The USD/JPY losses increased in the last two trading sessions, as the pair moved towards the 107.37 support in the beginning of Wednesday’s trading. This is despite the tendency of global economies to reopen and end terms of the closures, which brought the global economy more losses, pushing it into the strongest stagnation since the thirties. The pair did not care much about the announcement of a rise in US consumer confidence this month, which indicates signs of stability, as it is still near its lowest level in six years in the face of the widespread business closures that pushed the US economy into recession.

The Conference Board, the index source, stated that the US consumer confidence index rose 86.6 in May from 85.7 in April. The index, which reflects consumer assessments of current conditions and expectations for the future, has fallen in the past two months. The index reached a reading of 130.7 in February, before falling by about 12 points in March and by more than 20 points in April.

The Corona pandemic has forced companies across the country to shut down, which has stifled consumer spending, which accounts for about 70% of all economic activity in the United States. Optimism about the overall economy improved slightly as US states gradually lifted applied protection requests, and allowed companies of many categories to reopen under certain restrictions.

On the other hand. New US home sales increased 0.6% in April, a surprising gain amid a coronavirus outbreak. The US Department of Commerce reported that sales of new single-family homes rose slightly to an average annual rate of 623,000 homes in the past month. This came after a decrease of 13.7% in March, as companies and schools were closed in an attempt to contain the spread of Covid-19. Over the past 12 months, sales have decreased by 6.2%.

The Coronavirus outbreak disrupted what appeared to be signs of growth in the housing market as lower mortgage rates attracted buyers. They are now stuck in social isolation, and last month they chose to buy homes that haven't yet been built - a category that rose 26.5% from March and accounted for all sales growth in April. Under-construction home sales fell slightly, while already completed sales were down 13.6% from last year.

The average price of a new American home that was sold last month was $309,900, down 8.6% from last year. Prices seemed to drop due to the sale of fewer homes last month in the $300,000 range to $ 399,999 and $ 750,000 and above. The government report contains a high margin of error, so April numbers can be adjusted in the coming months. Sales of new homes increased in the Northeast, Midwest and South, but declined in the West.

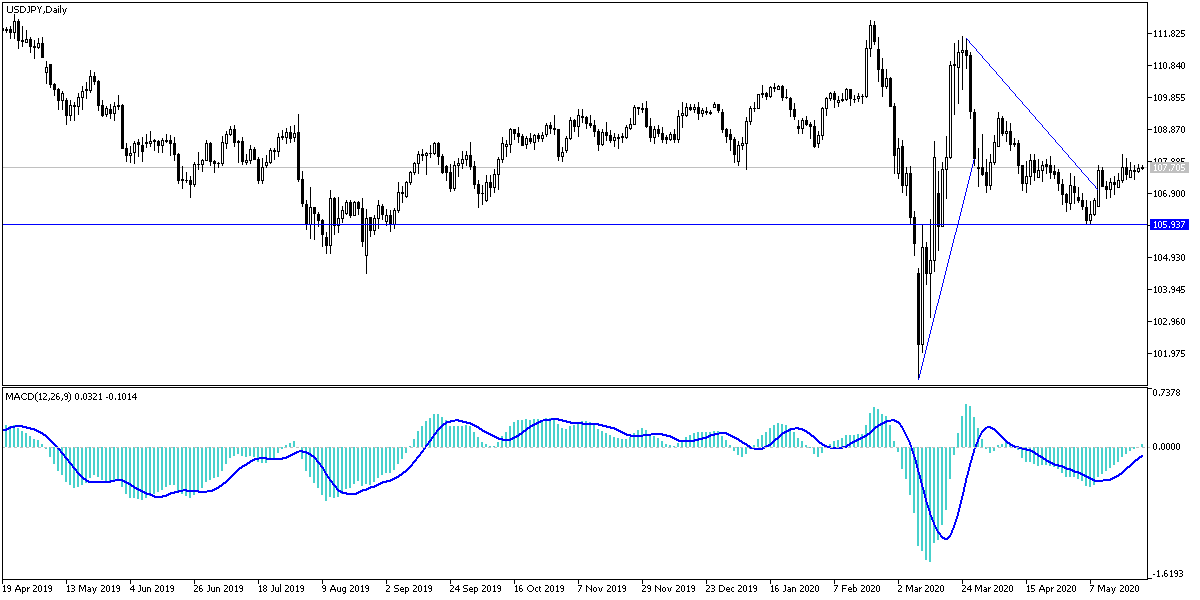

According to the technical analysis: If the USD/JPY pair succeeds in moving towards the 107.00 support, bears will gain more control over the performance, and at the same time, currency traders will start to exploit the situation to return to purchase deals. On the other hand, a return to the perimeter of 108.00 and higher will contribute to the pair continuing its move to its last upward channel to push towards higher resistance levels. The pair is expected to move today based on investor sentiment and the continuation of recent market gains in light of an empty economic calendar from important announcements.