The West Texas Intermediate Crude Oil market has rallied a bit during the trading session on Wednesday, as we simply cannot keep this market down. The gap above will be a massive resistance barrier, but do not be surprised at all to see it gets filled based upon the fact that a lot of different markets are completely ignoring both gravity and economic reality right now. Yes, there was a massive drawl down of inventory in Cushing Oklahoma but at the end of the day there is still a significant amount of demand destruction that we have in the past.

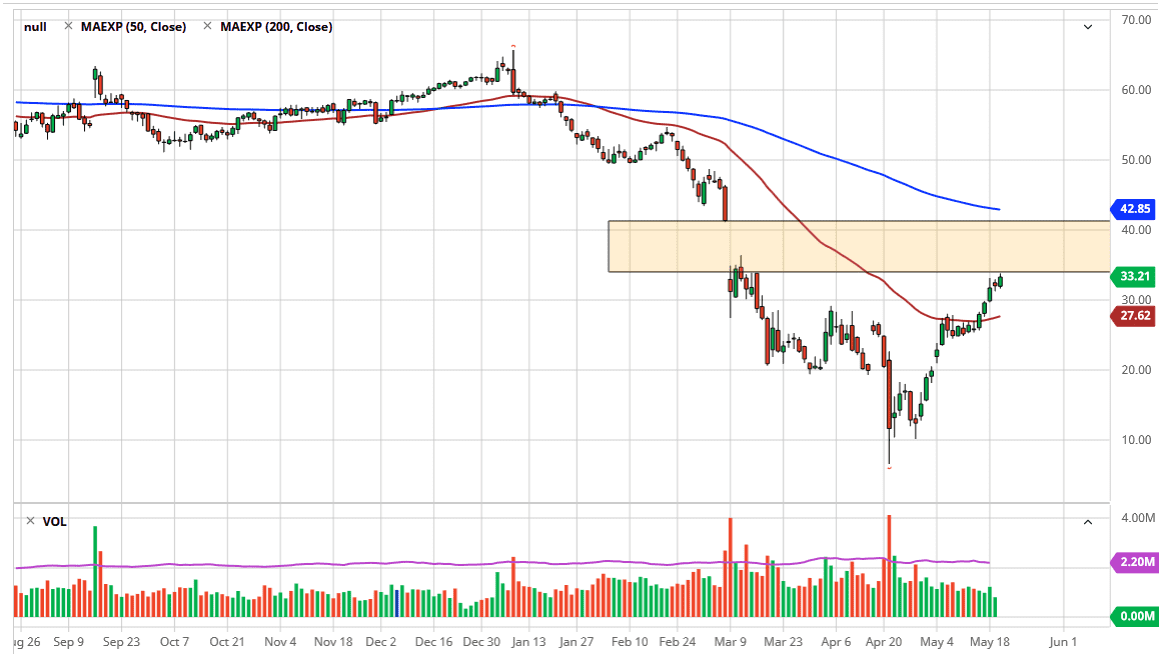

The question now is whether or not demand will come back to the market? It will, to a point obviously, as states around the United States start open up. The reality is that major components of demand are going to be there though, not the least of which is the aviation industry which is running at about 20% capacity. Having said that, perhaps the market had oversold itself and now it just simply trying to find some type of balance. $40 a barrel make some sense, but I think getting above there is really pressing the issue. Furthermore, there are quite a bit of technical signs in that general vicinity that should keep the market somewhat leveled if we get there.

The gap above extends all the way to the $41 level, and of course the 200 day EMA sits just above that level. Both of those are reason enough to think that perhaps the buyers will run out of momentum at that point. It is difficult to buy crude oil here for anything more than a short-term opportunity, but I think it is much easier to sell at signs of exhaustion because it will line up nicely with a lot of different technical analysts out there. I do believe that the market is overdone, but then again you could say the same thing about the market on the way down. To the downside, if we do start to break down expect the 50 day EMA to come into play which is currently sitting at the $27.63 level. The market is overdone, but as we have seen as of late, markets do not seem to care when they are overdone as we are trading on raw emotion and nothing more over the last several months.