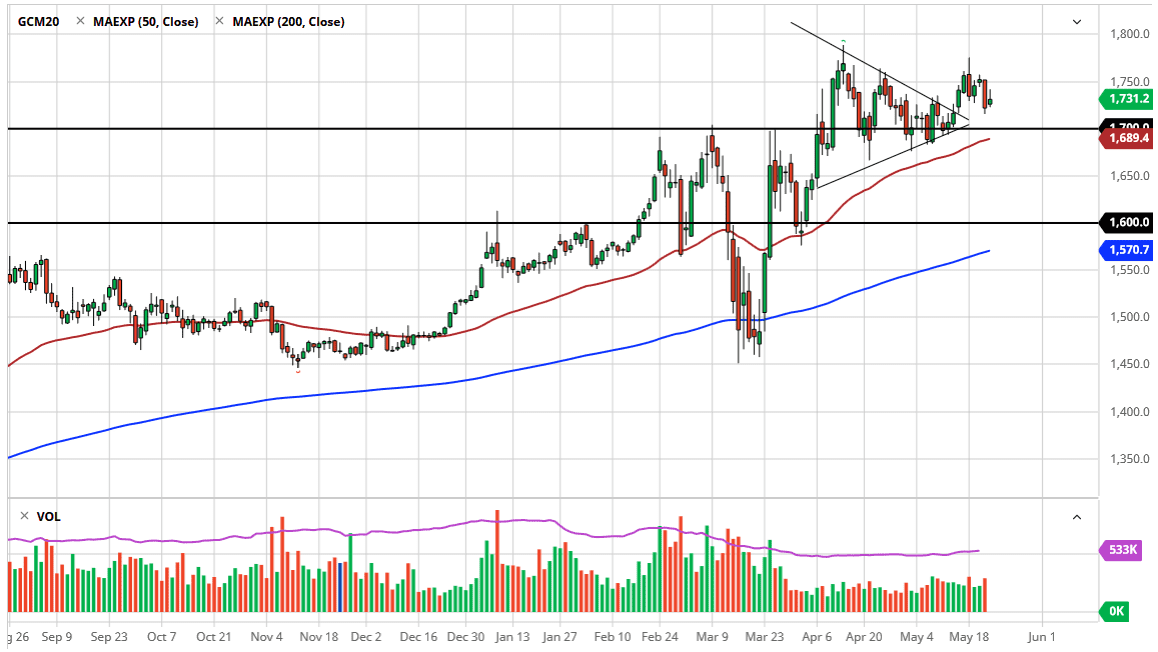

Gold markets have formed a bit of a “harami” during the trading session on Friday and using the Thursday candlestick as part of the pattern. Having said that, there is a significant amount of support underneath, the $1700 level where there should be plenty of buyers. Furthermore, not only is the $1700 level a psychologically important figure, but it is also going to be supported by the 50 day EMA rather soon. In other words, I do think that buyers will continue to jump into the gold market based upon value. It has been in an uptrend for quite some time and there is no reason to think that is going to change anytime soon.

I get a lot of emails asking me about whether or not a relatively strong US dollar is going to continue to work against gold. While it can do that, the reality is that we have seen both gold and the US dollar rise the same time in the past. Typically, that means that there is a serious lack of risk appetite out there, and we certainly could see that rather quickly at this point.

To the upside, there is a significant amount of resistance at the region between $1750 and $1770 level. I think it is can it take a significant amount of momentum to break above there, so at this point I like the idea of waiting to see whether or not we can break out above there to add to a position if we start buying at this point. Ultimately, the trade that I would really like to see is a pullback towards the $1700 level so I can start buying gold, and then I would be adding to it somewhere near the $1775 level. If we can break above the $1800 level, then I suspect that it would be time to add again as we will eventually go looking towards the $2000 level over the longer term. This does not mean that it is going to be easy to get there, but I do think that longer term we are going to continue to see buyers jump into this market and push it much higher. The downside is extremely limited, even if we do break down below the 50 day EMA. However, if we do, I will have to rethink the entire situation and of course will let you know what I think here at Daily Forex.