After Japan implemented an unprecedented ¥117.1 trillion stimuli in response to the Covid-19 pandemic, the Abe government is considering additional steps to assist business with rent and students who lost part-time jobs with tuition, among other measures. It highlights the severity of the virus and a reminder that hopes for a V-shaped recovery are not only misplaced but not supported by economic fundamentals. The Japanese Yen, the primary safe-haven asset in the Forex market, saw an inflow of capital as economies rush to reopen and risk a new infection wave. After the USD/JPY pushed below its resistance zone, bearish momentum is accumulating.

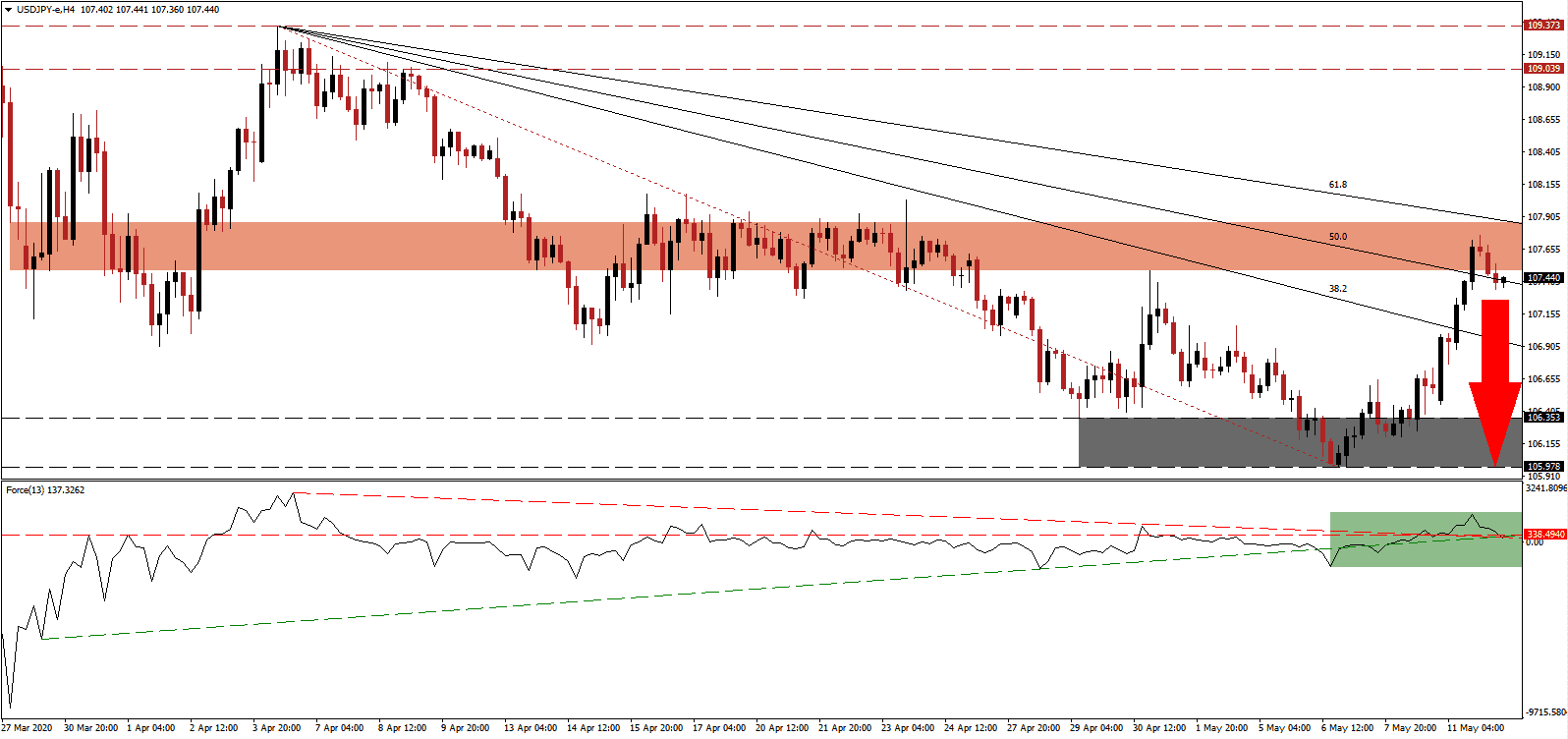

The Force Index, a next-generation technical indicator, reversed from a temporary breakout its horizontal resistance level and is now in the process of completing a triple breakdown. Following the push below its descending resistance level and its ascending support level, as marked by the green rectangle, more downside is favored to materialize. Bears are waiting for this technical indicator to correct into negative territory, which will cede control of the USD/JPY to them. You can learn more about the Force Index here.

This morning’s Japanese preliminary coincident and leading economic indicators for April confirmed further deterioration. Consumer spending is likely to face a significant impact, partially due to new social distancing measures. Japan is accustomed to challenges after the 1999 bailout of its financial system, a step the US duplicated in 2009. Despite massive headwinds, the Japanese Yen remains in demand due to its safe-haven status. Following the breakdown in the USD/JPY below its resistance zone located between 107.492 and 107.857, as marked by the red rectangle, an extended correction is anticipated to follow.

Adding to concerns is Japan’s initiative to lure US companies out of China, straining an already complicated relationship with its strategic competitor in Asia. Countering negative progress is a highly disciplined society, quick to adapt necessary lifestyle changes. The US is discussing more debt to please voters ahead of the November election, as economic reports are direr than initially forecast. It positions the USD/JPY for a breakdown below its descending 50.0 Fibonacci Retracement Fan Support Level, and into its support zone located between 105.978 and 106.353. More downside is probable, but a new catalyst is required.

USD/JPY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 107.450

Take Profit @ 106.000

Stop Loss @ 107.900

Downside Potential: 145 pips

Upside Risk: 45 pips

Risk/Reward Ratio: 3.22

Should the Force Index reclaim its ascending support level, presently serving as resistance, the USD/JPY may attempt a breakout. While the short-term outlook for Japan’s economy remains bearish, it is trumped by an increasingly negative US approach to the Covid-19 pandemic, risking more severe damages to long-term recovery prospects. Forex traders are advised to take advantage of price spikes with new net short orders. The next resistance zone is located between 109.039 and 109.373.

USD/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 108.300

Take Profit @ 109.150

Stop Loss @ 108.000

Upside Potential: 85 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.83