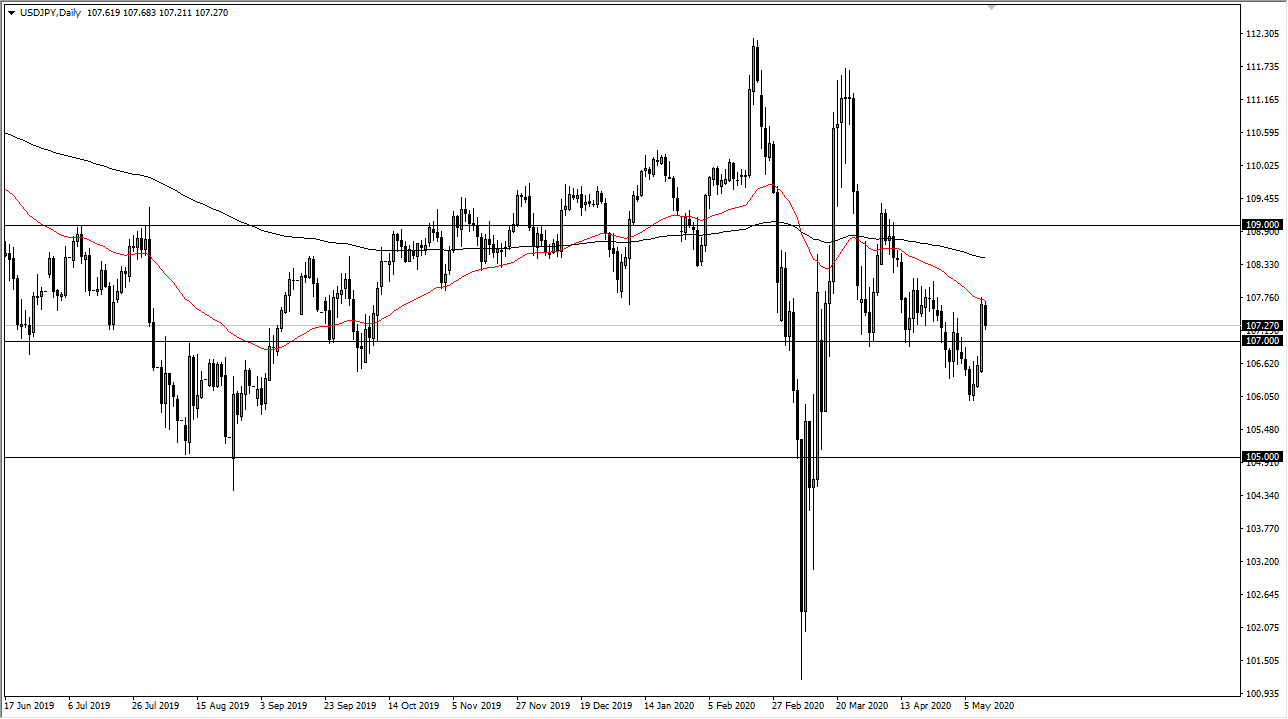

The US dollar has pulled back against the Japanese yen as the 50 day EMA has offered enough technical resistance to turn the market around. After the extraordinarily bullish candlestick of Monday, it was a bit of a surprise to see this market pullback so quickly, but it must be noted that we are still above the ¥107 level so it is below that level that I think fresh selling will come into play.

Remember that this pair is relatively sensitive to risk appetite, and therefore if risk appetite is starting to drift off a bit, it makes sense that this market would drop. With that in mind it should continue to bring appetite towards the Japanese yen which is considered to be a major safety currency. A breakdown to the ¥106 level makes quite a bit of sense, and then perhaps the ¥105 level after that. Looking at this market, it is obviously very volatile and that massive candlestick from the trading session on Monday shows just how noisy this market is going to be. At this point in time though, if we break down below the ¥107 level, I will be placing short positions on as I do favor the Japanese yen in this particular case. The fact that the 50 day EMA held so tightly is something to pay attention to as well. Even if we were to break above the top of the 50 day EMA, then it is likely that we could go looking towards the 200 day EMA above.

Pay attention to the stock markets, we have been witnessing a pattern over the last several weeks at the beginning part of the week tends to be positive in risk appetite, only to see the risk appetite wane in the end. That is already starting to play at the time I am writing this article, so we will have to see how this plays out over the next couple of days, but I do fully anticipate that this market continues to grind its way lower. At this point, I continue to fade rallies on short-term charts, and most certainly again sell the market out the break of the ¥107 level to the downside. Furthermore, you will probably get even more mileage out of a trade shorting another currency against the Japanese yen such as the British pound or even the Euro.