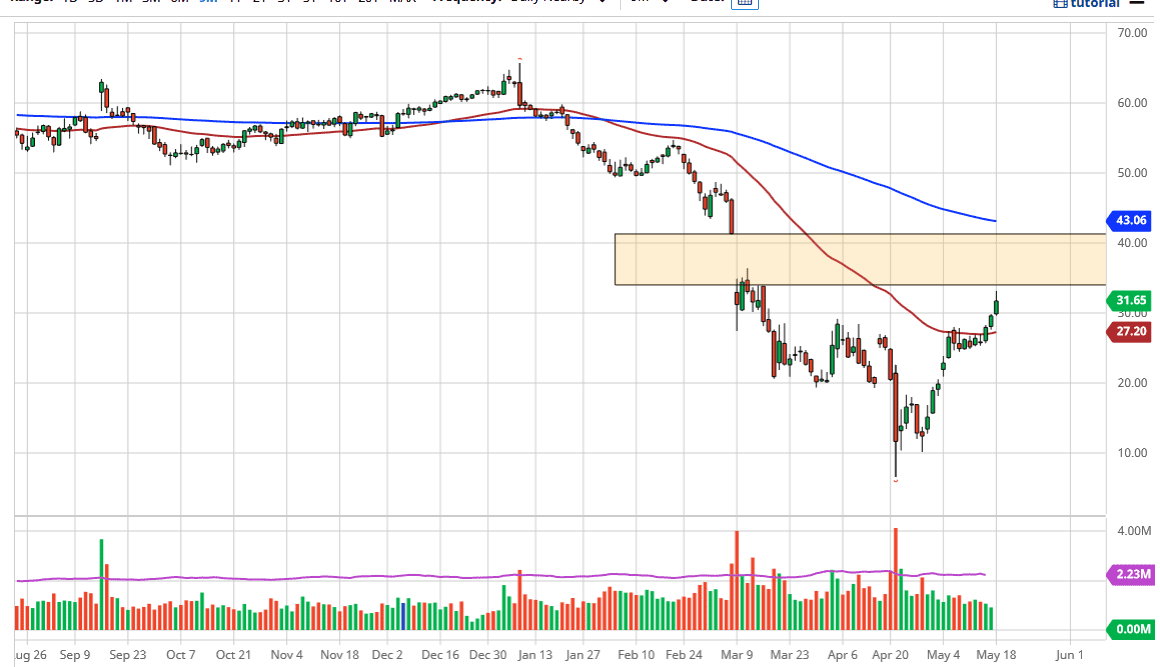

The West Texas Intermediate Crude Oil market rallied again during the trading session on Monday, gaining over 7% at one point. However, towards the end of the day it looks as if traders were willing to take some profits as we get close to the gap just above. At this point, the gap is something that should be paid attention to, as the market clearly recognizes that it is an area that could cause major resistance. I believe that resistance extends all the way to the $41 level. Furthermore, the 200 day EMA is right around the $43 level. At this point, we are trying to figure out whether or not this gap gets filled, or if it simply offers a ton of resistance.

When looking at the chart in general, it is likely that the market will continue to see a lot of noise just above and the fundamental situation of course is a bit of a mixed picture, as the rigs in the United States are closing down, as over half have already been shot. Ultimately, the market is likely to see selling pressure eventually, but clearly, we have a “fear of missing out” trade going on. It is worth noting that we pulled back from the very precipice of the gap, so I think this shows that if the gap does in fact get filled, that is probably going to be it for the upside.

In order to expect crude oil to simply take off for a longer-term move upwards, you would have to leave that the demand is suddenly going to skyrocket. It clearly is not, and one only has to look at the airline industry to understand that to be true. Having said that, I remain steadfast in my bearishness over the longer term, but clearly now is not the time to be shorting. I suspect you will get that opportunity soon, but I would also be a seller below the $30 level, and most clearly below the recent consolidation. Short-term day traders may try to take long positions, but keep in mind that we are getting at dangerously high levels. You must be quick to take your profits if you are going to do this, but if you are more of a swing trader like I am it is simply a matter of waiting for an opportunity to get short. That opportunity has not presented itself quite yet.