For the fifth consecutive day, the USD/JPY is moving in a limited range, which technically foreshadows a strong move in one of the two directions, with a greater willingness to fall. Gains reached the 107.50 level, where it was stable around in the beginning of Tuesday’s trading, and the testimony of Federal Reserve Governor Jerome Powell may present the opportunity for this move. Prior to the opening of this week’s trading, and in an interview with "60 Minutes" from CBS, Powell noted that the US economy was essentially healthy before the virus spread as quickly and suddenly forced to close businesses on a large scale and contributed to tens of millions of cases layoffs. Once the outbreak is contained, he said, the economy must be able to "get back" dramatically.

Powell presented a general positive message while warning that the economy would take much longer to recover to health than it took to collapse at an astonishing speed. He stated in his statements “on the long term, even in the medium term, we will not want to wager on the American economy. This economy will recover. This means that people will return to work. Unemployment will decrease. We will overcome that ordeal. ”

Powell noted that the downturn was not the result of entrenched financial instability, such as the collapse of housing and excessive risk-taking among banks that sparked the recent Great Recession. Instead, this resulted from an external event - a pandemic - that required the economy shut down. This, he said, could mean that "we can return to a sound economy fairly quickly." Meanwhile, American workers are suffering from their worst crisis in decades. More than 36 million people have applied for unemployment benefits in less than two months since the coronavirus forced companies to shut down and shrink the workforce. The US unemployment rate has risen to 14.7%, the highest since the Great Depression, and is widely expected to increase significantly in the near future.

In the same interview with CBS, Powell reduced depression comparisons. While he admitted that American unemployment could peak around 25% at the same rate in a recession. He indicated that American banks are healthier now, and that the Federal Reserve and other central banks are more capable and willing to intervene to support economies than they were in the 1930s.

However, Powell warned that it would take some time for the US economy to return to anything close to normal. He said the recovery "may extend until the end of next year." The vaccine is likely necessary for Americans to feel safe enough to return to their normal economic behavior of shopping, traveling, eating out and gatherings - activities that fuel much of the economy’s growth. In this regard, most health experts said that the vaccine will not be ready to be used for at least 12 to 18 months.

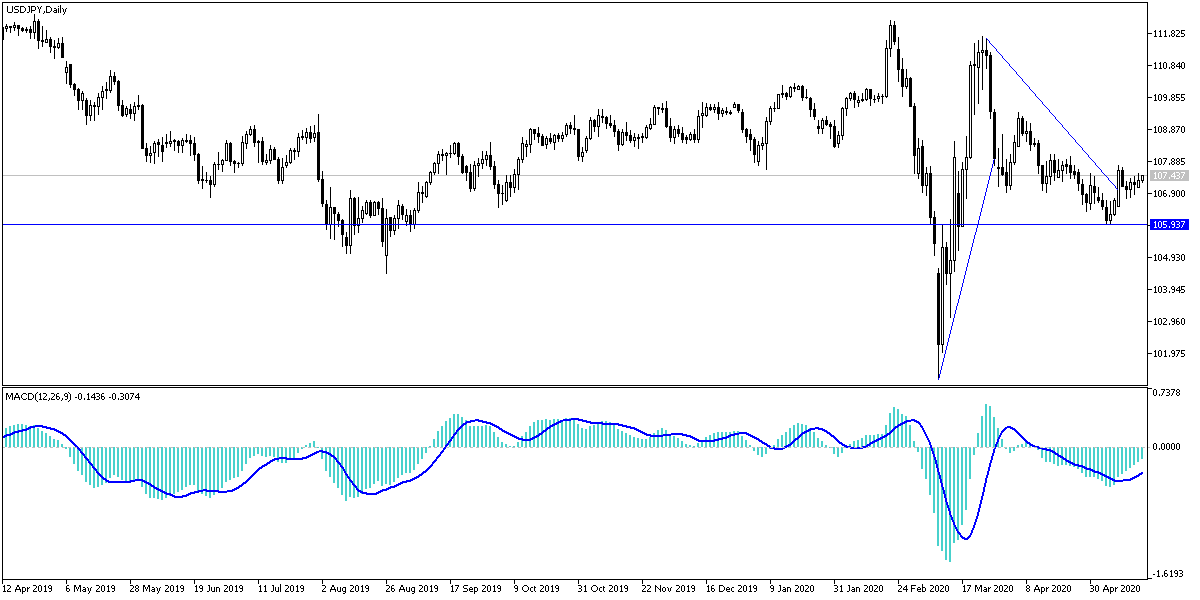

According to the technical analysis of the pair: Despite markets optimism in the beginning of this week’s trading, USD/JPY gains did not exceed the 107.50 level, which confirms the downtrend strength, as we previously expected that stability below the 108.00 level will remain supportive of Stronger bears control. The return of pessimism to Powell's statements in his expected testimony today may push the pair towards the support levels at 107.00, 106.65 and 105.90, respectively. On the upside, the true bounce back depends on the opportunity to move towards 109.20 and 110.00 resistance levels, respectively. Otherwise, the trend will remain bearish for a longer period.

In addition to Jerome Powell's testimony, US housing numbers, building permits and housing starts will be announced.