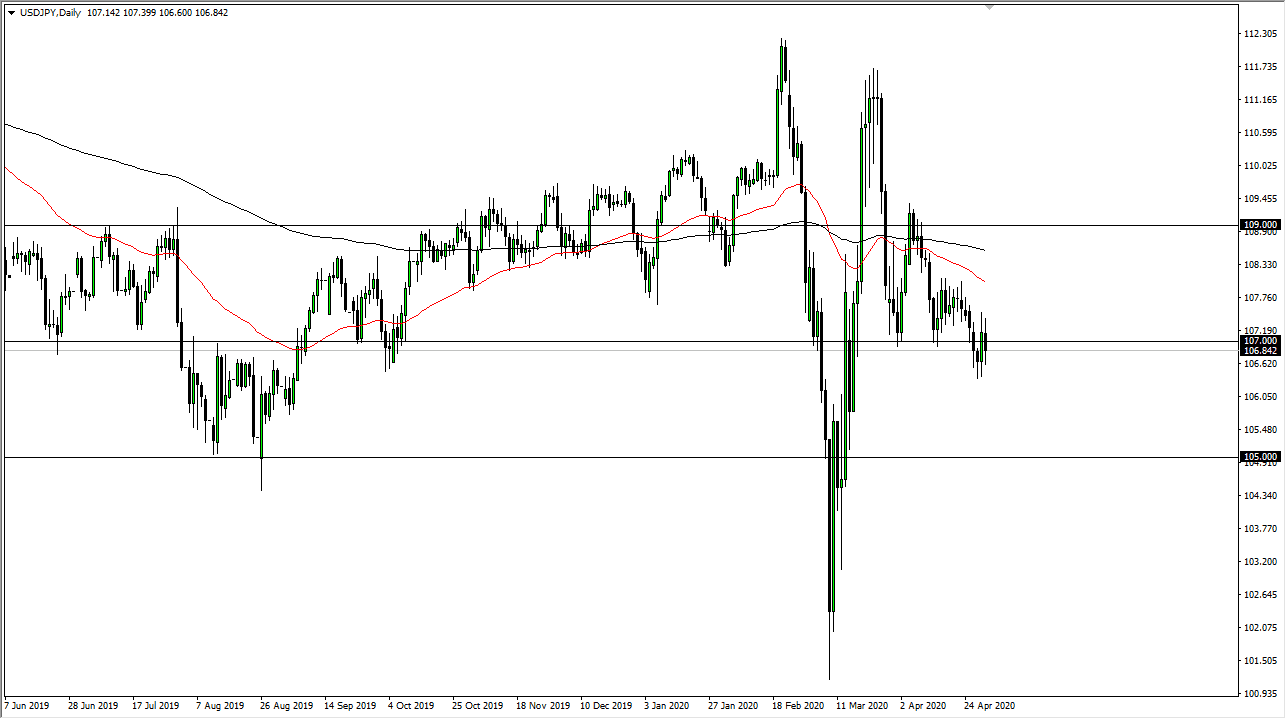

The US dollar continues to dance around the ¥107 level, as we have dipped a below there and now it looks like we are going to continue to see negative pressure applied to this currency pair. That being said though, the market is likely to see a lot of volatility, because both of these currencies are considered to be “safety currency.” As there are a lot of concerns around the world when it comes to global slowdown, that means that the market will continue to see both of these currencies demand a certain amount of attention.

The pair does tend to move right along with risk appetite in general, but at this point it is likely that the US dollar is going to continue to be a major influence in this pair, rather than the usual “risk on/risk off” type of trade. As we have broken below the ¥107 level over the last couple of days, it is a breach of significant support. You can make an argument for three “lower highs” in a row, or perhaps even a descending triangle. At this point in time, the market still looks as if it is ready to draw from here, and it looks as if the market continues to fade rallies.

This is the type of market that I think is a one-way trade, but things could change given enough time. In the short term though, I think that the US dollar weakening against other currencies might be the way you trade this pair, shorting it right along with the US dollar against other ones. If we were to break out above the last couple of candlesticks, you still have to worry about the ¥108 level, and that of course the 50 day EMA after that. Ultimately, there are a lot of little resistance barriers above that could cause some issues, so having said that it is likely that the upside is going to be much more difficult than the down. If the US dollar starts to gain strength against currencies in general, I will probably do something like short the Euro instead of trying to go long here. After all, the technical set up is not as favorable as it is over there, so it is just a simple matter of going with the flow of markets and simply going with the easiest trade that we get set up sign.