Abandoning safe havens amid markets’ optimism after recent positive comments by Federal Reserve Governor Jerome Powell and the sudden announcement of a successful first vaccine trials that might destroy the Coronavirus which paralyzed the global economy. This optimism contributed to USD/JPY gains to the 108.08 level, and while awaiting for stronger incentives, the pair returned to stability around the 107.75 level at the time of writing, and before announcing the minutes of the last Fed Reserve meeting later in the day.

Facing the most serious economic crisis in the United States in decades, Treasury Secretary Stephen Manuchin and Federal Reserve Chairman Jerome Powell offered Congress contradictory views on the government’s most urgent priority. Mnuchin has warned that prolonged business closings would pose long-term threats to the US economy, with widespread bankruptcy of small businesses and the long-term unemployment of millions of Americans.

"There is a risk of permanent damage," Manuchin said.

On the contrary, Powell stressed, as he emphasized in recent weeks, that the country is suffering from an economic shock "without a recent precedent" and that Congress should consider providing more financial assistance soon to support states, localities, companies and individuals to prevent the deepest recession. "What Congress has done so far has been remarkably strong and timely," Powell said. And added: “But we need to step back and ask, Is that enough? ”

Their focus points reflect the debate that is taking place across the country, between individuals, businessmen and political leaders, about when and under what circumstances the economy should reopen and what additional assistance the US government can or should provide. Mnuchin and Powell presented their views at a supervisory hearing of the Senate Banking Committee, where members of both parties questioned them about when their agency would distribute more emergency aid from Congress in late March to small businesses and struggling families.

Powell said that the Fed's prospective lending program for small businesses should be operational by the end of the month. In another twist, Mnuchin said that the treasury is now ready to absorb some of the losses in this program, which is funded by the Treasury. Doing so could enable the Federal Reserve to take more risks with the program and help more troubled companies.

The Fed announced in March that it would place the Main Street program, which will provide up to $600 billion in loans to medium-sized companies that are too large to participate in the salary protection program. The Treasury provided $75 billion, drawn from the $454 billion the Congress allocated, to cover any losses from the Main Street program. Therefore, Manuchin stated that, under some scenarios, the loss could include some or all of these $75 billion.

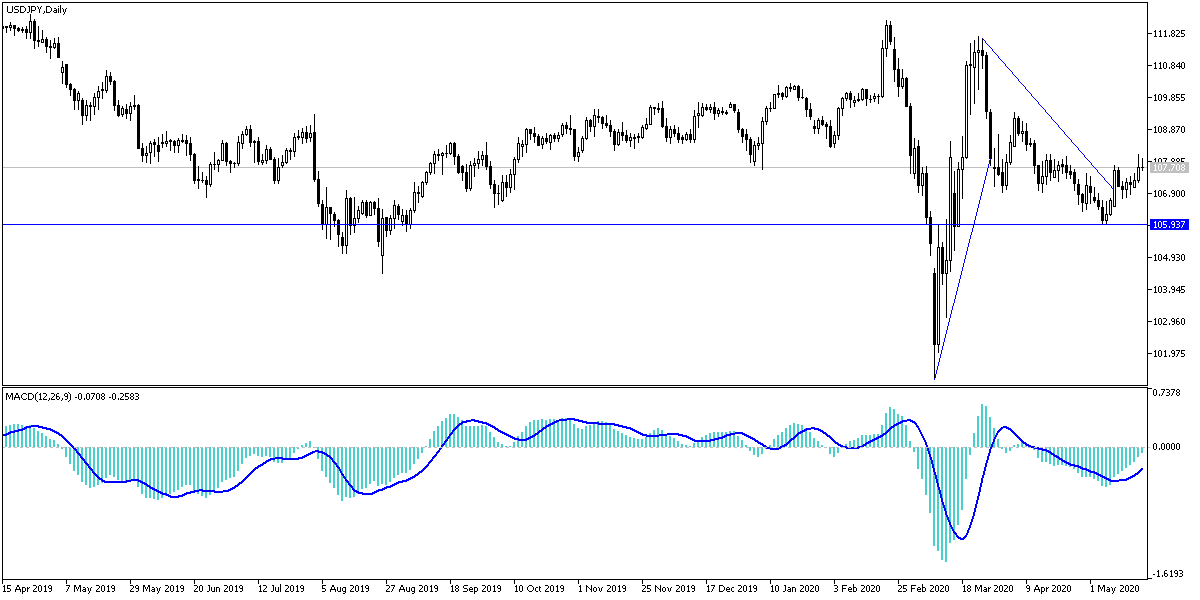

According to the technical analysis: On the daily chart, the USD/JPY stronger general trend remains bearish as long as it is stable below the 108.00 support, and the evaporation of recent optimism may push the pair back towards support levels 107.55 and 106.80, respectively. The 110.00 psychological resistance will remain the most supportive of bulls to control performance and abandon the current downtrend.

As for the economic calendar data today: The largest focus today will be on the announcement of minutes of the last US Federal Reserve’s meeting. This is in addition to whether investors want to take risks or not.