The continued collapse of the US labor market increases the pressure on the US dollar, especially with investors' appetite for safe havens amid new tensions in relations between the United States and China, this time around the Coronavirus. The USD/JPY pair fell to the 105.98 support, the lowest level in more than a month and a half, before settling around the 106.30 level at the time of writing. American companies cut 20.2 million jobs, an unprecedented result in April and an epic collapse of the US labor market with the outbreak of coronavirus, which closed offices, factories, schools, construction sites and stores that are pushing the American economy forward.

The ADP's Wednesday report showed the tragic depth and magnitude of job losses that have not left any part of the world's largest economy safe. Mark Zandi, chief economist at Moody's Analytics, said the losses will likely continue until May, and the employment recovery is likely to start in the following months. "The good news is that we are at the height of job losses," says Zandi. Although Zandi expects recruitment to resume in June as the states ease closings, he has warned that there will be "buzzing" over the course of several years to recover all of the jobs lost in April.

This report comes two days before the official monthly job figures from the US Department of Labor. Economists believe that Friday's report will reveal that unemployment in the United States is rising at 16% which is a shocking result, up from a 4.4% unemployment rate in March.

According to ADP, the entertainment and hospitality sector lost 8.6 million workers last month. Trade, transport and utilities caused job losses of 3.4 million. Construction companies have cut nearly 2.5 million jobs, while manufacturers have abandoned nearly 1.7 million people. The health care sector has cut one million jobs, but education services have made 28,000 jobs as colleges and universities do not seem to have been forced to lay off workers significantly.

More than half of April's job losses came from small companies with 500 or fewer workers. But big employers cut 8.9 million jobs. Surveys indicate that nearly eight out of 10 American families suffer from job losses.

The death toll in the United States from coronavirus has risen above 71,000, and in this regard, President Donald Trump has backtracked on his announcement that he will get rid of the government task force created to manage the epidemic.

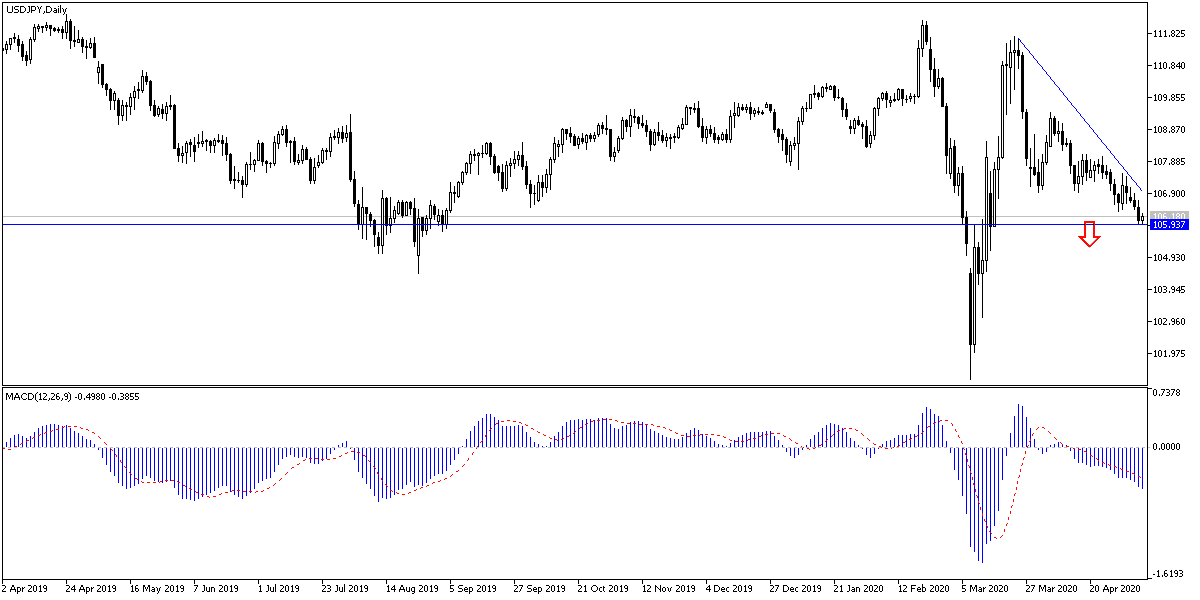

According to technical analysis of the pair: Recent USD/JPY drop pushed technical indicators to oversold areas, and therefore, forex traders may consider thinking to buy the pair, and the closest support levels for it currently are 105.90, 105.20 and 104.45, respectively. On the other hand, it is expected to return to stability above the 108.00 resistance so that the pair has the opportunity to correct higher, out of the current landing swamp. Investor demand for safe havens will remain stronger as long as global anxiety over the Coronavirus, its causing and its economic and human impacts persists.

As for the economic calendar data today: The beginning will be with the announcement of the Chinese data, Caixin Services Purchasing Managers' Index, then the Chinese Trade Balance. From the United States, jobless claims and non-farm productivity will be announced.