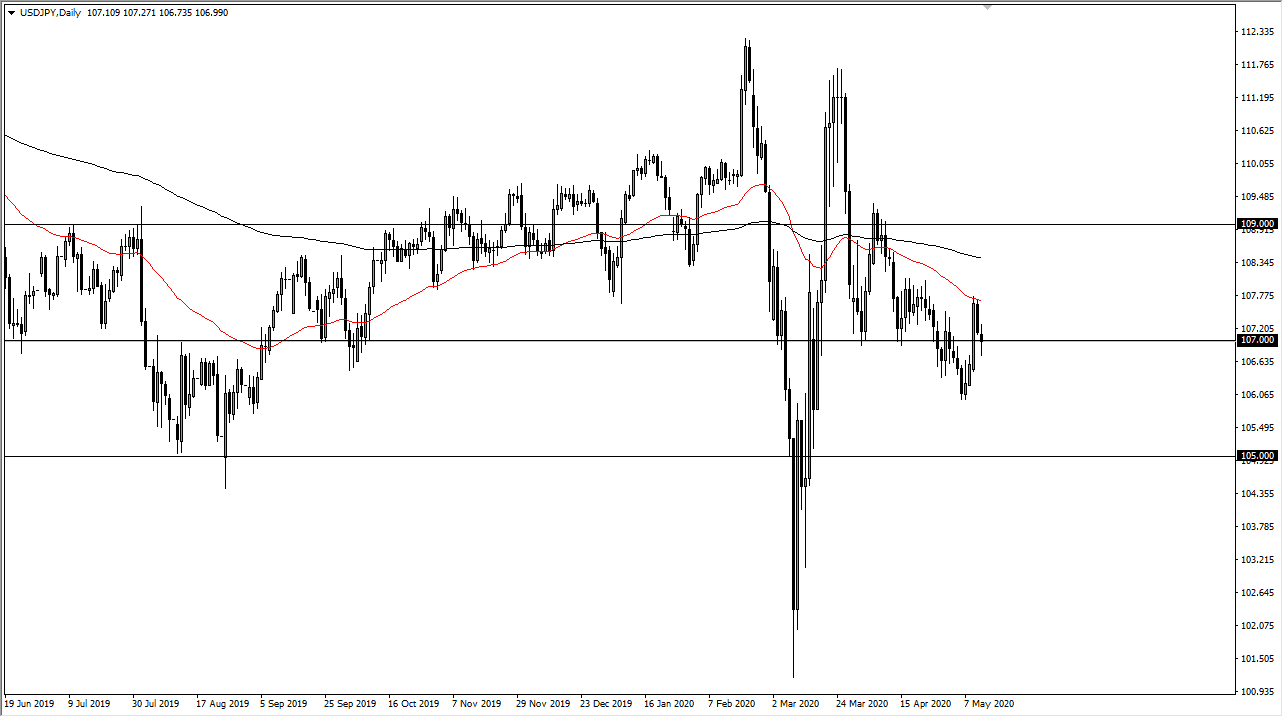

The US dollar continues to go back and forth against the Japanese yen, hanging around the ¥107 level. This is an area that should continue to be important, as it has previously been massive support. It should now be massive resistance now, but at this point in time it seems like it is going to act as a bit of a magnet for price. The question now is whether or not we get a major “risk off” move. If we do, that should see the Japanese yen pick up strength against most currencies around the world, including the US dollar. Paragraph looking at the candlestick, it tells you that there is a lot of confusion at the moment, and a breakout of this binary set up would give us a significant sign of momentum. If we break to the upside, I think it is still going to struggle to hang on to gains, with the 50 day EMA above offering significant resistance.

To the downside, a break down below the bottom of the candlestick for the trading session on Wednesday should open up the door down to the 160 and level. That is an area where we have seen buyers come back into the market but quite frankly, I feel it is only a matter of time before we break down through there and go looking towards the ¥105 level based upon the previous consolidation area. At this point on, I believe that the market continues to see a lot of volatility due to the fact that there are so many crosswinds when it comes to the global markets and of course the economic situation in the world.

Looking at this chart, it is a very choppy circumstance that we are finding ourselves in, but that is what you will probably see due to headlines risks and of course the lack of clarity that we will certainly see. It is not a market that I am looking to buy anytime soon, at least not until we break above the ¥109 level. With that, I favor fading rallies as the Japanese yen is considered to be the “safer” of the two currencies. With that in mind, I like the idea of taking advantage of “cheap Japanese yen” when they are offered. As you can see, the market has been extraordinarily choppy for a while, and as a result that is what you would expect going forward.