South African companies started to implement wage cuts to preserve dwindling cash piles due to the nationwide lockdown in response to the Covid-19 outbreak. While the government implemented an R500 billion stimulus, it is not sufficient to cope with a prolonged period of restricted economic activity. The South African Reserve Bank decreased interest rates twice by 100 basis points, taking the repo rate to 4.25%, the lowest since 1973. Household name Edcon filed for voluntary bankruptcy, South African Airlines is fighting for survival, and others may follow. The South African Rand remains resilient, and the USD/ZAR maintains its bearish bias inside of its resistance zone, assisted by rapidly deteriorating US fundamentals.

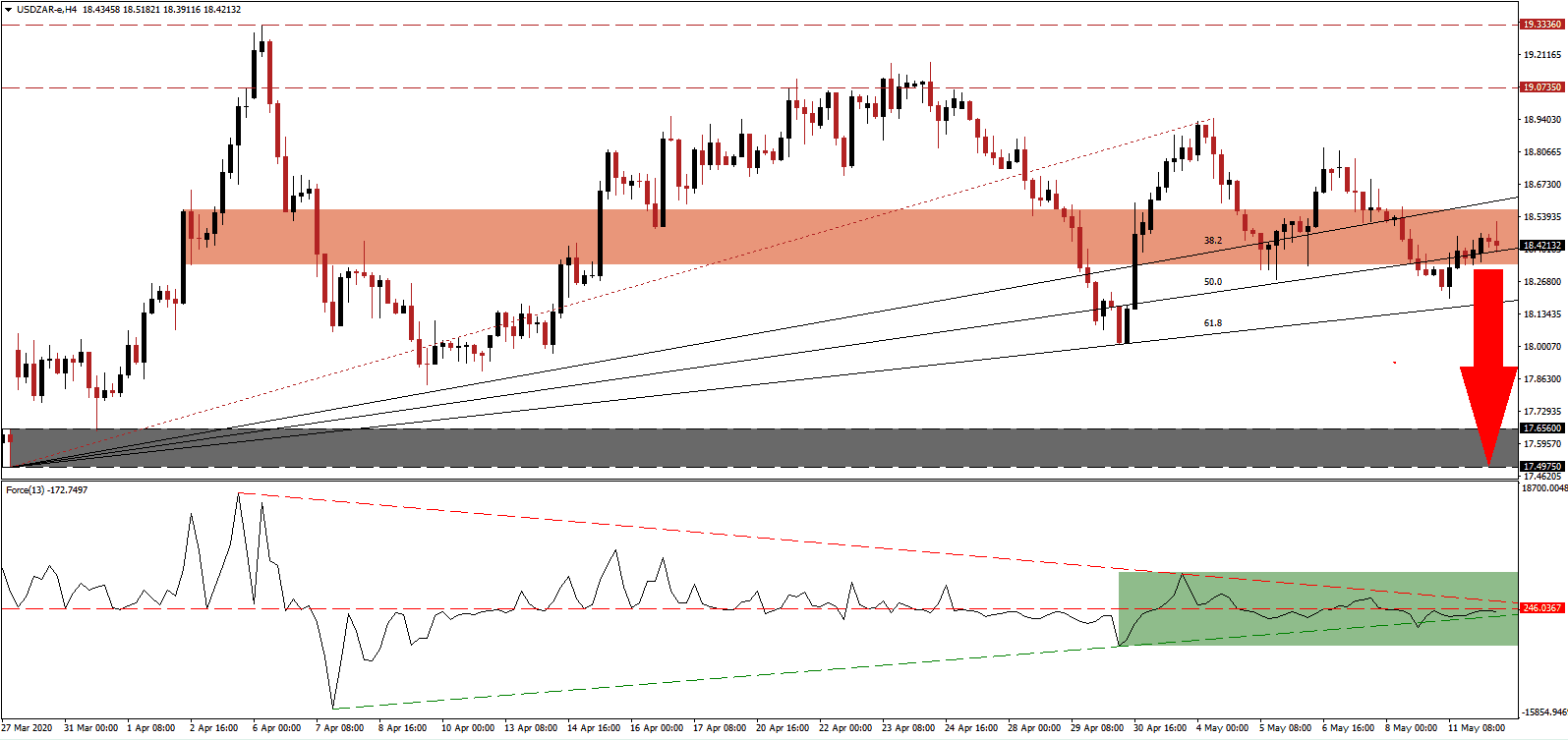

The Force Index, a next-generation technical indicator, confirms the dominance of bearish momentum as the horizontal resistance level ensures downside pressures are intact. With the descending resistance level closing in, as marked by the green rectangle, the Force Index is expected to be pressured below its ascending support level, leading to an accelerated sell-off in price action. Bears remain in full control of the USD/ZAR with this technical indicator comfortably in negative territory.

While the South African lockdown level was reduced to four, which permits select industries including basic materials, ports, and essential maintenance sectors, to resume adjusted activities, the recovery is anticipated to remain lengthy. It will be accompanied by permanent positive adjustments, enabling sustained progress. Volatility in the USD/ZAR has increased, but a sustained breakdown below its resistance zone located between 18.3390 and 18.5678, as identified by the red rectangle, is favored to materialize. Talks of additional debt-funded stimulus by the US delivers another breakdown catalyst for price action.

Forex traders are recommended to monitor this currency pair for a collapse below its ascending 50.0 Fibonacci Retracement Fan Support Level, passing through the short-term resistance zone. A move lower is likely to result in more selling pressure, providing the necessary volume for the USD/ZAR to correct into its next support zone. This zone is located between 17.4975 and 17.6560, as marked by the grey rectangle. A breakdown extension cannot be ruled out, given the worsening US conditions and response to the virus.

USD/ZAR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 18.4500

Take Profit @ 17.5000

Stop Loss @ 18.7000

Downside Potential: 9,500 pips

Upside Risk: 2,500 pips

Risk/Reward Ratio: 3.80

In case the Force Index advances above its descending resistance level, the USD/ZAR is positioned to attempt a push higher. With volatility on the rise, and the US poised to add more debt as its rushes to reopen the economy, any breakout from current levels will offer Forex traders an excellent selling opportunity. The upside is limited to an area between the intra-day high of 18.9463 and the bottom range of its resistance zone located between 19.0735 and 19.3336.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 18.8200

Take Profit @ 19.0700

Stop Loss @ 18.7000

Upside Potential: 2,500 pips

Downside Risk: 1,200 pips

Risk/Reward Ratio: 2.08