The USD/JPY is still lacking the necessary momentum to complete the path of the recent rise, as recent gains stopped around the 108.08 resistance and yesterday we could not overcome the 107.98 resistance barrier and settled around the 107.50 level in the beginning of Thursday's trading. The pair’s reaction was limited with the announcement of the contents of the minutes of the last US Federal Reserve meeting, because Jerome Powell, and on several occasions, cleared to the market the path of the bank's policy. In addition to the short-term effects of the coronavirus epidemic, minutes of the Fed's latest monetary policy meeting noted that measures to contain the epidemic also created significant uncertainties and significant risks to economic activity in the medium term. The minutes added that the participants in the meeting in late April discussed several alternative scenarios regarding the behavior of economic activity in the medium term.

"These scenarios differed in the length of the epidemic's life and the consequent economic turmoil," the Fed said. A number of participants believe that there is a high probability of additional waves of coronavirus outbreaks, which could lead to further economic turmoil.

Participants at the meeting cautioned against the turmoil, including additional periods of mandatory social distancing, more disturbances in supply chains, and a large number of business closures and income losses, which could lead to a prolonged period of severely reduced economic activity.

At the same time, economic activity can recover more quickly if the epidemic subsides enough for families and businesses to have enough confidence to relax or modify social distancing behaviors over the next several months.

The minutes of the Federal Reserve meeting of the: "The participants stressed that measures taken in areas of health care policy and fiscal policy, in addition to measures taken by the private sector, will be important in determining the timing and speed of the US economy return to more normal conditions." And added: "In addition, participants at the meeting agreed that recent actions taken by the Federal Reserve Board are necessary in helping to reduce negative risks to the economic outlook".

Meanwhile, the minutes indicated that the epidemic also poses many risks to long-term economic performance, including that workers who lose their jobs may experience skill loss, lose access to child-friendly or elderly care, or become frustrated and get out from the workforce.

After the meeting, the Fed decided to keep the target range for the Federal Reserve at 0 to 1/4 percent, as the public health crisis greatly affects economic activity, employment, and inflation in the near term and poses significant risks to the medium-term economic outlook. The minutes reaffirmed that the central bank is committed to using its full set of tools to support the US economy in this difficult time, thus enhancing the maximum employment targets and price stability.

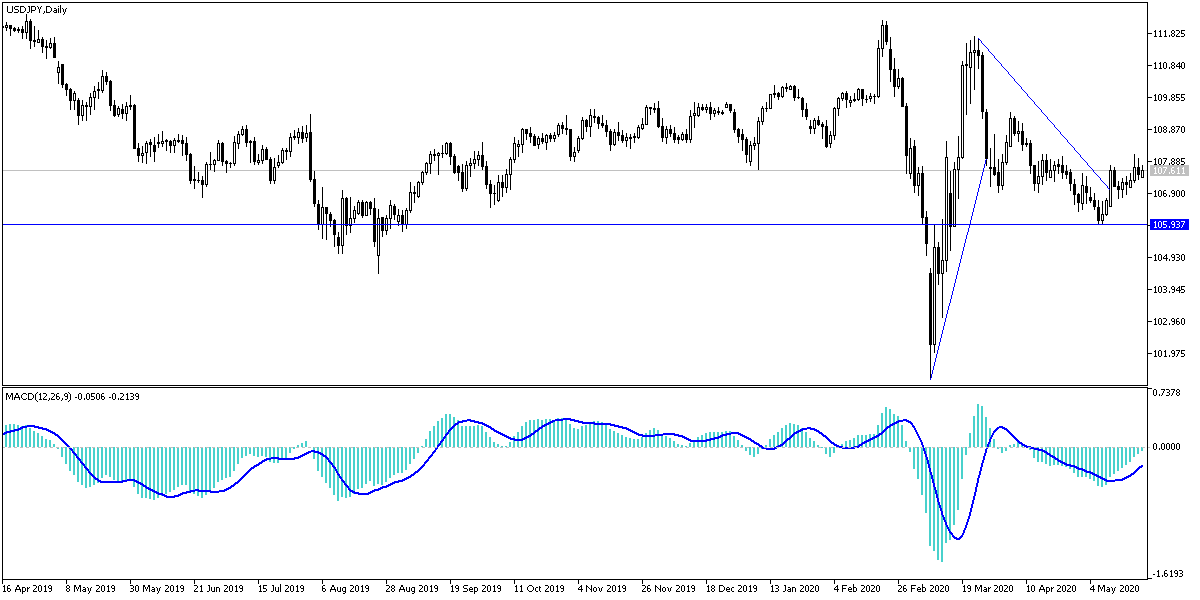

According to technical analysis: Recent USD/JPY performance confirms the failure of the bulls to get the pair out of its stronger downward channel on the long run and stability below 108.00 support 108.00 may give the bears a signal to start moving the pair to stronger support levels, the closest of them are currently 107.55 and 106.90 And 106.00, respectively. I still confirm that without going beyond the resistance levels of 109.20 and 110.00, respectively, the pair will remain bearish for a longer period.

As for the economic calendar data today: All focus will be on the US session data, which includes announcing the unemployed claims, the Philadelphia Industrial Index, the Industrial PMI, existing US home sales, and later statements by Federal Reserve Governor Jerome Powell.