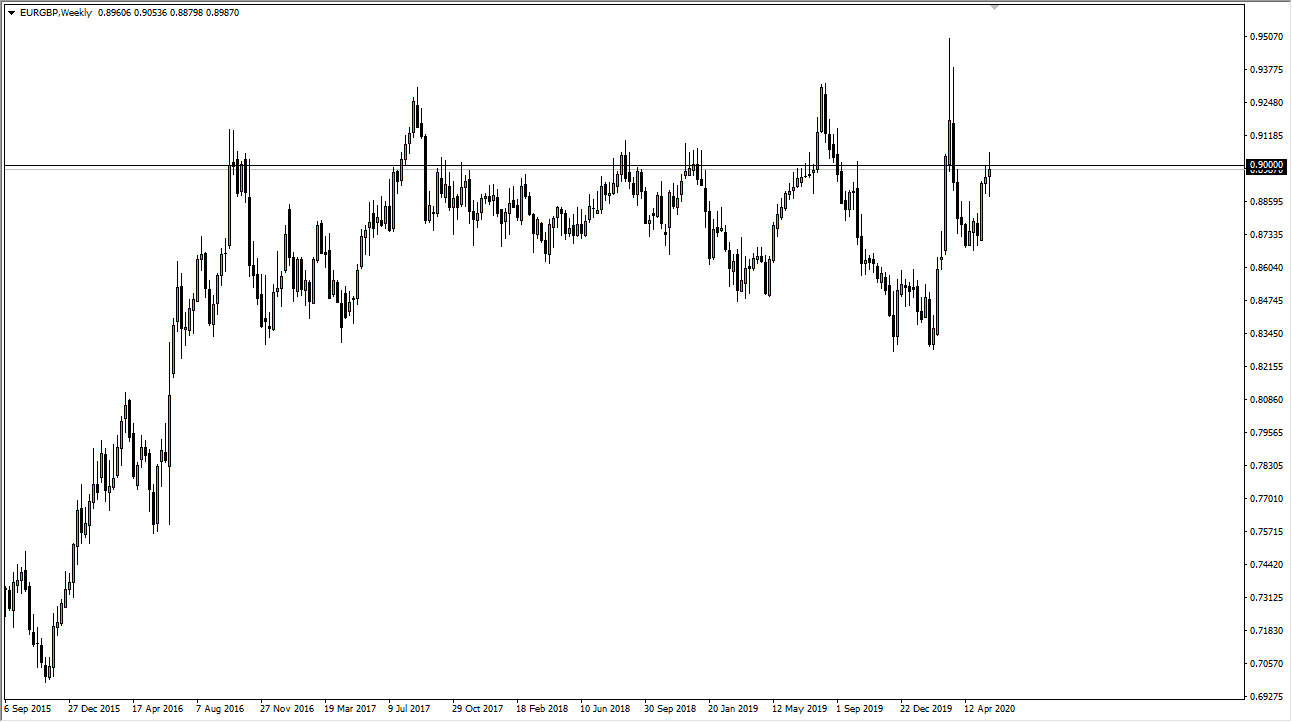

EUR/GBP

The Euro has gone back and forth during the course of the week, as the British pound has been up and down as far as strength is concerned. Looking at this market, if we can break above the very neutral candlestick for the week, then I believe that the pair can go looking towards the 0.9250 level. However, if we break down below the bottom of the candlestick for the week, then it is likely we go looking towards the 0.8750 level. Either way, we are building up for a bigger move in one direction or the other so this is a pair that should be watched.

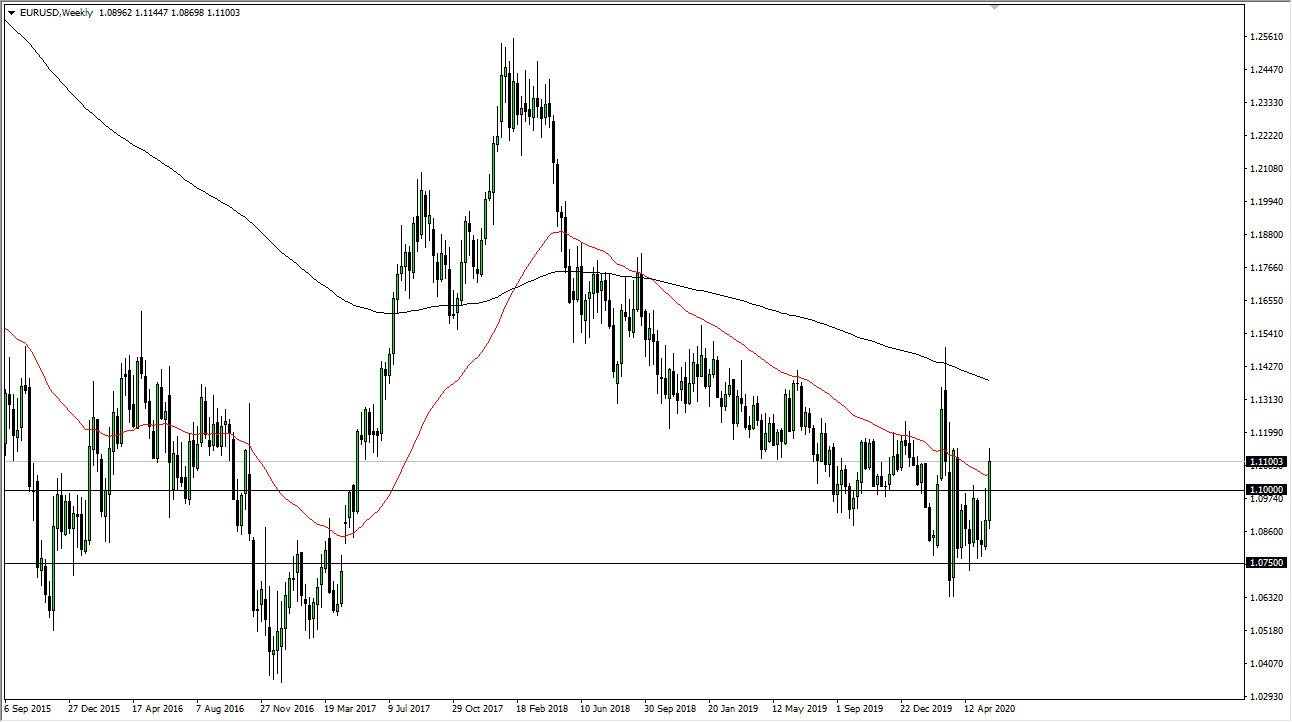

EUR/USD

No matter how you look at it, the Euro has had a great week. It broke his high as the 1.1150 level but pulled back 50 pips on the Friday session. At this point, the market is likely to see some resistance above, so I would not be surprised at all to see this market pull back just a bit to kick off the week. Furthermore, the shooting star that formed on Friday also suggests that maybe we need to bring back to lower levels closer at the 1.10 level. At this point, I anticipate that the market is trying to figure out where to go next, and I would say that we just broke a monthly hammer, but you can see just how volatile it had been the last time we try to break out.

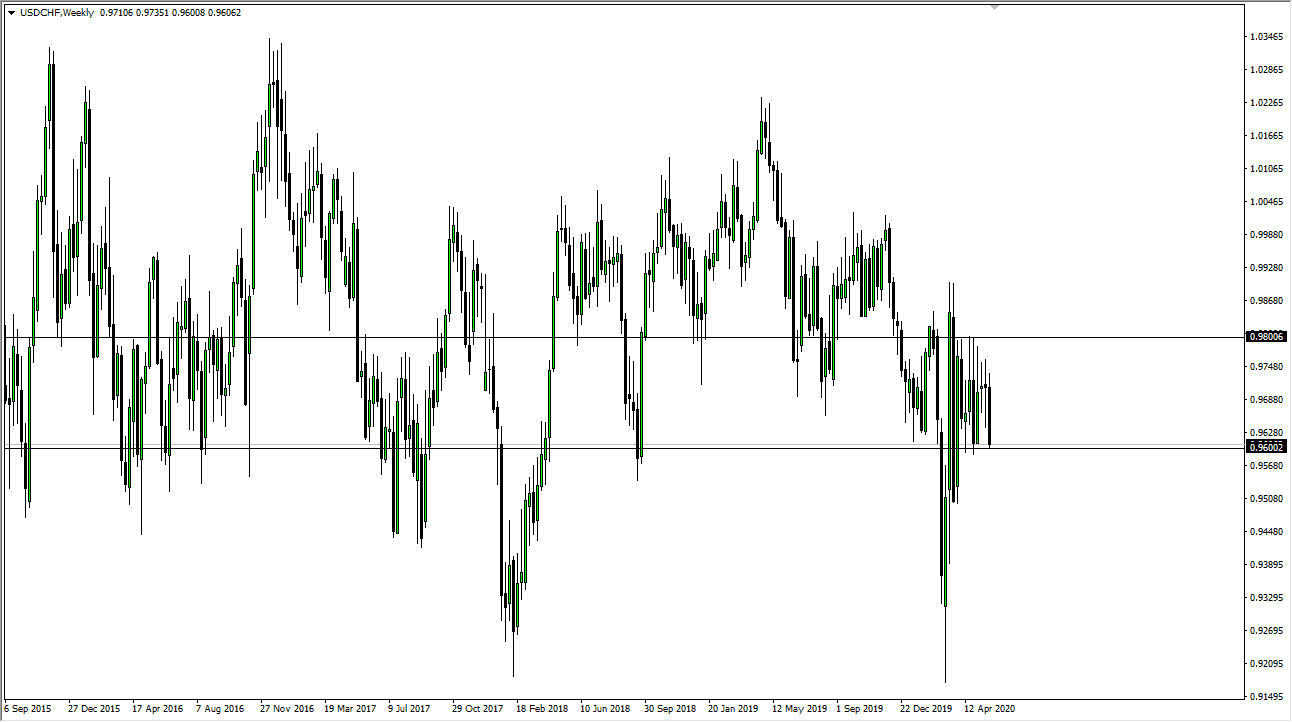

USD/CHF

The antithesis of the EUR/USD pair is the USD/CHF pair. If that pair continues to go higher, this pair will almost certainly breakdown. The 0.96 level of course has been incredibly supportive recently, so it will be interesting to see if we can break down through there. If we do, it is highly likely that we will open up a move to the 0.9450 level. However, we have bounced every time we have tried this place of the last couple of months. On the other side of that though, you can see clearly that there are long wicks at the top of the weekly candlesticks every time we have tried to hang on to gains. If there is one place the US dollar looks truly vulnerable, it is against the Swiss franc. Furthermore, one of the great things about this is that both of these are currencies that people run to in times of fear, so if things get ugly, this could continue to drift lower anyway.

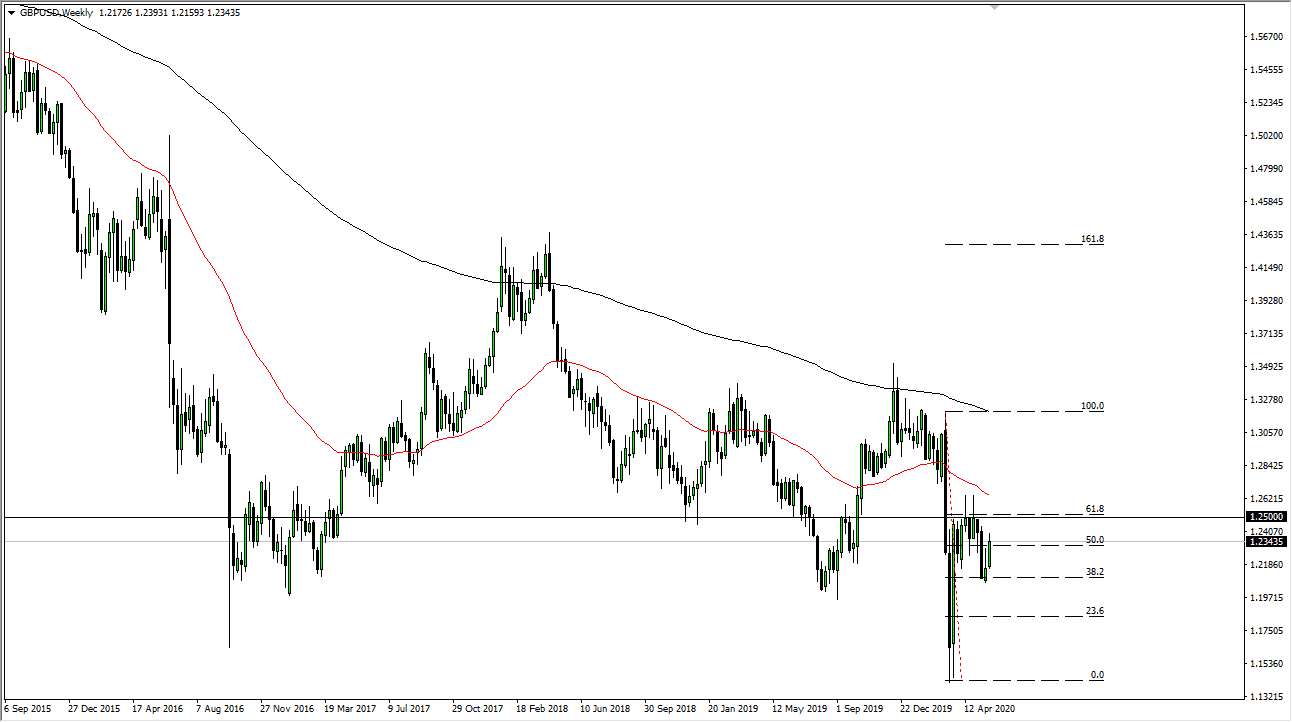

GBP/USD

The British pound rallied significantly during the week, but we are basically hanging around the 1.2350 level, an area that I think is going to continue to be resistance. Ultimately, the market had seen some selling later in the day, forming a shooting star right at the 50 day EMA on the daily chart. I think that the British pound more than likely drifts a bit lower to kick off the week but if we do break above the top of the Friday candlestick, then we look to resell at the 1.25 handle.