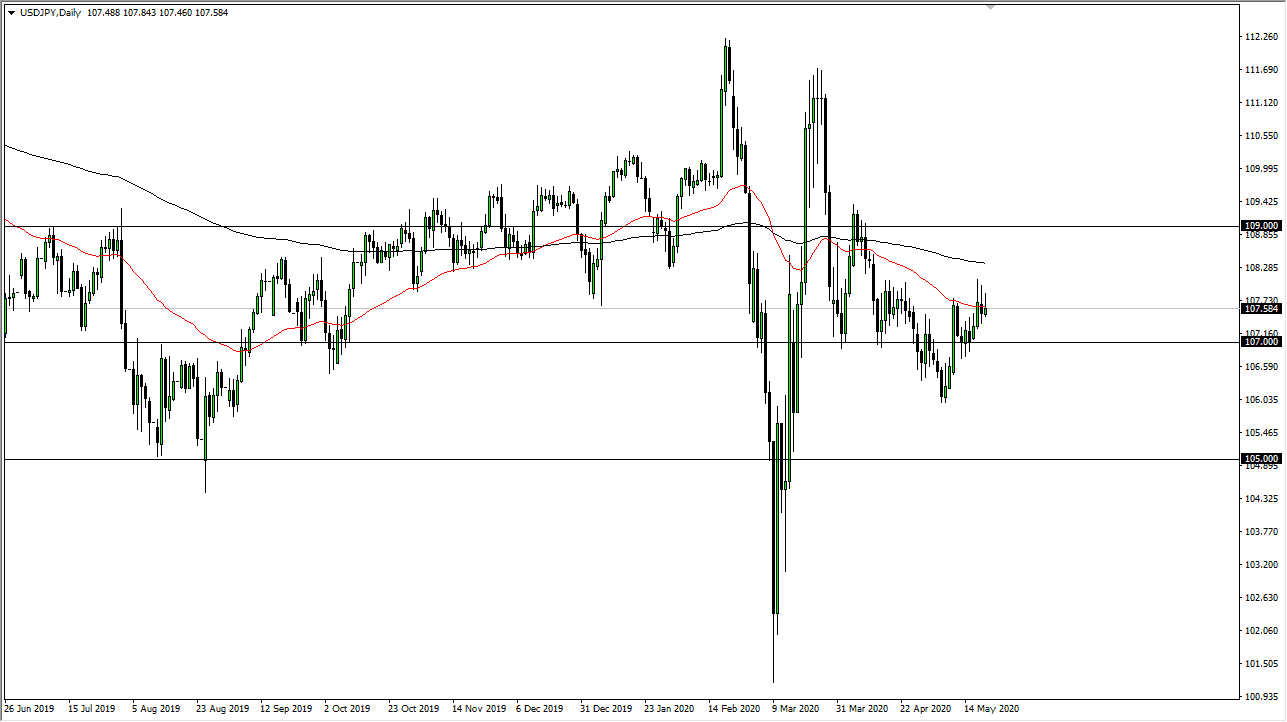

The US dollar rallied a bit during the trading session on Thursday, reaching towards the ¥108 level above before pulling back. This is the third day in a row that we have seen sellers come in and push this market lower. In fact, the highs continue to get lower and this suggests that we are ready to roll over again. Remember, the US dollar can strengthen against most currencies but fall here due to the fact that the Japanese yen is considered to be a safety currency. In fact, it is probably the one place where you may see US dollar weakness if we continue to see a lot of uncertainty in the markets.

Looking at the 50 day EMA, it has certainly done its job, showing signs of resistance every time, we reach towards it. Furthermore, the 200 day EMA sits above and show signs of exhaustion as well. Ultimately, this is a market that I think will go looking towards the ¥107 level, an area that has been significant support. In fact, we had broken down below that level couple of times but then turned around to form hammers to reach towards this area.

At this point, the market continues to drift a bit lower, as we are chopping around but continue to fall overall. At this point, the market is likely to continue to see more risk aversion, and that should drive this pair down. If we did however break above the highs of the last couple of days that would be a very bullish sign and could send this market looking towards the 200 day EMA. At that juncture, I would anticipate that the market has the likelihood of pulling back from there as well, but a break above the 200 day EMA offers a move towards the ¥109 level.

Expect volatility, that is something that we are seen everywhere so why would be any different here? However, you should also keep in mind that the range has been exceedingly small, so this is probably best trade on short-term charts more than anything else. Unfortunately, we are trading mainly on the latest headline, which of course has been extraordinarily noisy to say the least. In other words, we could get sudden moves back and forth, so therefore you are going to need to be extremely cautious about the position size that you use and be quick to get rid of losses.