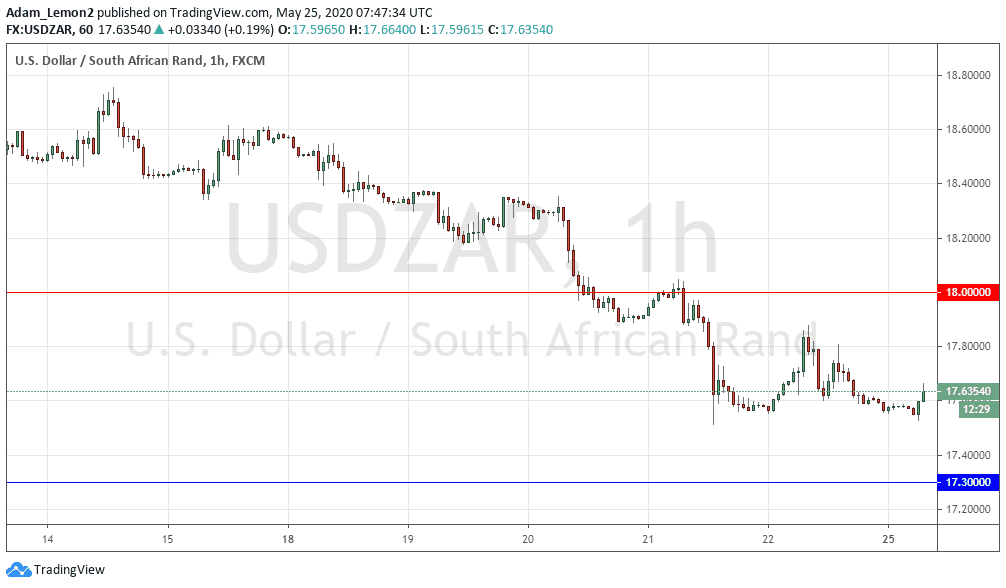

Strong bullish trend in Rand may reverse at 17.3000

The South African Rand has shown the ability to strengthen the past week against the US Dollar. The Rand has gone from a resistance level of 18.6000 to around 17.5000 over the past five days of trading. The price of Gold the past week has remained near highs too and this certainly has benefited market psychology for the South African Rand.

Since the onset of Coronavirus, the ZAR has gone from a strong position of nearly 15.2000 in early March and tested weakness near 19.0000 in early April. The South African Rand however has been able to mount a sustained move since the last week of April back to stronger values. However, the ZAR remains a speculative trade for investors looking to profit from its volatility as the trend gets questioned. The combination of a government without a great track record for transparency economically and underlying values in gold and mining entices ZAR traders with an appetite for profits and risk.

South Africa remains challenged by the Coronavirus pandemic and due to mistrust of internal accountability in the national government questions are heightened. Investors tend to punish the ZAR when clouds appear on the global economic stage. Questions regarding the durability of South Africa’s domestic economy are reasons for worry during the current coronavirus crisis. Because of this traders are likely to find an ongoing battle of value taking place in the ZAR. Although the currency has shown strength the past month, risk reward remains a question for individual traders as they try to take advantage of volatility.

Short term the South African Rand has been able show resilience against the US Dollar, but traders may suspect further tests of weakness will appear in the near term which may set the stage for further volatility and a run above the 18.0000 level again. However, there is no doubt the one month trend for the ZAR against the US Dollar has been strong and may prove enticing for short term traders who believe the South African currency will continue to do well against the US Dollar.

From August of last year until January of 2020 the ZAR traded in a fairly stable range between 14.2000 and 15.0000. The strongest the ZAR has been against the US Dollar this calendar year was in early January. However as of late January the South African Rand took a turn towards weakness and this was even before worries about Coronavirus escalated in the important African nation. Early April saw extreme weakness when the ZAR touched the 19.0000 level.

The past couple of weeks have shown the ZAR has the ability to strengthen and challenge support levels consistently. A target of 17.2000 appears to be the next support barrier in the forex market currently for the South African currency. A move towards the 17.0000 has been underway for a month and if the ZAR can hit these stronger values it would then put it within its mid-March values before it began to weaken against the US Dollar. A range between 17.0000 and 18.2000 are likely to remain the lynchpin for traders this coming week.

South African Rand Short Term Outlook:

Current Resistance: 18.0000

Current Support: 17.3000

High Target: 18.2000

Low Target: 17.0000