The West Texas Intermediate Crude market has pulled back just a bit from the gap above, as word got out that there were people in Russia suggesting that production cuts should be rolled back in late June. That of course is negative for price, so having said that you need to be patient as to what you do next. After all, the market is likely to continue to see a lot of noise from headlines and of course the fact that people are trying to figure out how the global economy behaves once everything opens up.

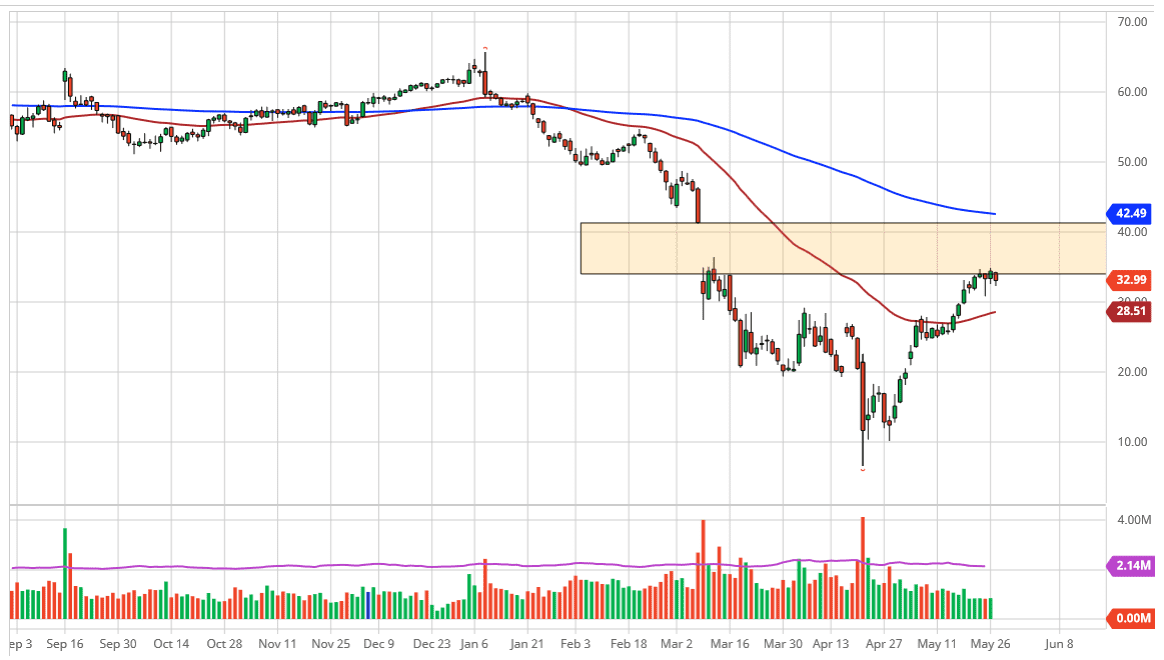

Looking at the chart, there is a major gap just above, that extends all the way to the $41 level. The entire market is looking at this gap, and therefore it would not be surprised at all to see this market try to fill that gap. Having said that, there is a huge amount of noise out there, and that will continue to throw this market around. We also have the inventory numbers that we should be paying attention to, so that could have an effect. However, as a general rule gaps do get filled but sometimes you get a move towards that level of the beginning of the gap only to see things turnaround initially.

To the downside, the $30 level will be incredibly supportive, as well as the 50 day EMA. The 50 day EMA currently sits at the $28.50 level, somewhere in that area I would anticipate quite a few buyers. If we were to break down below the $28.50 level, then it is likely that we go back towards the $25 level, possibly even the $20 level. I think oil is going to be a very noisy market over the next several sessions, and I would be cautious about putting too much money into it. Quite frankly, crude oil markets are not necessarily a retail market, despite what your broker might tell you. However, if you get the ability to trade CFD markets, or at least have a large enough account to trade futures, then you can look for a potential move to fill the gap above. Again though, if the market breaks down below the 50 day EMA, it is likely that we continue to go much lower as it would be a major technical breakdown. It seems as if there is a lot of hope out there for an economy that turns around and takes off, so that could be one of the key drivers here.