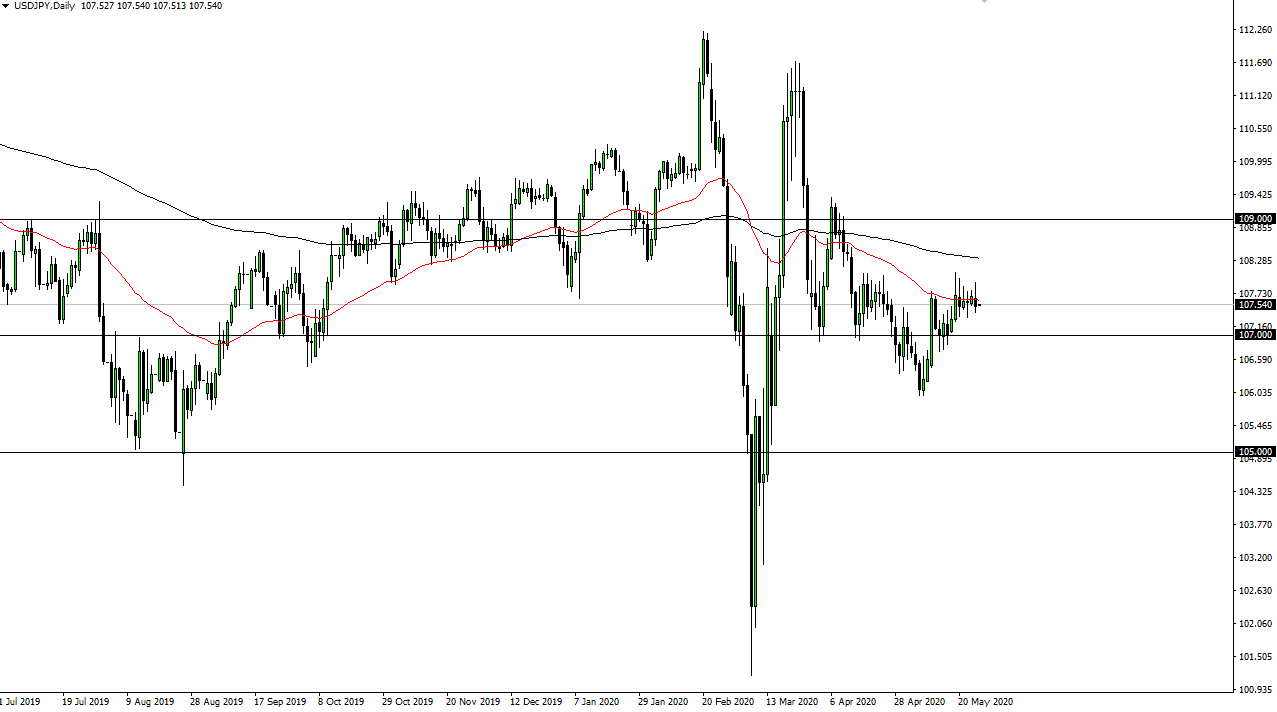

The US dollar has done almost nothing during the trading session on Tuesday, initially trying to rally before breaking back down. The ¥108 level continues to cause issues, as every time we get near the dollar cells off. At this point, the market has shown just how skittish it is, as the level continues to show more and more selling pressures once we get there. That being said, the market is likely to continue seeing a lot of noise in general, as we have so much in the way of questions out there. Ultimately, the market is likely to see a lot of back and forth, because quite frankly it is difficult to imagine a scenario where we get some type of sudden confirmation and perhaps even more importantly certainty.

Looking at this chart, it is not a huge surprise that we cannot get anywhere, because both of these are considered to be “safety currency.” At this point, the market is likely to see a lot of short-term opportunities to go back and forth, but ultimately this is a scenario where day trading might be the best way to go in this type of situation. After all, it has been relatively straightforward as far as taking advantage of the range, and until that range gets broken, it is difficult to imagine that you will be able to trade this with a lot of confidence.

If we do break down below the ¥107 level, then it is likely that we will try to go down towards the ¥106 level. If we break above the ¥108 level, then we have to deal with the 200 day EMA above there. Either way, I think what we are looking at is a scenario where we are just going to chop back and forth as there is no clear direction with markets in general. This is a scenario where it is difficult to think that things are going to change that quick, but if they do it will be very sudden. After all, markets cannot go nowhere forever, so as soon as we get some type of major impulsive candlestick in one direction or the other, it could be more of a “buy-and-hold” scenario for one of these currencies. Until then, expect a lot of headaches if you are looking for more than about 30 or 40 pips in either direction. However it does set up for nice trading opportunities if you are so inclined.