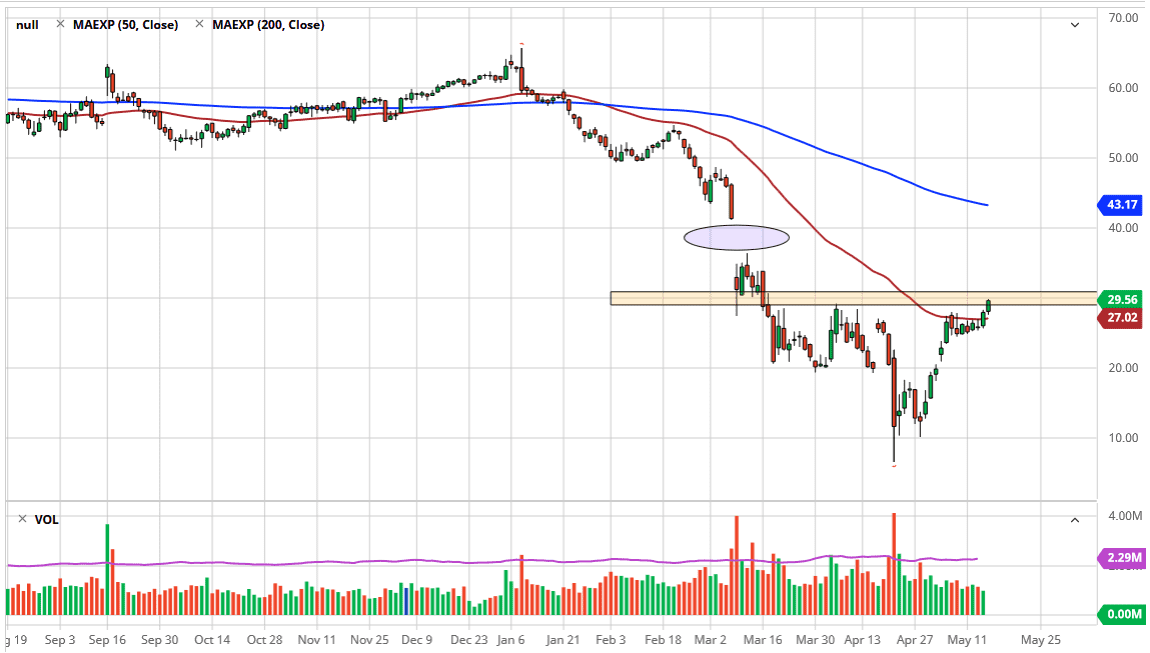

The West Texas Intermediate Crude Oil market has rallied quite a bit during the trading session on Friday again, as we continue to see bullish pressure build up. However, the $30 handle continues to offer significant resistance. It is a psychologically important level, and of course is also an area where we have seen a bit of resistance previously. That being said, the candlestick for the session on Friday is very bullish looking, and it is closing towards the top of the range. Having said that, it was also previous support so one would think that a bit of “market memory” should come into play and keep this market somewhat composed.

On the other side of the equation is that we get a significant break above the $30 level and continue to go higher, it could send this market much higher as it was the previous support and the so-called inflection point recently. A break above there, and I mean a significant one on a daily close, should send this market towards the gap above. The $41.50 region is the top of that gap, so we could go as high as that level before selling off again. If we break out, that is about as far as I would anticipate this market going.

However, you should keep in mind that it seems like market participants are willing to place a lot of credence in the shutdown of US rigs, and perhaps even the production cuts coming out of the Middle East. However, it is a short-term rally at best that I think we are going to see, so the longer-term situation is something that we should be paying close attention to as a lack of demand is going to make this market bearish eventually. After all, we are not going to see the same type of momentum that we had in the past, and with the lack of business movement, it makes quite a bit of sense that the oil markets will reflect that. Ultimately, I do believe that there still money to be made on the downside, but the question is whether or not the $30 level is going to hold. If not, then we know that the gap is the next major barrier. Between now and then we can make profit. Otherwise, if we turn around a break down below the $27 level it is likely that this market rolls over completely.