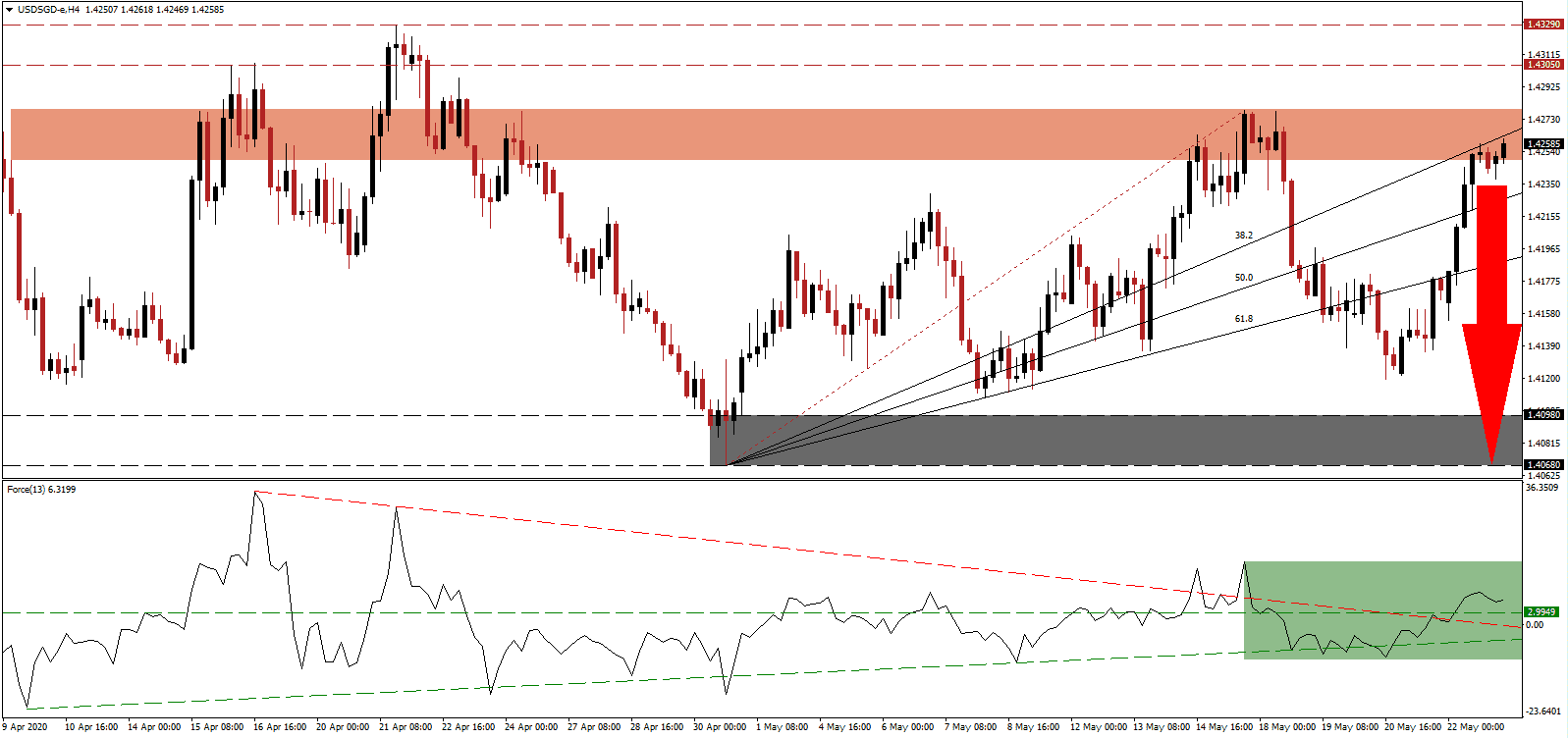

Singapore is faced with negative interest rates as the one-month swap offer rate (SOR) fell below zero last Wednesday for the first time in nine years. The overnight borrowing rate is on the verge of dipping into negative territory, hovering just above the 0.00% mark. While the Monetary Authority of Singapore (MAS) does not set interest rates directly, it manages the Singapore Dollar against the currencies of major trading partners. It did assure financial markets adequate liquidity will be supplied, adding further downside pressure on the Singapore Interbank Offered Rate (SIBOR), which is referenced daily. The USD/SGD was pushed into its short-term resistance zone, where it is challenging its ascending 38.2 Fibonacci Retracement Fan Resistance Level.

The Force Index, a next-generation technical indicator, confirmed the advance with a breakout sequence after briefly moving below its ascending support level. It swiftly reversed and eclipsed its descending resistance level, as marked by the green rectangle, before converting its horizontal resistance level into support. The Force Index did set a lower high, and bullish momentum remains depressed, suggesting an end to the advance. Bears are in a holding pattern until this technical indicator collapsed into negative territory, granting complete control over the USD/SGD.

With SIBOR anticipated to turn negative, the financial sector may swap Singapore Dollars for US Dollars. While it will temporarily increase upside pressure on this currency pair, the long-term outlook remains bearish. Singapore’s economy is forecast to contract by 4.0% this year, but US data points towards a more excessive disruption with the likelihood of a slow recovery. It adds a bearish catalyst to the USD/SGD, poised to force a breakdown below its short-term resistance zone located between 1.4249 and 1.4279, as marked by the red rectangle.

As bullish momentum is crumbling, price action is vulnerable to a profit-taking sell-off. Expanding breakdown pressures are rising tensions between the US and China. After the latter passed security laws governing Hong Kong, the former did note sanctions against it. With the relationship already fragile, the threat of China dumping US Treasuries has once again emerged. While it has not materialized in the past, given the present condition, it cannot be ignored. The USD/SGD is well-positioned to accelerate down into its support zone located between 1.4068 and 1.4098, as identified by the grey rectangle.

USD/SGD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 1.4260

Take Profit @ 1.4070

Stop Loss @ 1.4320

Downside Potential: 190 pips

Upside Risk: 60 pips

Risk/Reward Ratio: 3.17

In case the ascending support level pressures the Force Index higher, the USD/SGD is likely to attempt a breakout extension of its current advance. Forex traders are advised to view any move higher as a secondary short-selling opportunity, on the back of an increasingly bearish outlook for the US economy. The next resistance zone awaits price action between 1.4415 and 1.4443.

USD/SGD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.4360

Take Profit @ 1.4420

Stop Loss @ 1.4330

Upside Potential: 60 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.00