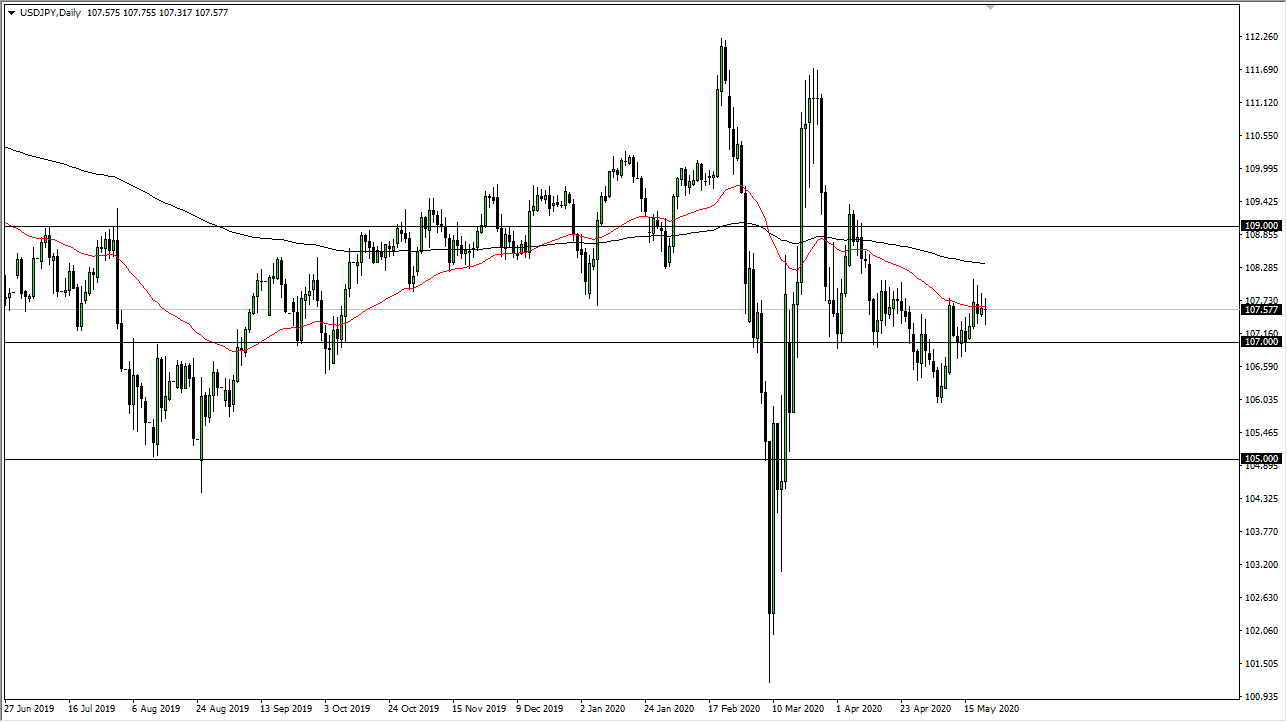

The US dollar continues to chop back and forth against Japanese yen, essentially putting the trading public to sleep. The pair is very choppy as of late, as we have been banging around between ¥107 and ¥108. I do not think this changes anytime soon, because there is no real catalyst for this pair to start moving. When looked at from a longer-term standpoint, you can make an argument for the market winding up and trying to build up momentum, but right now I just do not see that breaking loose until there is some type of major headline.

Both of these currencies are considered to be safety currencies, so that of course will have an effect on how this pair moves. As both of these currencies are relatively strong against other G 10 currencies, it makes sense that they have trouble with each other. That being said, as a general rule in a “risk off” scenario you can see this pair rollover. What is a bit different at this time though is the fact that there is a serious shortage of greenbacks out there to pay off sovereign debt and corporate debt, most of which is denominated in US dollars around the world. As we have had this massive debt binge, it has driven up demand for liquidity in those dollars. This could be a major issue eventually, but that is more of a long-term story than anything else.

If we see a run towards the Japanese yen, we would need to break down below the lows of the previous week in order to get truly aggressive to the downside, which could open up a move to ¥106, followed by the ¥105 level, an area that has attracted a lot of attention in the past. A breakdown below the ¥105 level would send this market much lower. To the upside, we need to clear the ¥109 level to get serious about momentum. All things being equal I think we probably continue to grind back and forth in the same general vicinity, causing this to be a short-term only type of environment. That of course can change but I do not see it happening in the next couple of sessions. The 50 day EMA of course attracts a lot of attention, so therefore it could see a lot of back and forth based upon that alone as technical traders flock towards those indicators.