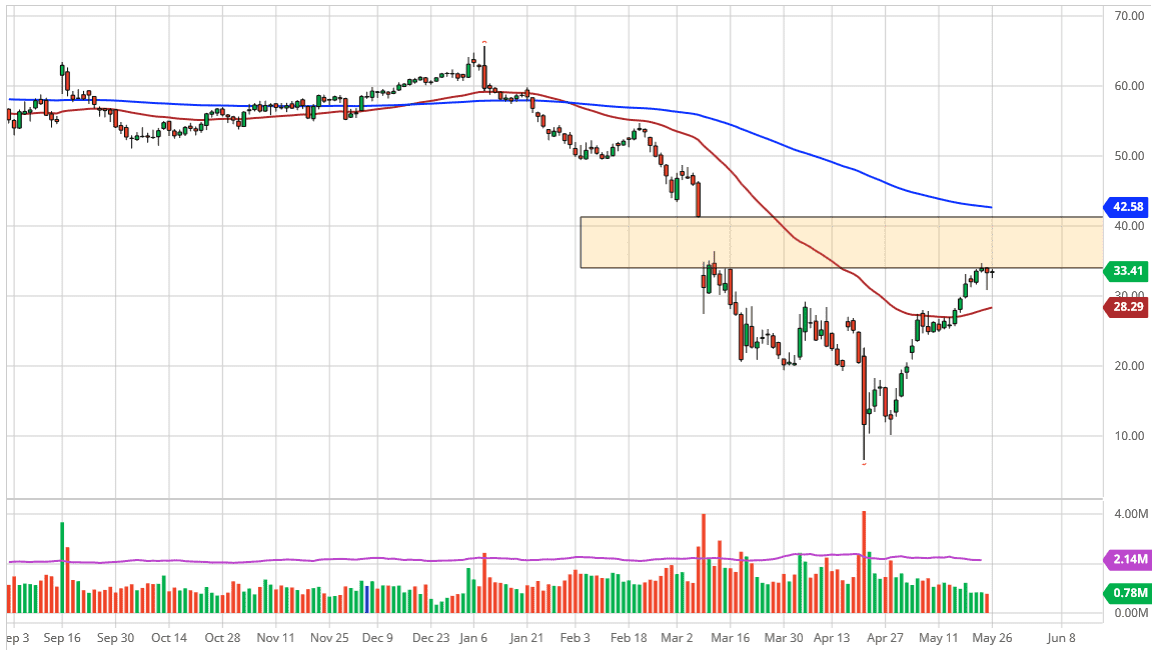

The West Texas Intermediate Crude Oil market has been going back and forth during the trading session on Monday, but it was also Memorial Day, so should keep in mind that liquidity would have been a bit of an issue. At this point, it is likely that the market is going to try to break into the gap above, but it is going to take a significant amount of momentum to make that happen. Because of this, I believe that we are simply waiting for the next catalyst. At this point, if we can break above the $35 level, then it opens up the door to the top of the gap which is the $41 level. At this point, the $41 level is also backed up by the 200 day EMA just above, so therefore it is likely that there will be plenty of sellers above.

To the downside, if we break down below the candlestick from the Friday session and then turns into a “handyman”, which of course allows the market to go looking towards the 50 day EMA, and then eventually the $27.50 level underneath. A breakdown below that level then could open up more selling. Having said that though, it seems to me as if the market is certainly trying to run to the outside, and as a result I think that the market is trying everything you can go higher.

The question now is whether or not there have been enough production cuts to drive the price higher. Ultimately, the market looks highly likely to see a lot of volatility regardless, but the gap being broken to the upside is very unlikely due to the fact that the market is going to have to come to terms with the idea of a serious lack of demand. The demand of course is going to be lower due to the fact that the economies around the world are slowing down and were long before the coronavirus head. In other words, sooner or later economic reality comes back to town but right now I think the gap is more than likely going to at least the attempted to be filled. It is a tactical move, but the 200 day EMA of course makes quite a bit of sense as resistance as well, because so many longer-term traders pay attention to it. All things being equal, I think the one thing you can count on is an extraordinarily volatile market.