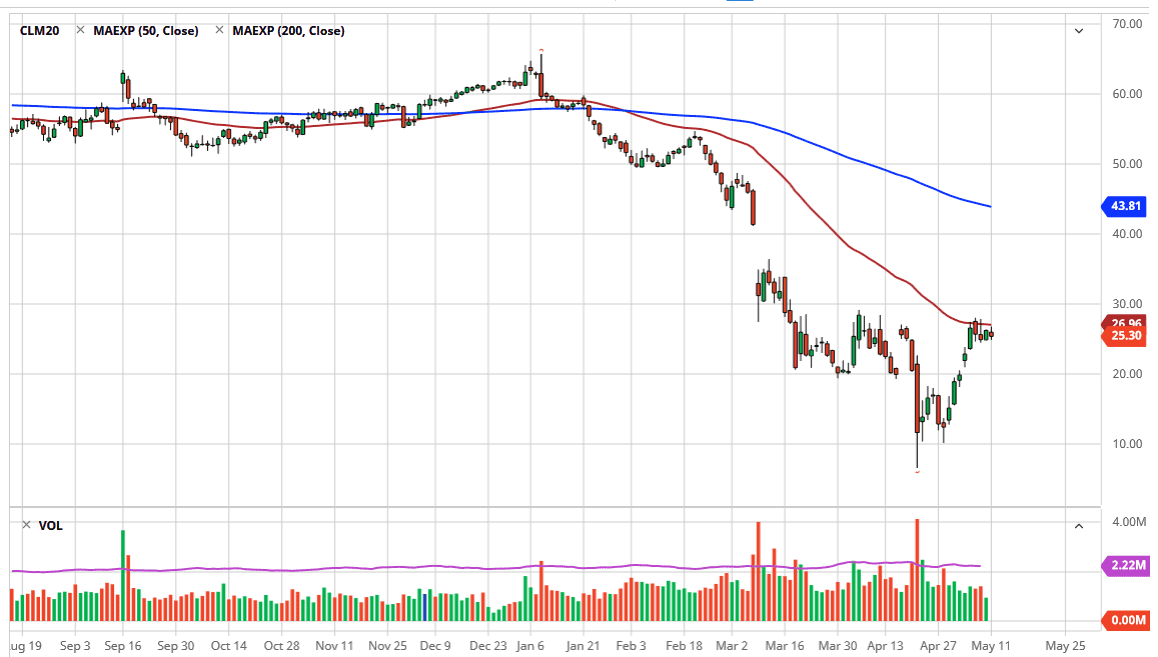

The West Texas Intermediate Crude Oil market try to rally initially during the trading session on Monday but pulled back from the 50 day EMA. Saudi Arabia announced that they were going to cut 1 million barrels of production daily, and therefore markets spiked a bit but as you can see, they have given up quite a bit of the gains in order to form a negative candlestick. At this point, the market is likely to see enough selling pressure to turn this thing around, perhaps reaching it towards the $25 level initially, before breakdown opens up the possibility of a move to the $20 level.

To the upside, the market was to break out above the $30 level, it would be a very bullish sign and could send this market much higher, perhaps sending it to the $35 level initially, before trying to fill the gap above at the $42 level. It is a bit difficult to imagine a scenario in which this happens, but it is one of the charts tell me. That being said, I am much more control fading rallies and of course breaking to the short side underneath the $25 level.

On a day that Saudi Arabia announces a 1 million barrel cut and people cannot be bothered to hang on to the contract, is a day that tells you pretty much everything you need to know about this market. Crude oil will continue to suffer, and therefore I have no interest whatsoever in trying to buy this contract right now. Having said that, a move above the $30 level would be somewhat convincing and I would certainly have to pay attention to that, but it is also easy to tell that the market has been a bit overdone as of late, so that would of course be unexpected.

Volatility continues to expand in this market, so therefore it makes quite a bit of sense that we will see more noise, and that noise will continue to make trading conditions a bit difficult but as the last couple of days have been rather tight, expect an explosive move sooner or later. By the Saudis not been able to push the market higher, that tells you that we still favor the downside overall. The trend has been down, and quite frankly with good reason for some time as the global economy is essentially at a standstill.