Mexico’s President Lopez Obrador believes the economic slowdown in China will benefit his country, entice a spike in foreign investment, and attract companies to create jobs. The Covid-19 pandemic has harmed Latin America’s second-largest economy, but the deterioration in the fragile Sino-US relationship, anticipated to worsen drastically if the US imposes sanctions on China in response to a proposed security law for Hong Kong, sets to benefit Mexico. While the long-term outlook for the USD/MXN remains increasingly bullish, a brief counter-trend rally is favored to materialize inside its support zone.

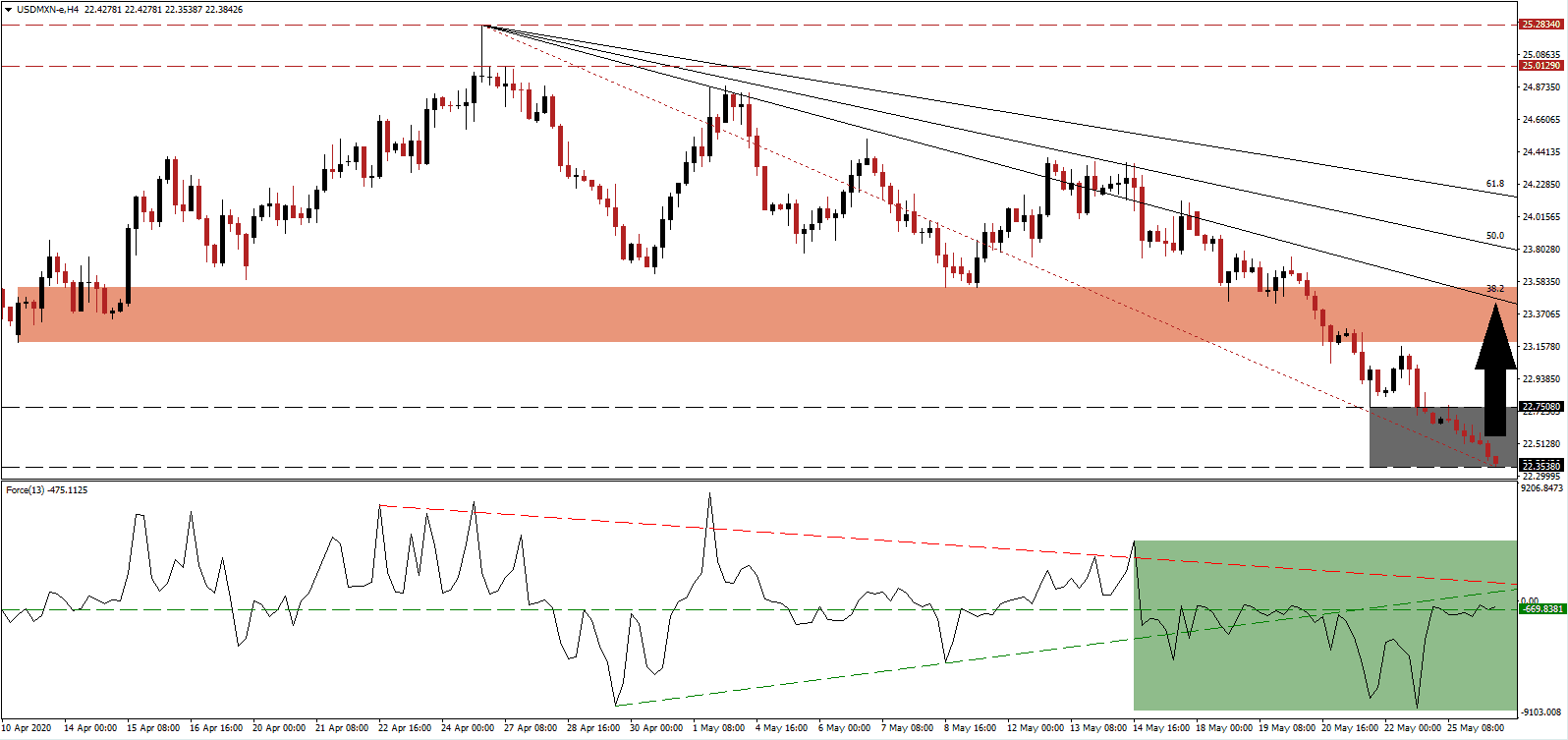

The Force Index, a next-generation technical indicator, points towards the emergence of a positive divergence, a bullish development indicative of a pending price action reversal. Due to the accumulation in upside pressures, the Force Index pierced above its horizontal resistance level, converting it into support. A spike into its ascending support level is expected, from where the descending resistance level is likely to challenge a further advance. Bears remain in control of the USD/MXN with this technical indicator in negative territory.

With the United States-Mexico-Canada Agreement (USMCA) taking effect on July 1st, and the US on course to ruin its relationship with China further, Mexico hopes for a more comprehensive investment between the three USMCA members. The greatest beneficiary of likely manufacturing relocations by US companies within its borders or nearby remains Mexico. It has improved its relationship with the US, as evidenced in its assistance with migrants and securing the US-Mexican border. The USD/MXN is positioned for a temporary breakout above its support zone located between 22.3538 and 22.7508, as marked by the grey rectangle.

US economic data indicates more severe disruptions than planned for, while any recovery is in danger of a double-dip recession or the dreaded W-shaped pattern. Complacency by the US government regarding the long-term impact of the global Covid-19 pandemic, and consumer misconceptions about the labor market, limit the upside potential in the USD/MXN to its descending 38.2 Fibonacci Retracement Fan Resistance Level. It is passing through the short-term resistance zone located between 23.1797 and 23.5448, as identified by the red rectangle, favored to enforce the dominant long-term downtrend.

USD/MXN Technical Trading Set-Up - Temporary Breakout Scenario

Long Entry @ 22.3500

Take Profit @ 23.2000

Stop Loss @ 22.0750

Upside Potential: 8,500 pips

Downside Risk: 2,750 pips

Risk/Reward Ratio: 3.09

In case the Force Index is faced with rejection by its ascending support level, the USD/MXN is anticipated to bypass a short-covering rally. It will position this currency pair for a brief counter-trend advance in the future, essential to ensure the longevity of the correction. Forex traders should view any advance as an excellent selling opportunity. The next support zone awaits price action between 20.9610 and 21.3110.

USD/MXN Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 21.8250

Take Profit @ 20.9750

Stop Loss @ 22.0750

Downside Potential: 8,500 pips

Upside Risk: 2,500 pips

Risk/Reward Ratio: 3.40