Pressure on the South African government is rising to end the nationwide lockdown. Business groups ignore health risks and urge resumption of activities, or caution the economy could collapse by 16% in 2020 and result in over four million lost jobs. While Africa’s second-largest economy by GDP, and most industrialized nation on the continent, is faced with identical problems developed countries struggle with, its financial resources are significantly lower. Therefore, it cannot sustain a prolonged period of economic hibernation. Despite broad issues, the US Dollar is faced with more devastating long-term developments, favored to extend the corrective phase in the USD/ZAR after contracting below its short-term resistance zone.

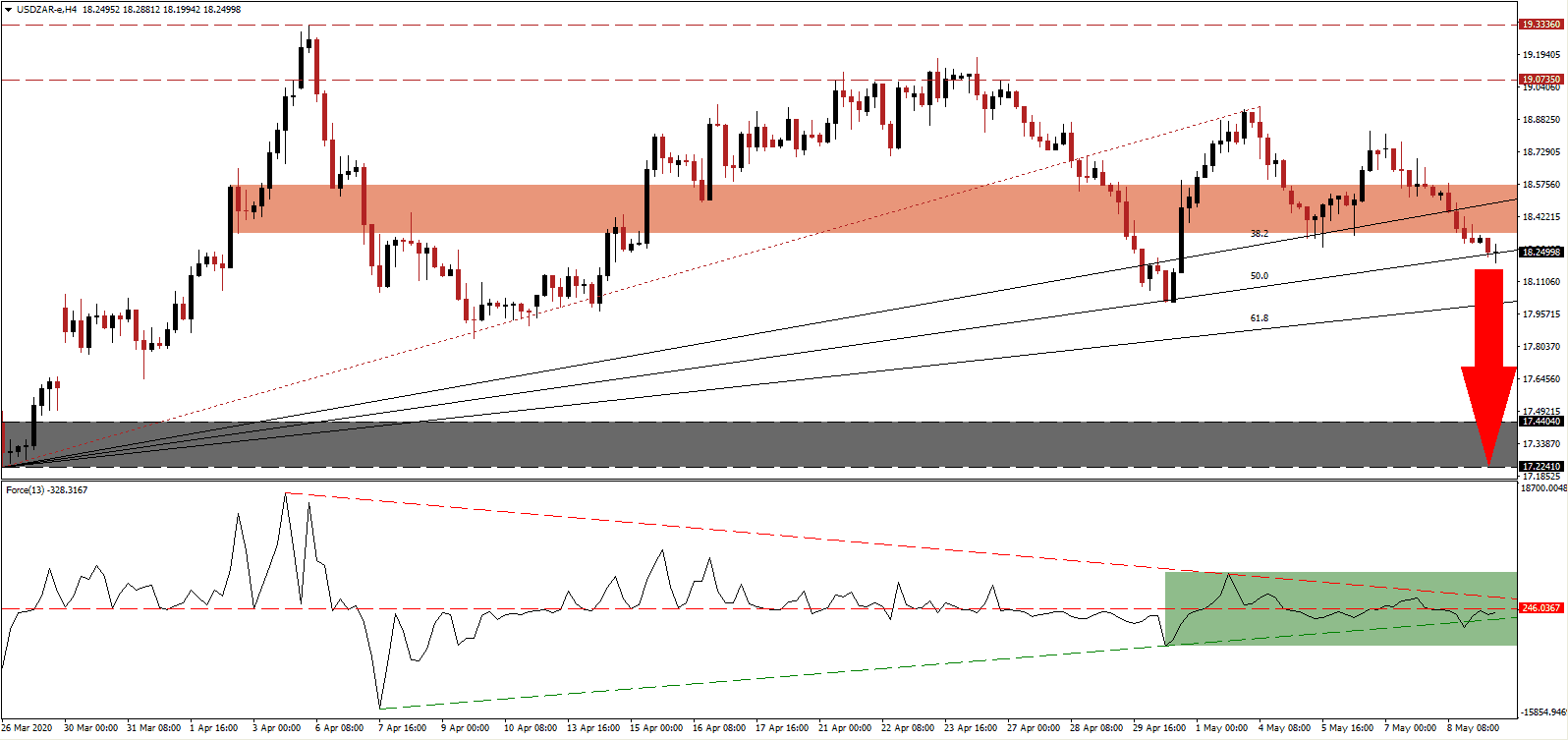

The Force Index, a next-generation technical indicator, recovered from a brief dip below its ascending support level and is now faced with its horizontal resistance level. Increasing breakdown pressures is the descending resistance level, as marked by the green rectangle. Bears remain in full control of the USD/ZAR with the Force Index in negative territory. This technical indicator is anticipated to accelerate to the downside, leading price action lower.

South Africa was praised for limiting the number of confirmed Covid-19 cases, and implemented measures allow the healthcare system to prepare for an expected surge in infections. The risk-adjustment approach of the government spans six to eight months before the economy can resume reduced activities. According to the workgroup Business for South Africa, companies need to prepare significant adjustments to ensure sustained growth. Acceptance of this face and willingness to change course positions the USD/ZAR for more selling. Bearish momentum increased following the breakdown below its short-term resistance zone located between 18.3390 and 18.5678, as marked by the red rectangle.

A minor pause at the ascending 50.0 Fibonacci Retracement Fan Resistance Level is expected to lead to a breakdown extension, on the back of ongoing US weakness with a lack of urgency to adjust the debt-driven virus response. One essential level to monitor is the intra-day low of 18.0115, the base of the current corrective phase. A push lower is likely to initiate the next wave of net sell-orders, generating volume for the USD/ZAR to collapse into its support zone. This zone is located between 17.2241 and 17.4404, as identified by the grey rectangle. More downside is probable but will require a fresh catalyst.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 18.2500

Take Profit @ 17.2300

Stop Loss @ 18.4900

Downside Potential: 10,200 pips

Upside Risk: 2,400 pips

Risk/Reward Ratio: 4.25

Should the Force Index eclipse its descending resistance level, the USD/ZAR may initiate a short-term counter-trend advance. The upside potential is limited to its intra-day high of 18.8253, the peak before the most recent breakdown sequence, and a lower high. Forex traders are advised to view any bounce from current levels as a secondary selling opportunity, as the US response to the virus risks a second infection wave in the summer.

USD/ZAR Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 18.5700

Take Profit @ 18.8200

Stop Loss @ 18.4200

Upside Potential: 2,500 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 2.50