Investors have abandoned the US dollar, albeit temporarily, after the results of recent important US economic releases that confirm the extent of the world's largest economy’s suffering from the closures policy imposed to contain the Corona pandemic and the loss of millions of jobs in record time. After two consecutive trading sessions in which the USD/JPY pair made gains that pushed it to the 107.77 resistance, the pair returned to drop to the 107.10 support around the beginning of trading on Wednesday, after announcing a stronger decline than expected for the US inflation. The economic paralysis caused by the Coronavirus in April led to the largest sharp drop in consumer prices in the United States since the 2008 financial crisis - a decrease of - 0.8%, driven by lower gasoline prices.

The US government said in its monthly report on consumer price inflation that, with the exception of the usually volatile groups of food and energy, core prices fell by 0.4%. The decline was the strongest since 1957. Closed business, reduced travel, and reduced consumer spending caused by the virus are likely to push the US economy into a deep recession. The resulting drop in economic activity exerts a downward force on prices in all sectors of the economy.

Deflation is a broad and long decline in prices and wages, often in the value of homes or other assets. During deflationary periods, broad measures, such as the consumer price index released by the government on Tuesday, will show constant price changes below zero. For two months now, this is what the CPI showed. The index fell - 0.4% in March and - 0.8% in April. This trend is likely to continue as the virus reduces economic growth and consumer spending and therefore exerts downward pressure on prices.

From Japan, a summary of views at the monetary policy meeting, held on April 27, showed that some Bank of Japan policy makers called for close coordination with the government in order to formulate policy to avoid the great depression amid the Coronavirus, and the bank’s statement said, “The policy authorities Act decisively to avoid a second Great Depression”. "Close cooperation between the financial and monetary authorities in terms of their policies is essential at the time of a major economic crisis" they added.

Members noted that, given the current situation where there is concern about deflation, financial and monetary authorities can increase cooperation with each other regarding their policies. On the other hand, some policy makers said that it is desirable to make more active purchases for JGBs and T-Bills, with the aim of holding the yield curve at a low level.

At the April meeting, the Bank of Japan expanded the monetary stimulus by removing the ceiling for government bond purchases. The bank raised the ceiling for additional purchases of securities and corporate bonds, and raised the upper limit for existing holdings to around 20 trillion yen.

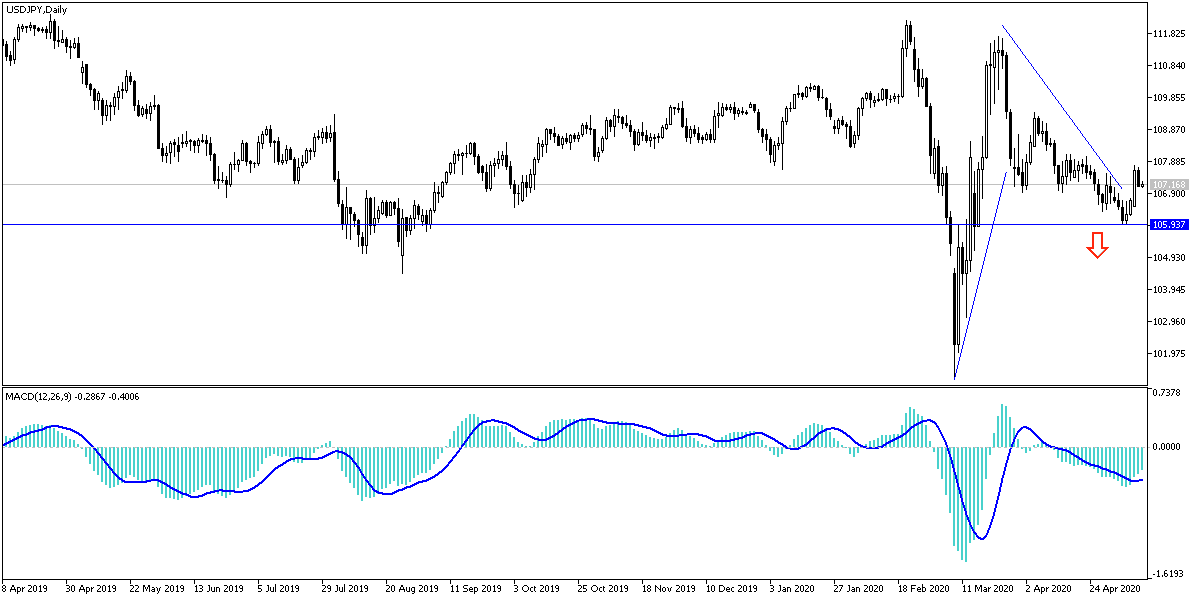

According to technical analysis of the pair: the USD/JPY pair is in a neutral position after the recent bounce, but with stronger tendency towards the decline. Especially if it returns to the support levels at 106.65 and 105.80. A return of the upward correction higher need to move towards the resistance levels of 108.00 and 110.00 to confirm the reversal of the trend. The pair will continue to fluctuate until there is a clarity about the trade talks between the United States and Chine, and the confirmation of the Federal Reserve on the expectations of the possibility of negative interest rates.

As for the economic calendar data today: From Japan, the current account will be announced. The main focus will be on the announcement of the US Producer Price Index fr and statements by Federal Reserve Governor Jerome Powell.