There was no movement of the USD/JPY pair in the beginning of this week’s trading, as the performance remained between the 107.54 level and the 107.77 level throughout Monday trading. In the beginning of Tuesday’s trading, the pair settled around the 107.72 level. The American recess and the absence of any important and influential economic data was a good reason for this performance. The conflict between the two largest economies in the world remains the main driver of global financial markets, including the forex market.

On the latest developments. China yesterday condemned the step taken by the US Department of Commerce to expand the list of Chinese companies, which are prohibited from doing business with US companies, due to alleged human rights violations in the Xinjiang Uygur Autonomous Region. Bloomberg News reported that the Chinese Foreign Ministry expressed "strong dissatisfaction" with the decision at a special press conference.

"We urge the United States to correct its mistakes, withdraw relevant decisions, and stop interfering in China's internal affairs," said Chinese Foreign Ministry spokesman Zhao Legian, adding, "China will continue to take all necessary measures to protect the legitimate rights and interests of Chinese companies and protect national sovereignty and security and development interests”.

The United States of added dozens of Chinese companies last fall amid a fierce trade war between them that has grown to include concerns about American technological dominance, especially in the race to build a more robust AI.

On Friday, the US Department of Commerce added nine Chinese organizations to the list, arguing that it was "complicit in human rights violations and abuses committed in the crackdown, arbitrary detention, forced labor, and technical surveillance against Kazakhs, Uighurs and other members of Muslim minorities in the Xinjiang Uygur region”. The expansion of the list was against the backdrop of growing Sino-US tensions after news that the Chinese parliament would consider a bill enabling the Chinese authorities to reduce opposition activity in Hong Kong, including protests or engaging in discussions with international allies.

We see that the renewed disagreement between the two largest economies in the world at this time coincides with US accusations that China is the cause of the epidemic and that it has deceived the whole world of the gravity of the epidemic on the future of the global economy and humankind.

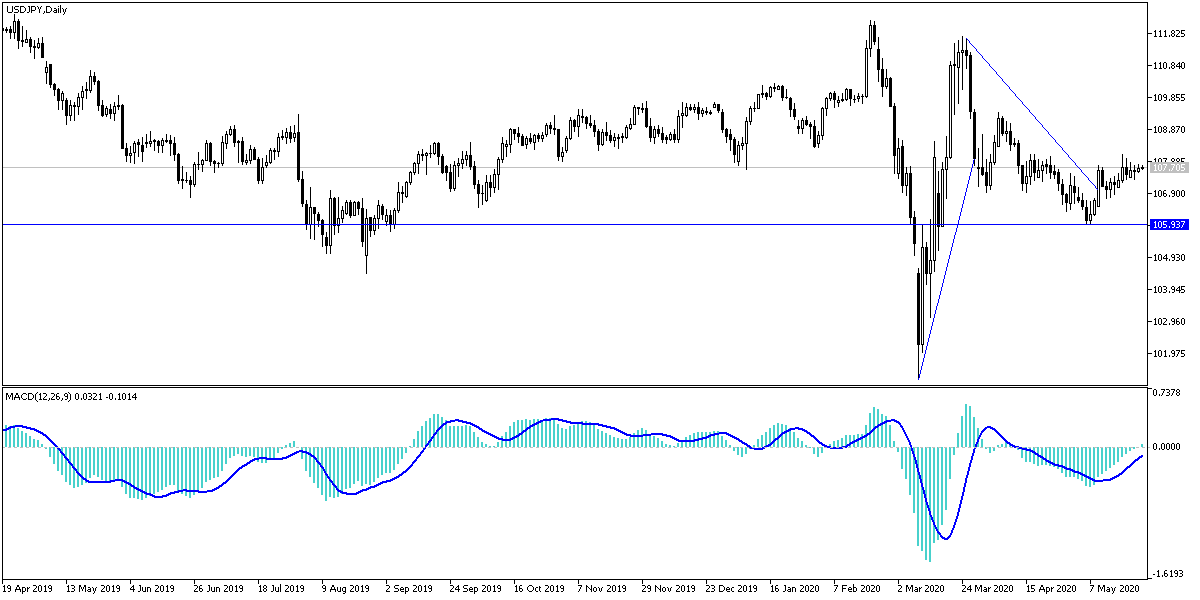

According to technical analysis: On the USD/JPY daily chart, we notice a neutral performance, but the stronger trend will be downwards with the stability below the 108.00 support. The struggle of safe havens is represented by this pair, as the US dollar has been one of the most gainers since the beginning of the Coronavirus, and the Japanese yen is a historical safe haven for investors in times of uncertainty. The 110.00 psychological resistance will remain the most important for the current trend shift, which is still bearish.

As for the economic calendar data today: From Japan, the Producer Price Index, Activity of All Industries and CPI will be announced. During the US session, the Consumer Confidence and New Home Sales Index will be announced.