The West Texas Intermediate Crude Oil market ended the month of April with a bang, reaching towards the $19 level at the close of open pit trading. This is a very bullish sign, but at the end of the day there is still a significant amount of resistance near the $20 level that will come into play. With that being the case, I think it is only a matter of time before the sellers get involved as it is an area that had previously been massive support. Ultimately, this is a market that I think will continue to run into a lot of trouble due to the fact that there is almost no demand for crude oil, so one thinks that there would be a lot of selling pressure in this general vicinity.

At this point, I believe that the market probably tries to break above the $20 level but then finds enough selling pressure to turn things around and go looking towards the $17.50 level. Underneath there, then we probably go looking towards the $15 level. It should be noted that the $10 level underneath will almost certainly be looked at as a potential target and support level as well. Ultimately, this is a market that still has to worry about whether or not the economy is open back up and demanded of crude oil to chew through a massive supply issue.

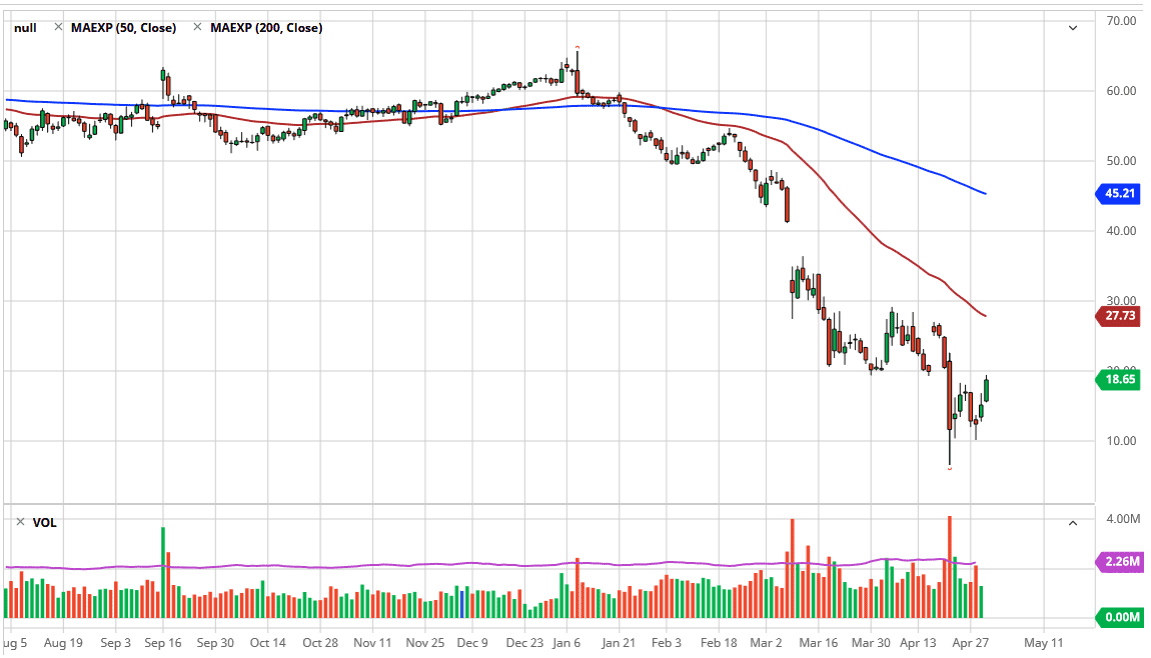

The 50 day moving average is all the way up at the $27.75 level, and as a result it is likely that we will see the top of the consolidation area above offer plenty of resistance as well. Ultimately, I do believe that the longer-term downtrend is very much in trouble, and therefore it is more likely to test the $10 level that it is the $30 level. With that, look for signs of exhaustion to take advantage of. Part of what may have been a boost towards the end of the day was the fact that it was the last day of the month, and traders may have been trying to book profits. Nonetheless, we are still very much bearish, and we are still awfully close to running out of room to store crude oil, not exactly something that would bring a lot of confidence into the marketplace and have oil screaming to the upside. Although you cannot just jump in and sell here, I would not be surprised at all to get an extremely negative sign at the end of the day on Friday.