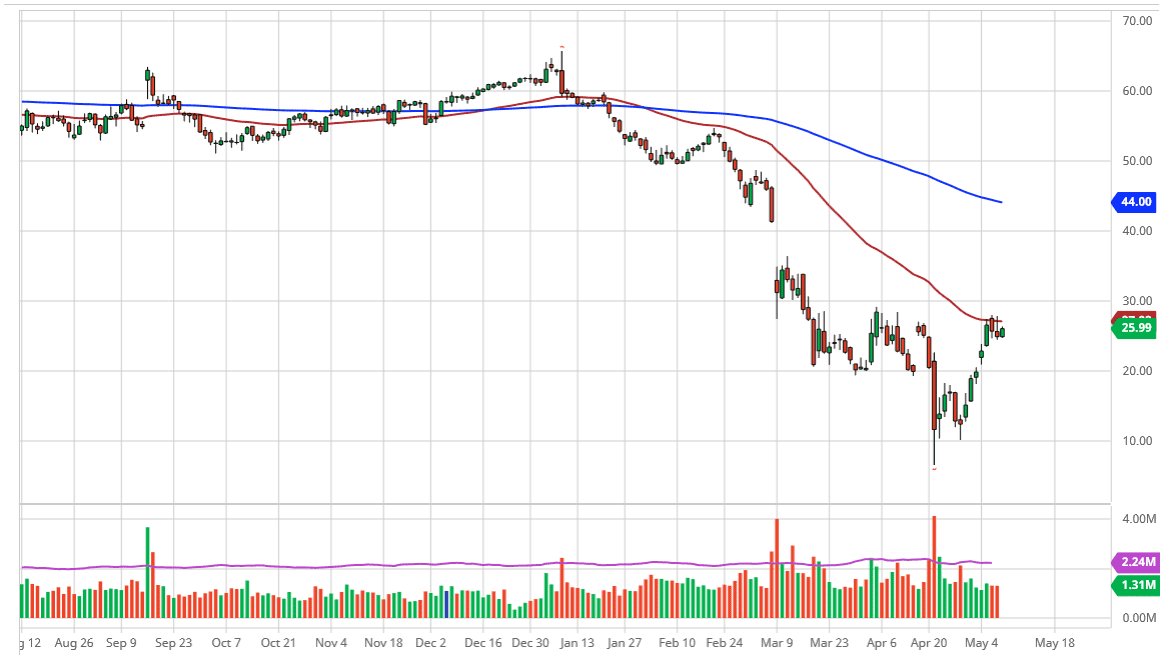

The West Texas Intermediate Crude Oil market rallied a bit during the day on Friday after an exceedingly difficult jobs number in the United States. That being said, the market is highly likely to run into a lot of resistance just above, as the 50 day EMA of course attracts a lot of attention. Furthermore, we have formed a shooting star during the day on Thursday, so it shows just how much resistance there really is above. If you think about it, it makes perfect sense.

The crude oil market has continued to struggle just below the $27.50 level, and it looks very much like a market that has a larger resistance barrier that extends all the way to the $30.00 level. At this point, short-term rallies probably get sold into, and I think it is only a matter of time before this market breaks down due to the fact that there is a massive amount of selling pressure just above historically.

You should also keep in mind that although half of the rigs in the United States have been closed, the reality is that there is still far too much in the way of supply when it comes to crude oil in relation to demand. This has been an impressive rally if you look at through the prism of the media, which of course continues to be astounded at 8% gains, or other such numbers per day. However, one thing that they failed to keep in the back of your mind is that 8% of $20 is much less than 8% of $55, where we were just a couple of months ago. In other words, do not get caught up in the “clickbait” of the day.

When you look at this chart, it is obvious that the $30 level is going to cause massive resistance, and quite frankly it is a market that has been in an extremely negative trend for quite some time. I have no interest in buying oil, at least not quite yet. If we were to get a daily close above $30 then I would start to consider it, as we could have this market looking to fill the gap. I find it difficult to believe though, and a pullback is almost inevitable at this point. After all, even if you were bullish of this market you must recognize that the market has gotten ahead of itself.