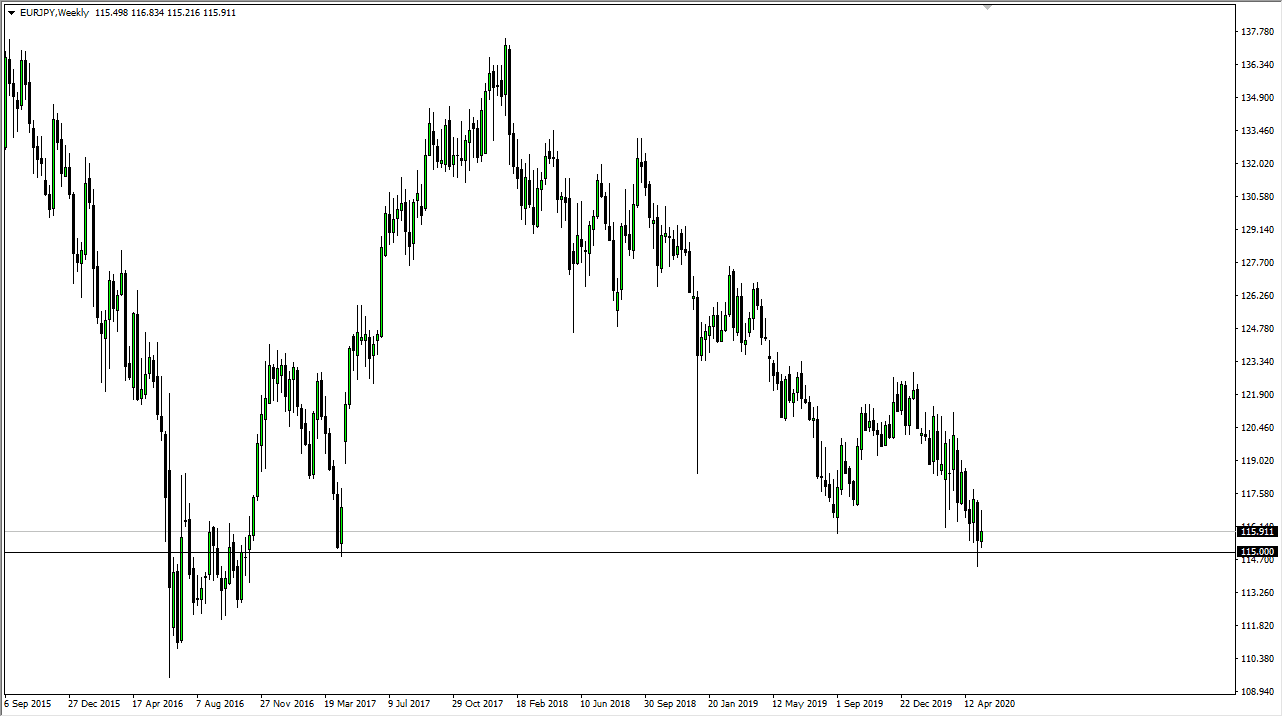

EUR/JPY

The Euro spent most of the week trying to gain against the Japanese yen but once we got past about Tuesday or Wednesday, the risk appetite of traders around the world shifted dramatically. We ended up forming a bit of an inverted hammer in this market, sitting just below the ¥116 level at the close. Ultimately, I do think that we probably break down below the 115 level and once we do that should bring in fresh selling. However, the market was to recapture ¥117.50, that could send the market looking towards the ¥120 level.

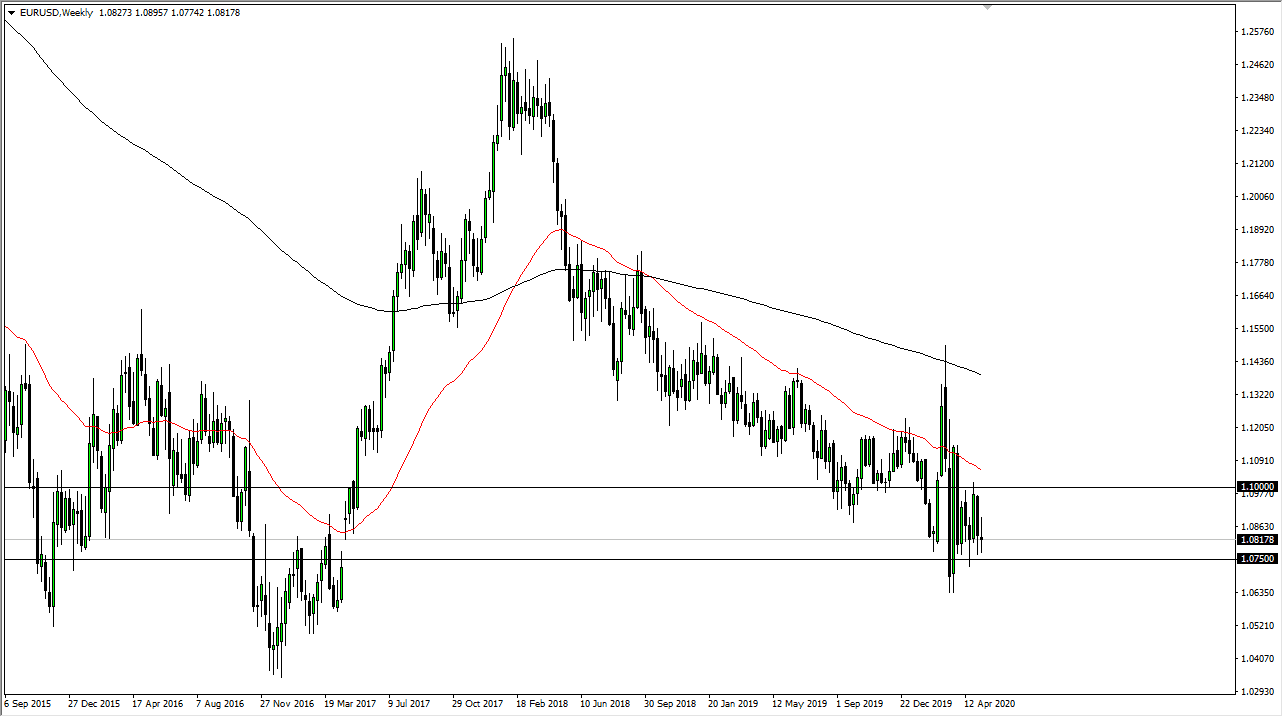

EUR/USD

If there has ever been a pair that is essentially “dead money most of the time”, it is this one. This week was no exception as we have simply gone back and forth but the one thing that does seem to be holding true of the longer term is that every time this market rallies, you should be looking for an opportunity to sell it. I do not think that changes this week, although you can make an argument for a bounce towards the 1.09 level before you see serious selling again. If we were to break down below the 1.0750 level, that would open up a move down to the 1.0650 level underneath.

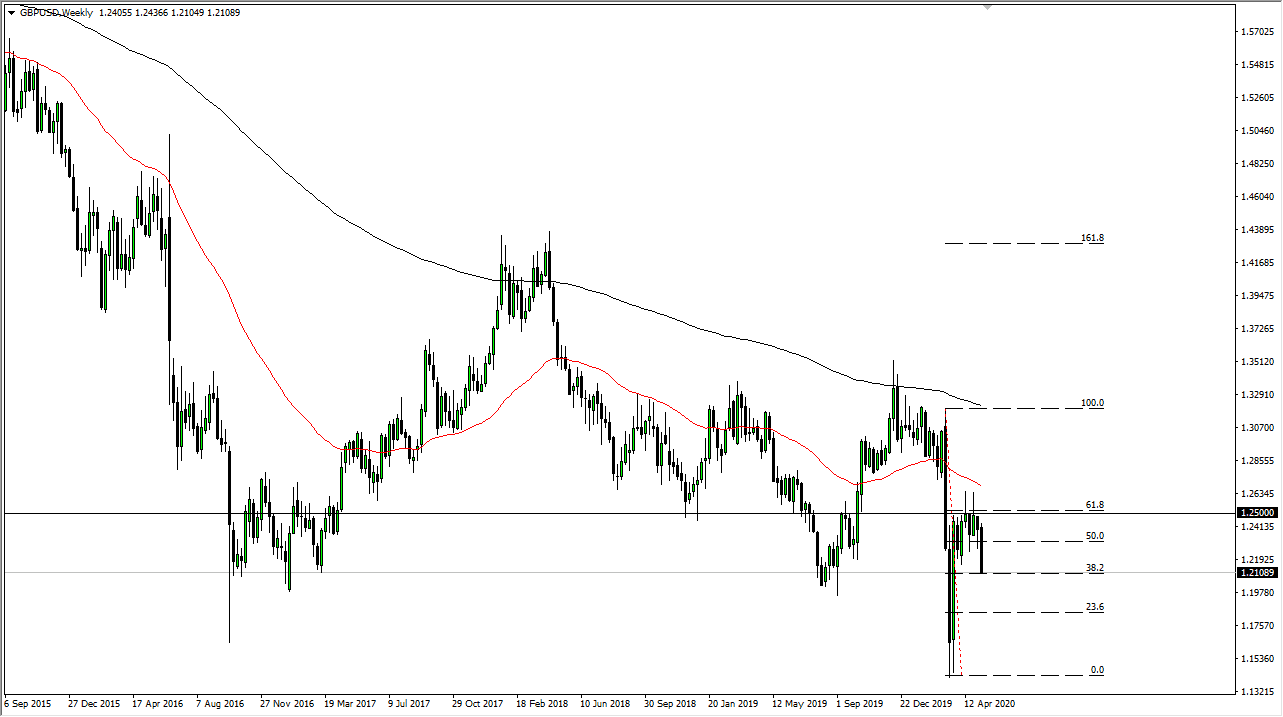

GBP/USD

The British pound sold off hard on Friday, breaking through all kinds of support, but it also has support below at the 1.20 level. I suspect the best way to trade this market this week is going to be waiting for rallies that you can take advantage of, as the British pound most certainly looks very weak. Just two weeks ago we had fallen from the 1.25 level, so a little bit of a bounce early in the week could be expected in order to digest some of the gains of the greenback. However, if there is a major “risk off” type of event, this pair will most certainly fall.

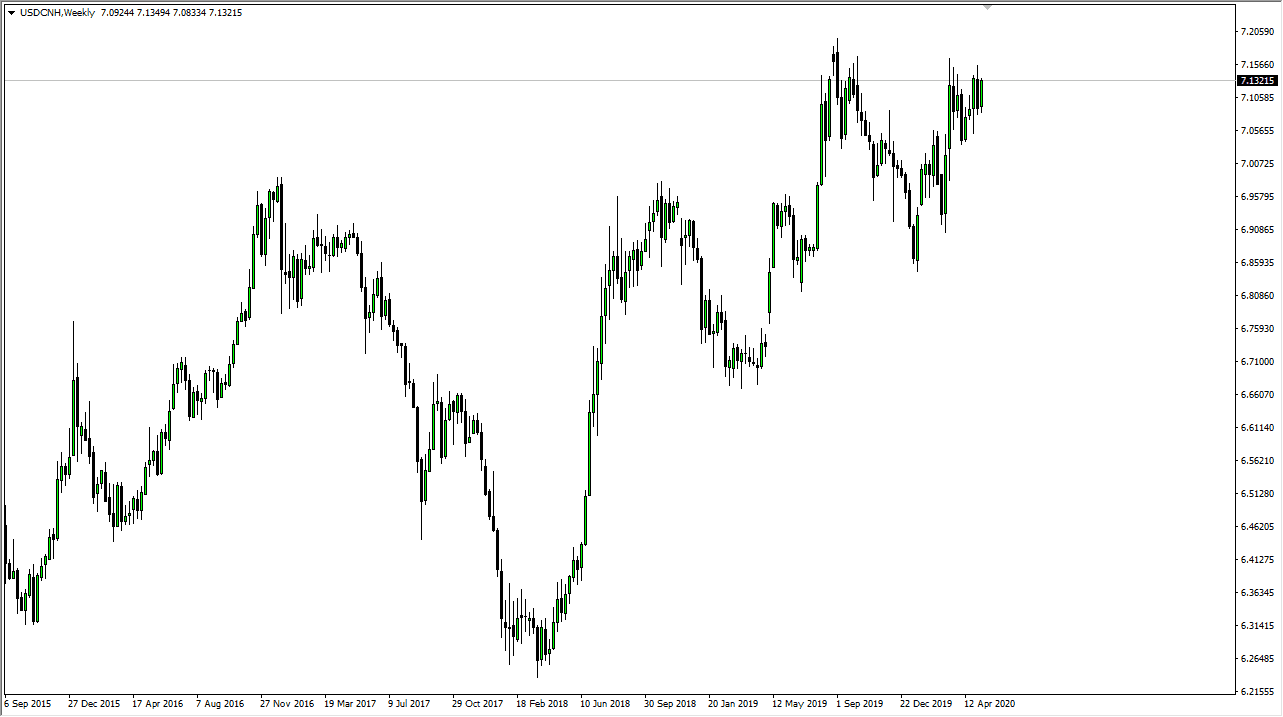

USD/CNH

As per usual, I keep an eye on the chart as it shows me a good representation of the global risk appetite. The US dollar clearly is looking to break out against the Chinese Yuan, which is most certainly a major “risk off” type of scenario. The market will probably find support near the 7.10 level, but if it breaks above the 7.20 level, this thing could take off rather quickly. While not easily traded, this is a market that should be paid attention to.