Singapore notes that the gradual reopening if its economy will be impacted by virus case numbers, testing and contact tracing, and the global condition regarding the Covid-19 pandemic. Financial markets have now dismissed long-term negative impacts of nationwide lockdowns and warnings of a slow recovery. Singapore was initially praised for its response but saw cases soar in a delayed response. During the pandemic, measures implemented to contain the spread and protect the economy have been more concentrated and efficient than many others, providing the USD/SGD with a bullish catalyst favored to initiate a new breakdown in this currency pair.

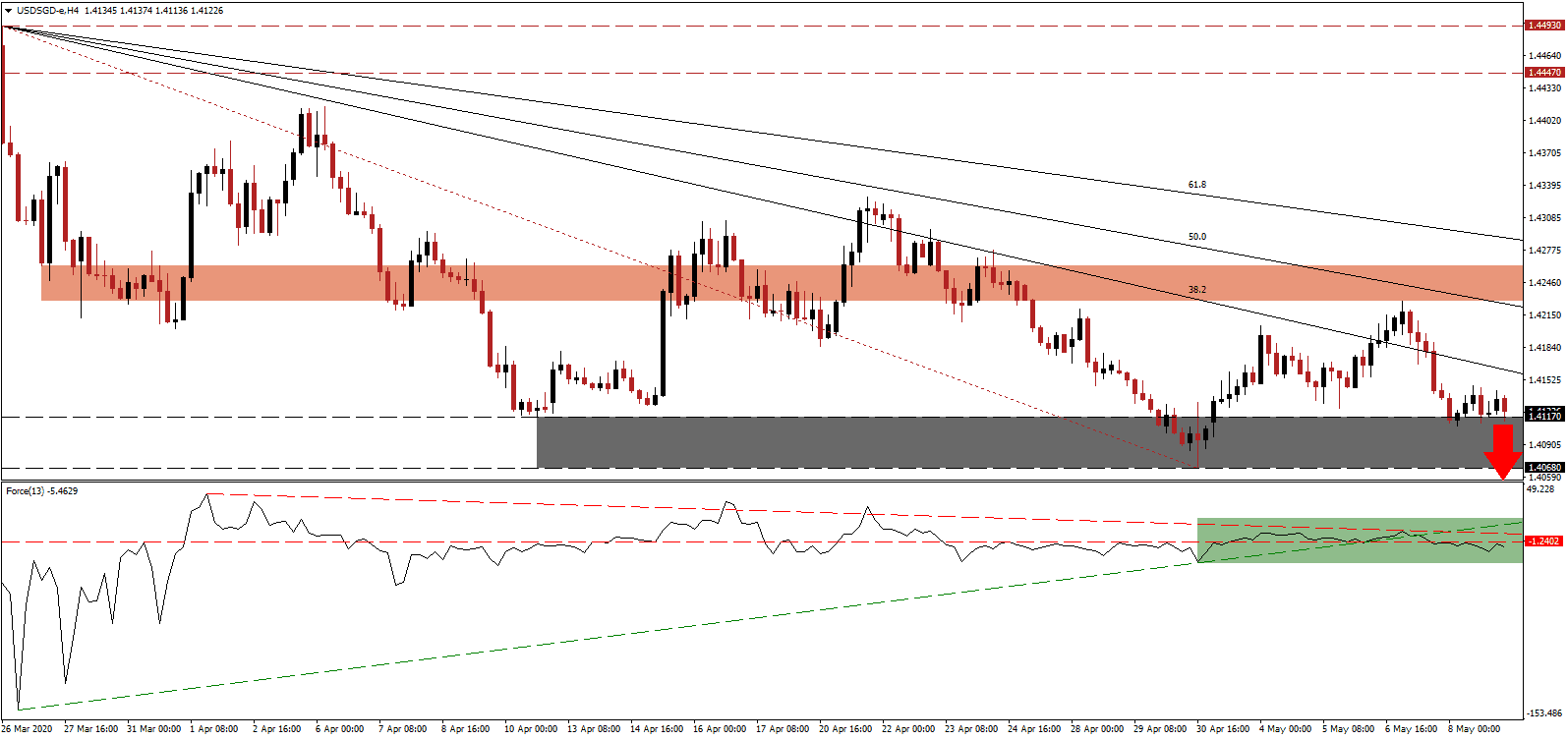

The Force Index, a next-generation technical indicator, confirms the dominance of bearish pressures, which were elevated after the breakdown below its ascending support level. Increasing downside momentum is the descending resistance level, as marked by the green rectangle, expected to push the Force Index farther away from its horizontal resistance level. Bears are in control of the USD/SGD with this technical indicator below the 0 center-line.

Despite the US announcing record job losses, retail traders have rushed into equity markets, creating ideal conditions for the second wave of selling. US 2-Year Treasuries are racing towards a 0.0% yield, adding bearish pressures to the US Dollar. The Trump government is in bipartisan discussions for the next round of stimulus, spiking debt further, in another bearish development for the USD/SGD. Price action is awaiting the next breakdown catalyst above its support zone located between 1.4068 and 1.4117, as marked by the grey rectangle.

This currency pair is under enhanced pressures to extend its corrective phase with the descending 38.2 Fibonacci Retracement Fan Resistance Level narrowing the gap to the top range of its support zone. The short-term resistance zone located between 1.4229 and 1.4262, as identified by the red rectangle, is continuously adjusted lower to reflect the bearish chart pattern maintained through lower highs. A new breakdown is pending, which can extend the USD/SGD into its next support zone located between 1.3752 and 1.3796.

USD/SGD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.4120

Take Profit @ 1.3760

Stop Loss @ 1.4200

Downside Potential: 360 pips

Upside Risk: 80 pips

Risk/Reward Ratio: 4.50

In case the Force Index accelerates above its ascending support level, presently serving as resistance, the USD/SGD is likely to attempt a reversal. Due to growing long-term bearish developments out of the US, which remain ignored, the upside potential is reduced to the 61.8 Fibonacci Retracement Fan Resistance Level, closing in on the top range of the short-term resistance zone. Forex traders are advised to consider any breakout as an excellent short-selling opportunity.

USD/SGD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.4220

Take Profit @ 1.4280

Stop Loss @ 1.4190

Upside Potential: 60 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.00