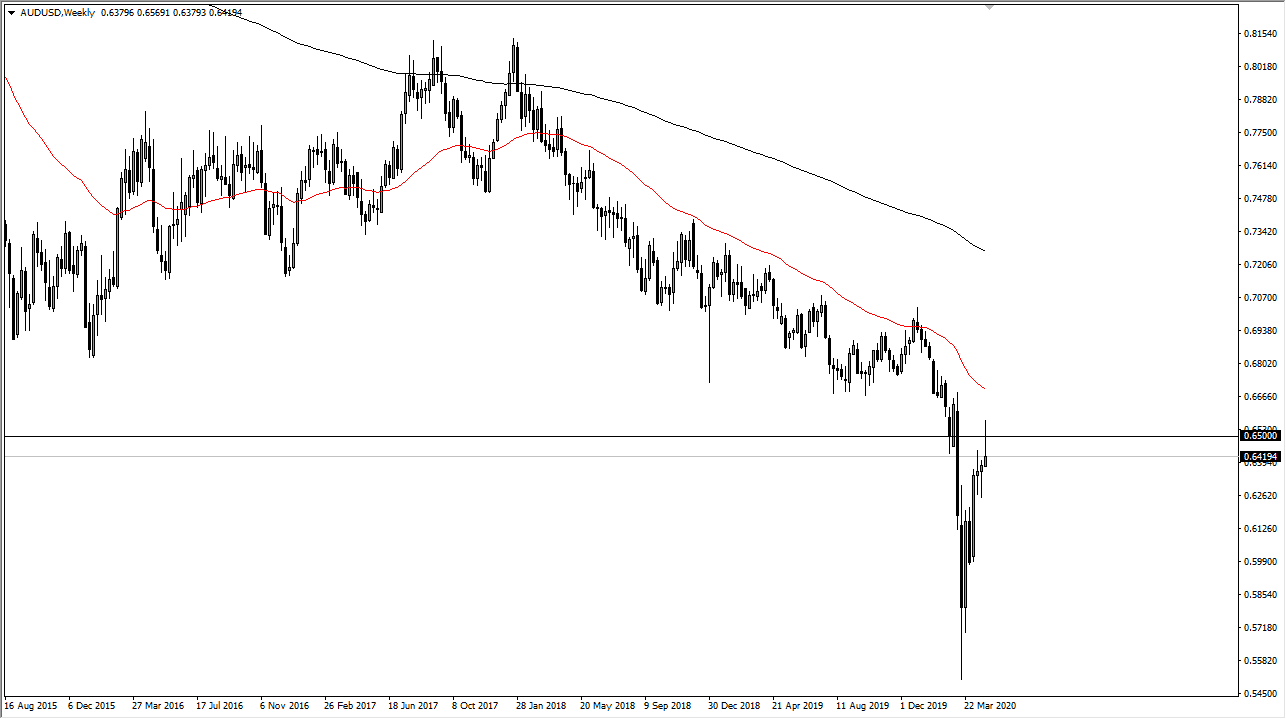

AUD/USD

The Australian dollar rallied significantly during the week but gave back almost all of the gains to form a massive shooting star. Quite frankly, I think that we have a massive amount of resistance above that is going to continue to come in and punish the Aussie. I think it is only a matter of time before we break down from here, reaching down towards the 0.62 level. However, there are a couple of hammers on the weekly chart previously, so that could cause some issues. Expect choppy “fade the rally” type of scenarios in this market. The 0.65 level of course catches a lot of attention in general.

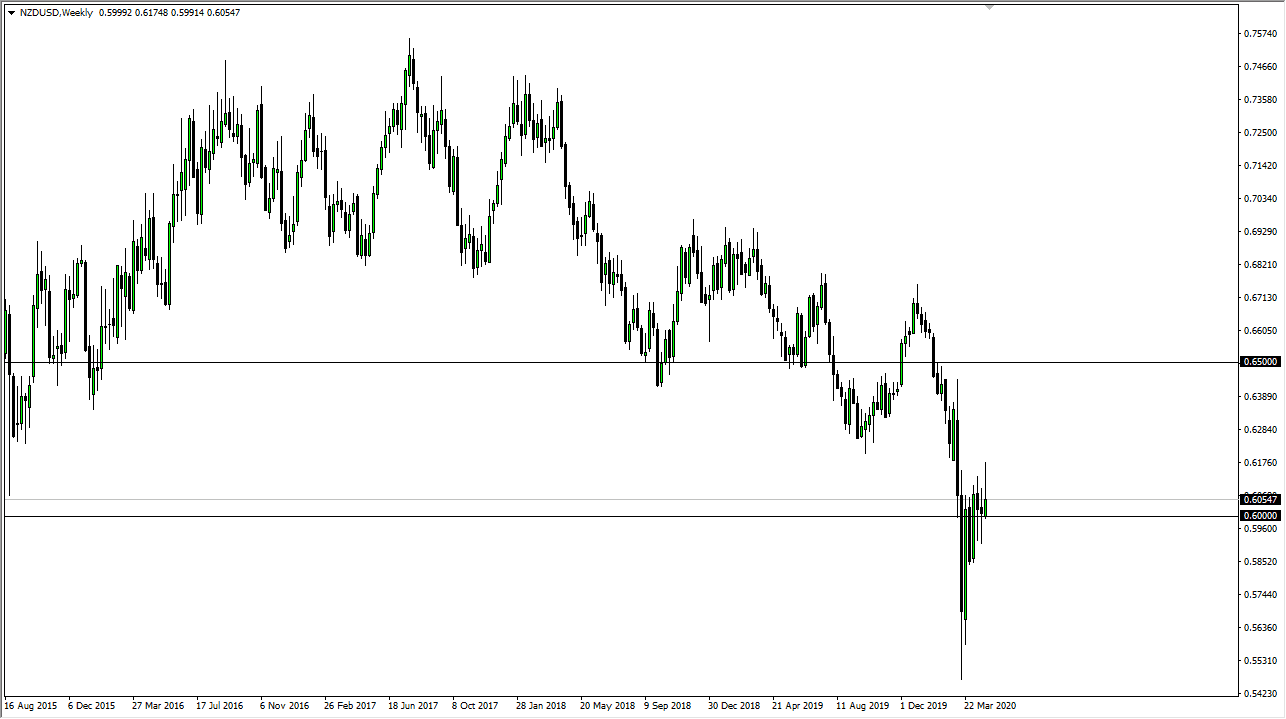

NZD/USD

The New Zealand dollar has initially tried to rally during the week but gave back the gains just as the Australian dollar did, but also has a hammer preceding it. The candlestick is sitting right at the 0.60 level, and if we can break down below that I think a move to the 0.58 level is likely. That being said, I am not bullish of the New Zealand dollar until we get above the 0.62 handle. If we do then okay, I would have to be a buyer but right now it looks as if New Zealand could roll right over and demand for US dollars could start to pick up again during the week.

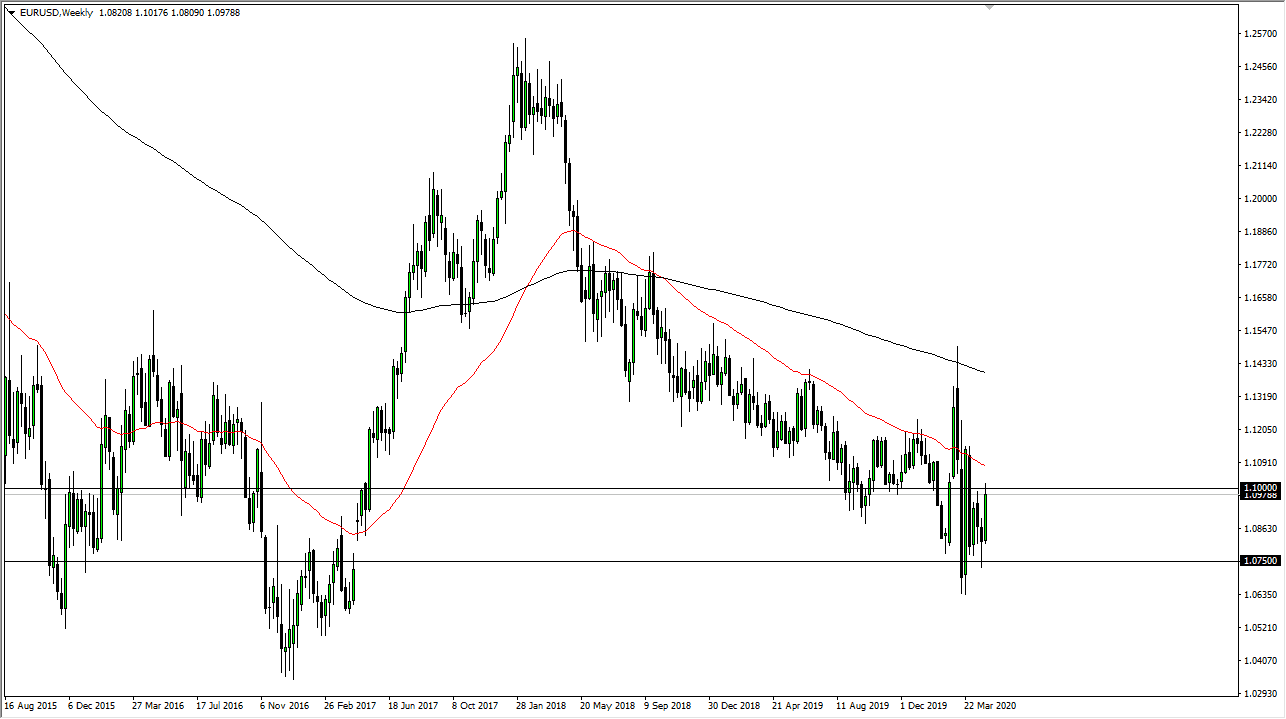

EUR/USD

The Euro rallied during the majority of the week over the last five sessions, but the 1.10 level has offered a significant amount of resistance yet again. In fact, the Friday candlestick was a shooting star, so it suggests that the market is going to pull back into this range and try to grind sideways between the 1.10 level and the 1.08 handle or so. I like fading this rally, I think we continue to chop back and forth. I would not be a buyer until we get well above the 1.12 handle, and even then, I have to think about it.

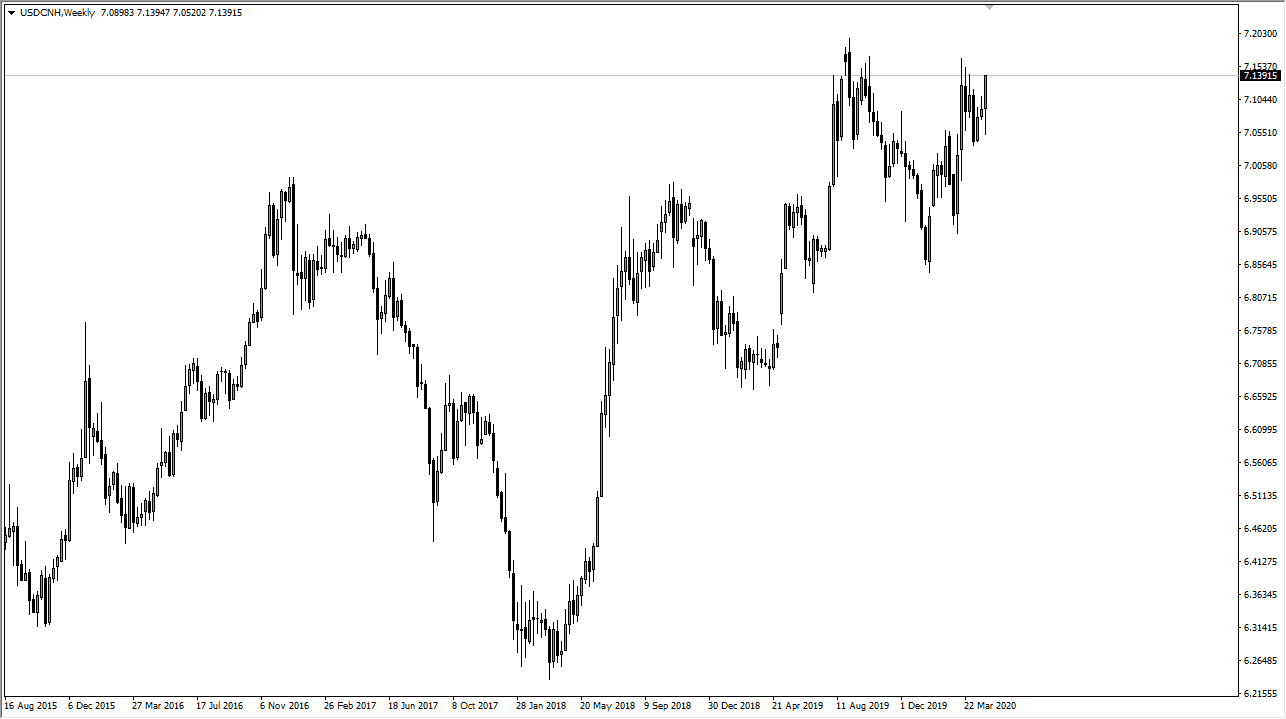

USD/CNH

The US dollar has rocketed higher against the Chinese Yuan over the last couple of days of the week as Trump is threatening tariffs. At this point in time, it looks as if the pair is going to continue to rally, and this is not a good sign for “risk off” trading. While many of you do not trade this pair, you should pay attention to it if we break above the 7.2 level, because it will show a rush to safety and could show a lot of strength in the greenback worldwide.