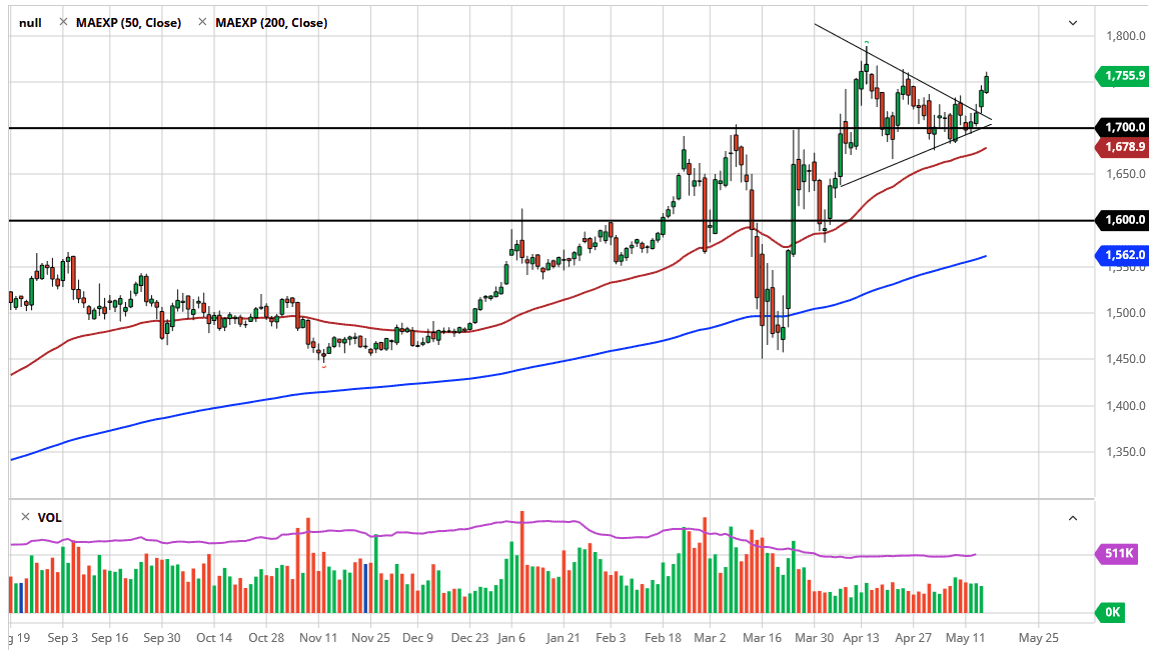

Gold markets have rallied significantly during the trading session on Friday, peaking above the $1750 level. With this, the market should continue to see a lot of buyers on dips, as it is so bullish. The major triangle that we have just broken out of suggests that we are going to go looking towards the $1800 level, possibly even further than that. Ultimately, the market looks as if it is going to go to the $2000 level longer-term, based upon the measurement of the base of the triangle. Furthermore, it is also a somewhat preordained figure based upon valuation of risk and of course the fact that the market likes large, round, psychologically significant figures.

In the meantime, pullbacks offer value that you can take advantage of, because quite frankly there is no reason to think that the gold market is certainly going to have a reason to turn around. It likes simple bank printing of currencies, as it has plenty of it to chew on. Furthermore, the global concerns around the world continue to see a lot of damage to the economy and therefore people will be looking towards gold for preservation of wealth and safety.

The one thing that is working against the gold market though is going to be the US dollar, as it continues to rally significantly. That is probably the one thing that has kept the gold market from going even higher. Having said that, both can go higher due to a safety trade, and as a result I think that is what it is about to happen. The market could pull back towards the $1700 level, but I also believe that there is plenty of support in that general vicinity. At this point, I am looking for short-term pullbacks to continue buying. In fact, I believe that traders will continue to add to the longer-term core positions that have served them so well, especially with the 50 day EMA racing towards the $1700 level also. I do not have a scenario in which I am willing to sell gold, but of course if that changes, I will let you know in my further analysis. Ultimately, the $1650 level underneath would be massive support. Ultimately, I think that the market has finally seen enough digestion to continue sending this market higher, and it looks likely to continue to be a “find value” type of trend making