Risk aversion still supports stronger yen gains against most other major currencies. The USD/JPY share of this pushed it to the 106.37 support in the beginning of trading on Wednesday. The pressure on the pair coincided with the gradual opening of the US economy, which suffered the largest numbers of coronavirus infections and deaths. The United States has approved nearly 3 trillion dollars to try to save the US economy from the coronavirus outbreak. Although these are stimulus plans, they are still a river of debt that was unthinkable even a few months ago.

In light of the frightening free fall of the American economy, the government has no choice but to pump trillions of dollars with contingency plans. Doing less would risk a disaster - a recession that could turn into a full depression. And if that happens, the US government's financial situation will be much worse.

Moreover, lessons of World War II and the 2008 financial crisis indicate that combining of extremely low interest rates and eventual economic growth can keep government debt manageable and prevent a budget crisis. As for investors’ anxiety about the deep recession more than worrying about whether the government may eventually struggle to pay off its mounting debt, the yield on record 10-year treasury bonds remains well below 1%. So many analysts say that while the rise in federal debt may end up slowing the recovery eventually, there will be no recovery if the government does not borrow and spend aggressively now.

The US Treasury announced on Monday that it will borrow $ 2.99 trillion in the April-June quarter, breaking the previous quarterly record of $ 569 billion, which was set in the 2008 recession year, and exceeded the $1.28 trillion it borrowed in the bond market in 2019. By the time the budget year ends in September, government debt - its accumulated annual deficit - will equal 101% of US gross domestic product, according to the US Central Bank.

For economic news. The US Department of Commerce reported that the gap between what the United States sells and what it buys abroad widened by 11.6% in March to $44.4 billion from $39.8 billion in February. US exports fell 9.6% to $187.7 billion due to lower prices for cars, auto parts and industrial machinery. Imports fell 6.2% to $232.2 billion. Total trade - exports plus imports - was $419.9 billion in March, down 7.8% from February and 11.4% from March 2019.

The politically sensitive deficit in commodity trade with China fell 21.3% to $15.5 billion in March, as exports increased slightly and imports decreased. The coronavirus, closures and travel restrictions have affected the global economy and paralyzed global trade. In March, the United States generated a surplus of $21.2 billion in trade in services such as tourism and banking. But it recorded a deficit of 65.6 billion dollars in trade in goods, such as cars and appliances.

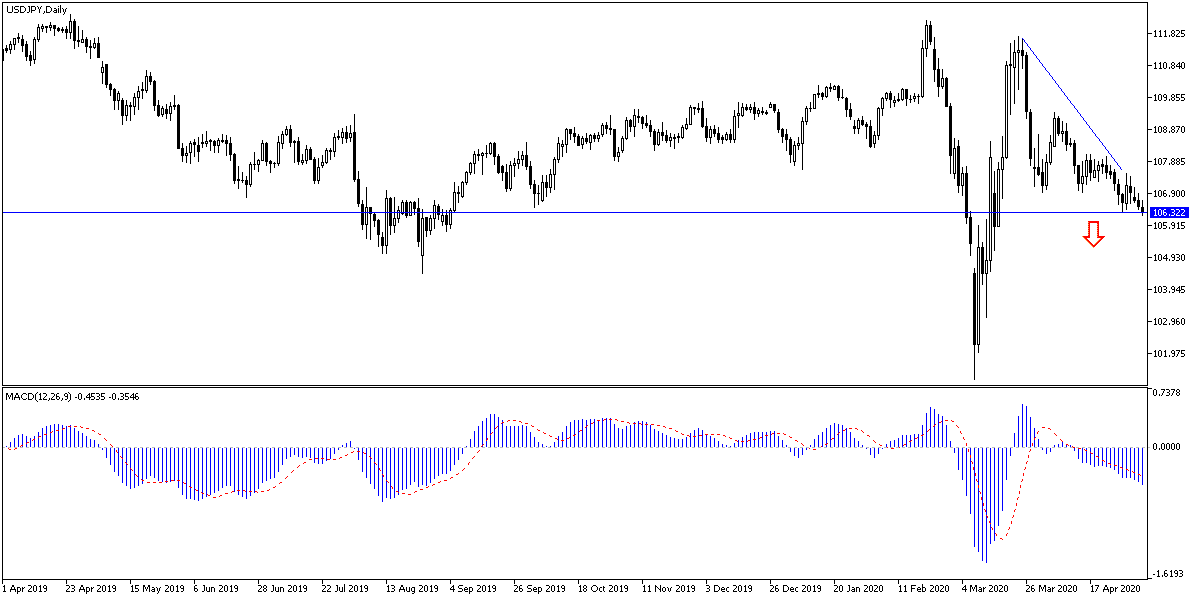

According to technical analysis of the pair: General trend of USD/JPY is getting stronger towards the downside, moving towards the 106.00 support, its lowest level for eight years. Currency traders may be tempted to think about buying the pair. The pair's bullish momentum will not return without a strong move towards the 110.00 psychological resistance. The pair may remain under downward pressure until the official US job numbers are announced starting today, with the announcement of the ADP survey of non-farm jobs change, the announcement of jobless claims tomorrow, and the announcement of the unemployment rate, average wages, and the change in US Non-farm employment on Friday.