While US President Trump claims new Covid-19 infections across the country are falling rapidly, his task force, led by Vice President Pence, contradicts those claims. Infection rates in what is known as the heartland are spiking, in some cases exceeding 200%. Additionally, states where lockdown measures have been relaxed, witness a surge in new confirmed cases. Democrats drafted a new aid package worth $3 trillion, including a second direct payment to citizens. With the absence of a function test, trace, and isolate (TTI) infrastructure in place, the US is on track to witness a significant increase in infections with depressed economic demand despite the rushed reopening of local economies. The USD/ZAR continues to accumulate breakdown pressures inside of its short-term resistance zone.

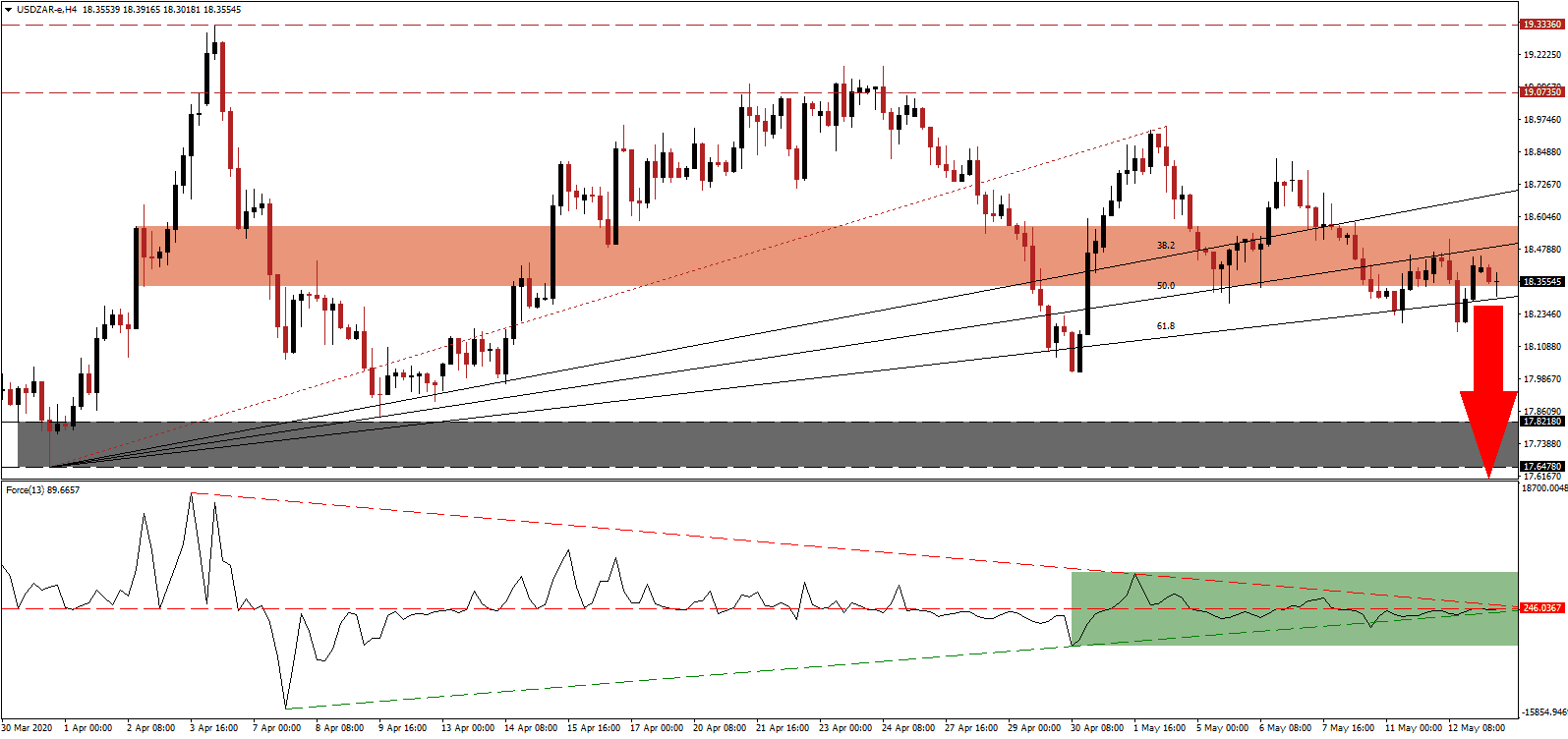

The Force Index, a next-generation technical indicator, is located below its horizontal resistance level with the ascending support level and the descending resistance level closing in, as marked by the green rectangle. It is spiking pressures for either a breakout or a breakdown. The series of lower highs suggest a collapse in the Force Index is pending. Bears will resume full command of the USD/ZAR once this technical indicator moves below the 0 center-line.

Complacency and misplaced hopes for a V-shaped recovery prevent the US leadership from focusing on implementing the required procedures to enable a sustained, healthy, and slow recovery. The preferred method of rushing resumption of activities without the infrastructure or treatments in place risk a more severe long-term shock to consumer confidence and the economy as a whole. It provided a bearish catalyst for the USD/ZAR to initiate a new breakdown sequence from its short-term resistance zone located between 18.3390 and 18.5678, as marked by the red rectangle.

South Africa is facing significant challenges, as epidemiology and economics become intertwined. Implemented measures resulted in a slowdown of Covid-19 infections, but the population is displaying fear over economic survival. The R500 billion stimulus is not executed well, while new forecasts indicate more citizens will enter poverty than exit from it in 2020. A willingness to address structural reform grants the South African Rand a bullish catalyst, enhancing bearish pressures in this currency pair. A conversion of the ascending 61.8 Fibonacci Retracement Fan Support Level into resistance is favored to accelerate the pending sell-off into its revised support zone located between 17.6478 and 17.8218, as identified by the grey rectangle. A breakdown extension in the USD/ZAR cannot be ruled out, backed by ongoing deterioration in the US outlook.

USD/ZAR Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 18.3500

- Take Profit @ 17.6500

- Stop Loss @ 18.5500

- Downside Potential: 7,000 pips

- Upside Risk: 2,000 pips

- Risk/Reward Ratio: 3.50

A breakout in the Force Index above its descending resistance level is likely to allow the USD/ZAR a push to the upside. The upside remains confined area between the intra-day high of 18.9463, the end-point of the Fibonacci Retracement Fan sequence, and the bottom range of its resistance at 19.0735. Due to ongoing bearish fundamental progress out of the US, Forex traders are advised to take advantage of any price spike with new sell orders.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 18.8200

- Take Profit @ 19.0700

- Stop Loss @ 18.7000

- Upside Potential: 2,500 pips

- Downside Risk: 1,200 pips

- Risk/Reward Ratio: 2.08