Before the announcement of a package of important US economic data today, the USD/JPY is subjected to a downward pressure that pushed it towards the support 107.36 level before settling around the 107.70 level in the beginning of Thursday’s trading. Although the US deaths from the Corona epidemic have crossed the 100,000 mark, John Williams, President of the New York Federal Reserve, said that the US economy is beginning to show some initial signs of increased activity as businesses reopen as the coronary virus pandemic recedes. "I think we're somewhat in a good place ... maybe close to the bottom in terms of economic downturn and we hope to start seeing an improvement in the coming months," Williams said in an interview on Bloomberg TV. "We see people willing to travel a little bit more, and we see retail sales increase, especially in areas where restrictions have been lifted."

Williams said he expects to see a major recovery in the second half of the year. When asked if the worst is over, Williams replied, "We're really close. May or June may be a low point."

In a separate interview later Wednesday, Fed President St Louis James Pollard agreed with Williams. By saying “I might go a little further”. As Bollard told reporters after a webcast, “I think April was probably the worst month”. In his interview, Williams added that he expected inflation to remain low for the next year or so.

Williams added that the coronavirus pandemic continues to lead expectations, and as a result, things remain unclear. Fed officials will meet on June 9-10, to consider determining monetary policy. As president of the New York Federal Reserve Board, Williams has always had a voice on interest rate decisions.

In that interview, Williams said that the Federal Reserve will prepare key economic forecasts for the June policy meeting, but also studies alternative scenarios, both positive and negative. When pressed whether controlling the yield curve was a political tool that the Fed might soon use, Williams replied that it could “supplement” the existing Fed’s tools. Return curve control is the term for determining interest rates after short-term maturities. It was used by the Bank of Japan.

Fed officials first reported in February that this policy was gaining more attention as the crisis progressed. Where the Fed officials discussed the use of the tool at their meeting in late April, as revealed by the content of the minutes of the last meeting. Based on comments made by Fed Vice President Richard Clarida last week, Federal Reserve monitors believe the issue will not be decided until September.

Williams also said that the tools the Fed decides to use depend largely on how the economy develops. "These are issues we are studying very clearly very carefully and we will discuss them as a group, so I have nothing to say about what will happen and what will not happen," he said.

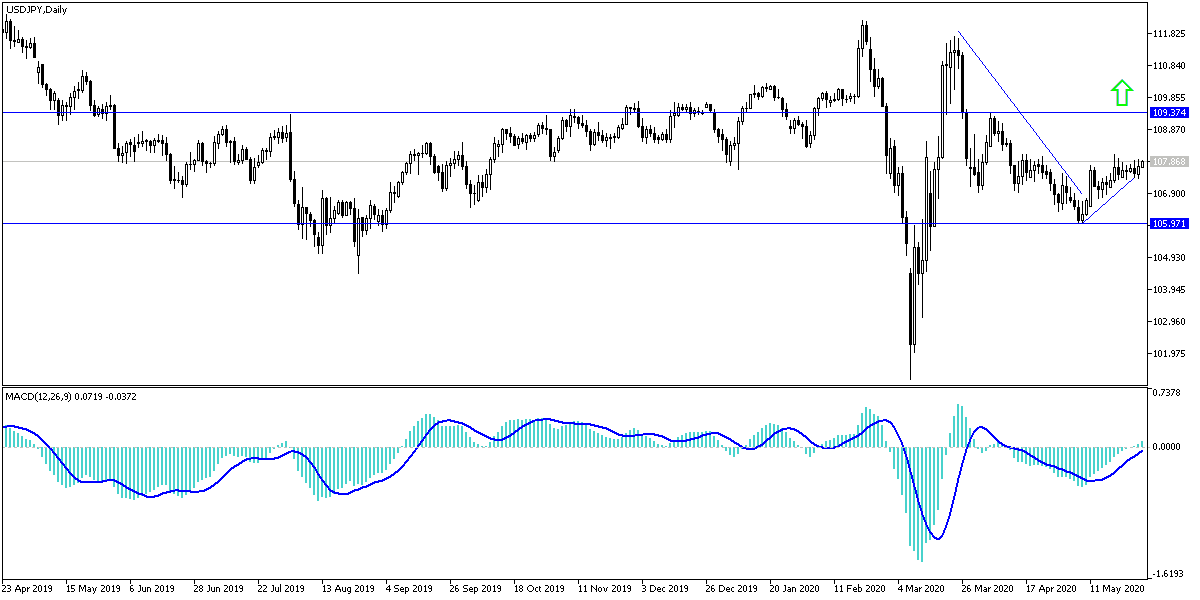

According to the technical analysis of the pair: the recent USD/JPY stability in a narrow range for several trading sessions in a row foreshadow a strong movement in one direction or the other. Until this moment, the bear is dominating, with the pair settling below the 108.00 support and the control of the sell-offs will be strengthened if it moves towards the 107.30, 106.45 and 105.80 support levels respectively, with the last two levels are the best to buy from at the moment. There will be no strong reversal of the trend without moving towards the 110.00 psychological resistance. The dispute between the United States and China remains a major driver of markets.

As for today's economic calendar data: All focus will be on US economic data, which includes the announcement of the US GDP growth rate, jobless claims, durable goods orders, and pending home sales.