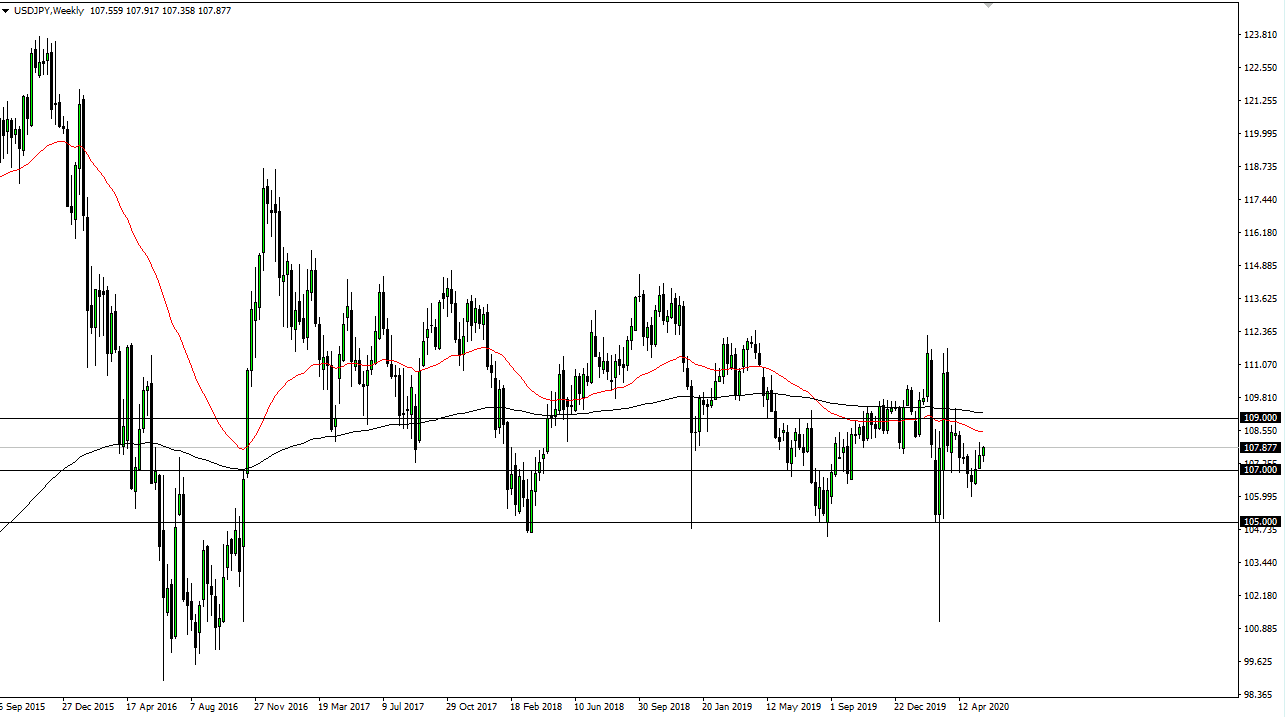

The US dollar has risen most of the month of May against the Japanese yen, but as you can see on the weekly chart, we are still in a relatively tight range. In fact, I think this is a market that is probably going to do more of the same during the month of June, building up inertia for a much longer term position. After all, the pair cannot go sideways forever but as you can see the market has seen a lot of interest right around the ¥107 level, so that is something worth paying attention to.

Underneath, I believe that the ¥105 level will continue to offer significant support, and as a result I do not know that we breakdown through there. If we do, that could obviously lead to some serious losses in this currency pair, perhaps opening up the path towards the ¥102 level. The Japanese yen is considered to be a major safety currency, so if this happens it will more than likely coincide with some ugliness and the stock markets. That being said, there does seem to be a lot of hope out there for a return to normalcy, so there is also the other direction that we need to look at.

If this pair can break above the ¥109 level, that opens up a move towards the ¥111 level. That would take a significant amount of bullish attitude when it comes to risk appetite, something that has been around for a while but I would also point out that during the last couple of months while stock markets, mainly in the US, have gone straight up in the air, this pair has essentially gone nowhere. It is because of this that I suspect the downside is probably the more likely of the two when it comes to relative strength. Obviously, this can change over the course of the month, but I do see where that is a potential issue.

About the only thing that I could really count on over the next month is of course going to be choppy and volatile behavior. One thing to pay attention to is the fact that the first wave of PPP recipients will run out of money in the United States, so that could be the beginning of a major headwind to risk appetite at the end of the month. That being said, Hope does tend to spring eternal, so you have to keep both sides of this potential trade in mind. Expect back-and-forth trading for most of the month.