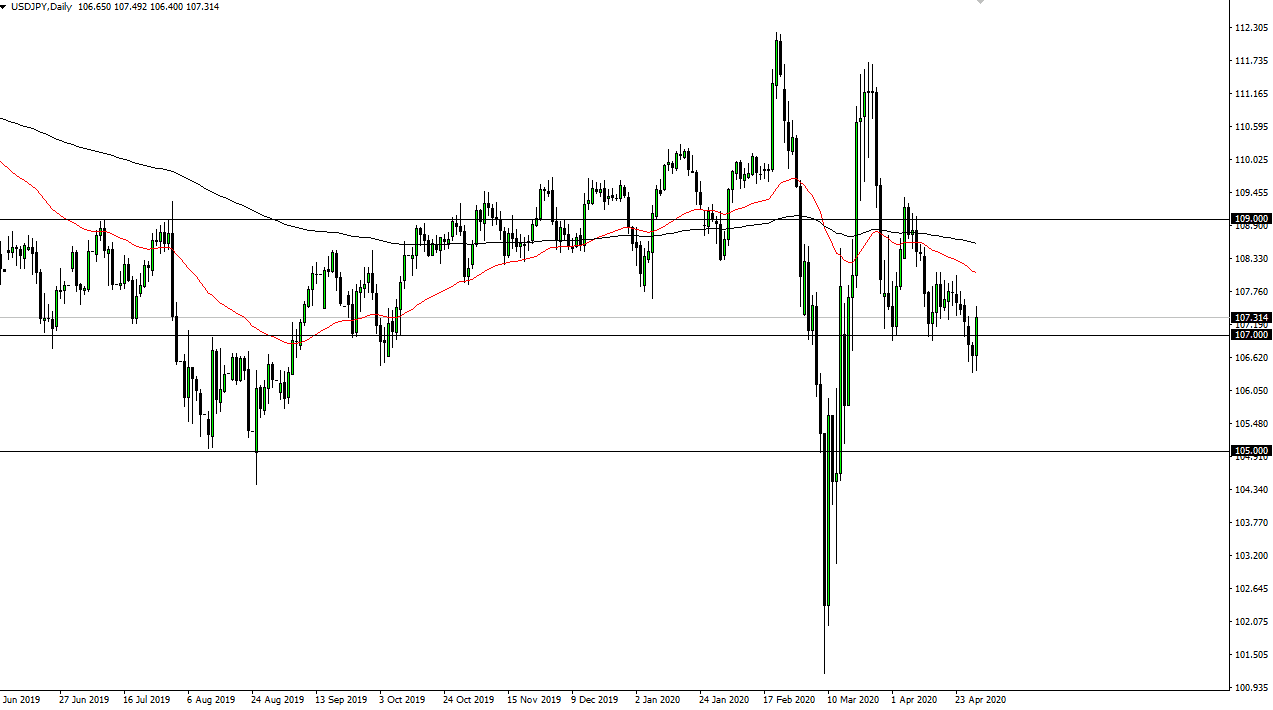

Although the US dollar made an impressive turnaround during the trading session on Thursday, it is telling that the entire top of the candlestick gave back the gains late in the day, and this tells me that there is a lot of resistance above that will probably continue to push this pair lower. Having said that, we have broken below the ¥107 level, which was a trigger for lower prices. We had formed a hammer during the trading session on Wednesday, so the fact that we rallied probably should not have been a major surprise, but at this point it is likely that we will continue to see downward pressure.

There are a multitude of reasons to think that this pair would drop from here, as the US dollar has a central bank that is flooding the market with liquidity, and that in theory should drive down the value of the greenback. That being the case, it is highly likely that we are going to continue to see the greenback lose value against some other currencies. The Japanese yen also has a certain amount of safety attached to it, and with the world of negative headlines everywhere, it makes quite a bit of sense that the Japanese yen should continue to attract inflows longer term.

Looking at the technical analysis, you can make an argument for a descending triangle that had been broken, and now we have rallied right back into it. We gave back quite a bit of the gains, so I suspect that if we break down below the ¥107 level, it is likely that we break a fresh, new low, reaching towards the ¥105 level over the longer term. I have to admit that this was a little bit of a shakeout during the trading session on Thursday, but that has been my analysis for a while, although I did not expect a recovery back into the triangle. Sometimes that happens, especially with a volatile market like we are in right now. The alternate scenario would be if we recapture the ¥108 level, something that does not look highly likely but if it did happen on a daily close it is likely that the market probably goes looking towards the 200 day EMA which is painted black on the chart. I believe that we still have more downward pressure coming, and therefore I am a seller of exhaustion.