American job figures in the Coronavirus era completed the bleak picture for the US economy, and increased pressure on the US currency, and therefore it was natural for markets to push the USD/JPY price towards the 105.98 support, its lowest level in nearly two months. The return to risk appetite amid increasing expectations that the negative interest rate could be approved by the Federal Reserve Bank, contributed to the pair's gains towards the 107.15 level in the beginning of this week’s trading. However, the general trend is still supporting the decline for a longer period. After the American jobs announcement, the attention of investors turned to the commercial conflict between the two largest economies in the world.

The US and Chinese negotiators discussed the progress of the trade agreement and issued a reference statement explaining how the two sides worked toward the matter. It was as if it was aiming to lessen US President Trump's threat to pull out of the deal if China failed to fulfill its obligations. The truth of the matter is, as we have emphasized from day one, it will be very difficult to achieve quantitative targets even in the best of circumstances, and they are certainly not. As China agreed to boost imports from the United States above 2017 levels, which were higher than 2019, however, during the first four months of 2020, China's imports from the United States fell almost 6% from last year’s levels. This is a type of political bomb, which provides a cycle for the US elections, and we doubt that things will reach their climax next month.

After the US job market disastrous, markets await more US economic stimulus. But it appears that U.S. President Donald Trump is in no hurry to negotiate another financial bailout bill, although the government has reported that more than 20 million Americans lost their jobs last month due to economic turmoil caused by the coronavirus.

The president's approach came at a low level, as the Labor Ministry announced last Friday the highest unemployment rate since the Great Depression. As 20.5 million jobs evaporated in the worst recorded monthly loss. Trump, his administration and even the Federal Reserve, led by Jerome Powell, have always sung with the strength of the US job market, the lowest unemployment in 50 years after an 11-year streak of economic growth. But with the Corona epidemic, everything collapsed in record time.

The report indicated that the clear majority of April's job losses - roughly 75% - are temporary, as a result of companies that were forced to close suddenly but hoped to reopen and call up laid-off workers. The collapse of the American labor market was amazing. Last February, the unemployment rate was the lowest in five decades at 3.5%, and employers added jobs for a record period of 113 months. In March, the unemployment rate was only 4.4%.

Commenting on those numbers, President Donald Trump, who faces the prospect of high unemployment rates during the November elections, said the numbers were "not surprising." "What I can do is get it back." “All these jobs will be back and they will be back very soon. Next year we will have an extraordinary year”. But economists are increasingly concerned that it will take years to recover all of the lost jobs. The Congressional Budget Office predicts that the unemployment rate will reach 9.5% by the end of 2021.

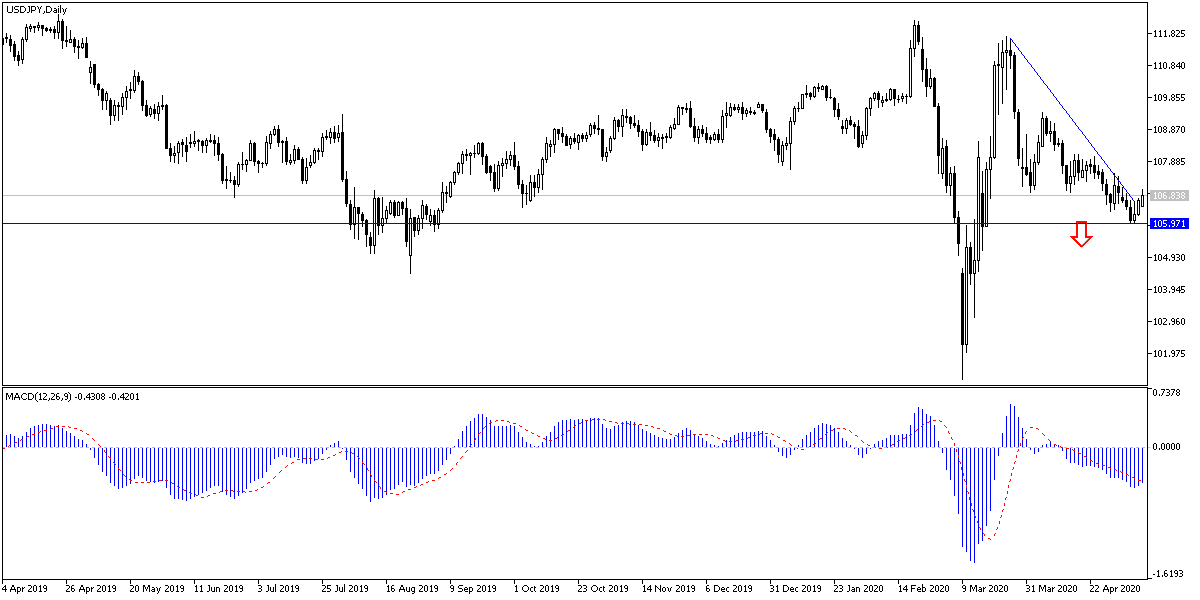

According to the technical analysis of the pair: The general USD/JPY trend remains bearish, which is confirmed it’s by stability below the108.00 support. Risk aversion will remain supportive of the trend for a longer period, and there will be no chance for an upward correction without breaking the 110.00 psychological resistance. The closest support levels for the pair are currently 106.35, 105.75 and 104.90 respectively. They are the best levels to buy the pair from, while working to determine profit and stop loss levels. Markets are witnessing a continuous change in the era of the Corona pandemic, which remains the main driver of the markets and a continuous impact on investor sentiment.