After the Turkish Lira plunged to record lows, an event President Erdogan and his government blames on foreign powers attempting to cripple its Covid-19 struck economy, the USD/TRY embarked on a massive corrective phase. Turkey banned Citigroup, UBS and BNP Paribas from trading the Turkish Lira, as it identified the three global banks as contributing factors to the plunge in its currency. While President Erdogan is often labeled as deploying unorthodox economic ideas, critics fail to notice his actions have delivered more accurate results than those in economies where an orthodox approach is favored. Challenges do remain, but this currency pair is well-positioned to extend its breakdown.

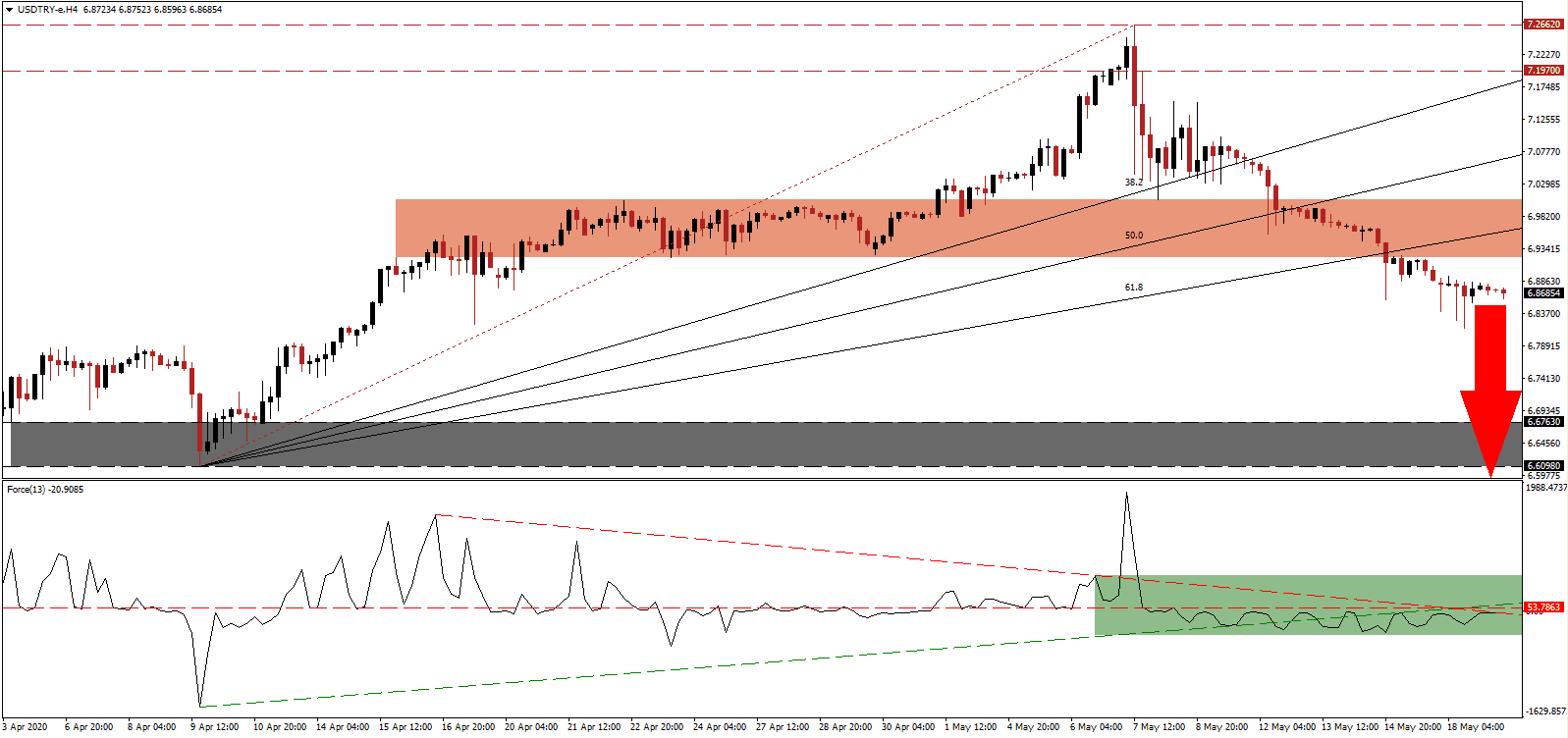

The Force Index, a next-generation technical indicator, confirms the dominance of bearish momentum, suggesting that the preceding advance in price action was purely speculative on thin trading volume. The Force Index remains below its horizontal resistance level, as marked by the green rectangle, and the descending resistance level is exercising downside pressure. Adding to bearish developments was the breakdown below its ascending support level. Bears are in control of the USD/TRY with this technical indicator in negative territory.

One of the most pressing concerns for the Turkish economy is the retreat in direct foreign investment, but plans to entice the local population to exchange household gold reserves for the Turkish Lira have the potential to resolve short-term currency woes. Turkish households hoard an estimated $200 to $300 billion in gold, providing a substantial economic boost if brought to market. The breakdown sequence in the USD/TRY, which originates inside its long-term resistance zone located between 7.1970 and 7.2662, gathered momentum following the breakdown leading to the conversion of its short-term support zone into resistance. This zone is located between 6.9213 and 7.0070, as marked by the red rectangle.

Adding to downside pressures is the collapse in price action below its entire ascending Fibonacci Retracement Fan sequence. Forex traders are recommended to monitor the intra-day low of 6.8157, the current base of the correction in the USD/TRY. With US policy centered on spiking debt levels, in conjunction with complacency for required changes to the existing economic model, this currency pair is expected to accelerate to the downside until it can challenge its support zone located between 6.6098 and 6.6763, as identified by the grey rectangle. A breakdown extension remains a distinct probability, and the next support zone awaits between 6.4399 and 6.4917.

USD/TRY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 6.8650

Take Profit @ 6.4400

Stop Loss @ 6.9800

Downside Potential: 4,250 pips

Upside Risk: 1,150 pips

Risk/Reward Ratio: 3.70

A spike in the Force Index above its ascending support level, serving as present resistance, is likely to encourage the USD/TRY into a reversal. As a result of US monetary policy and reliance on debt, the upside is confined to its 38.2 Fibonacci Retracement Fan Resistance Level, which is approaching the bottom range of its resistance zone. Forex traders are advised to consider this an additional entry opportunity to existing short positions.

USD/TRY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 7.0800

Take Profit @ 7.1900

Stop Loss @ 7.0300

Upside Potential: 1,100 pips

Downside Risk: 500 pips

Risk/Reward Ratio: 2.20